| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

It has been a difficult week with considerable uncertainty emanating from Europe and mixed economic signals from home. As I write this I see that the Greek PM has survived a no-confidence vote and pledged to form a unity Government. This is good for Europe but pity the poor Greeks who face extreme austerity measures.

While the attention has been mostly on Greece, it is really a sideshow compared with the problems facing Spain and Italy and it is up to the Italians in particular to take action. Unfortunately, the G-20 summit failed to produce extra financing for the European Financial Stability Fund which could potentially save the PIIGS bacon (excuse pun!).

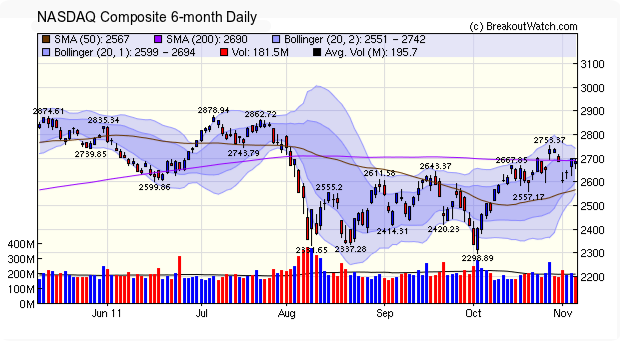

So we can expect more volatility on US markets with no clear direction. Our trend signals are mixed with the larger cap indexes still trending down, because larger companies are the most coupled to the global economy, and the tech heavy NASDAQ and smaller cap Russell 2000 trending up. The NASDAQ Composite is wavering around its 200 day average and will likely continue to stutter-step higher with frequent setbacks.

Although we saw many fewer breakouts this week, they did comfortably beat the market averages with a positive close on average.

Not a new feature, but a new introductory home page. http://www.breakoutwatch.com/newWelcome.php.

We are transitioning the current home page to that one over the weekend. Subscribers who have their login and start page stored in a cookie, will not normally see this page as they will be taken directly to their start page when accessing the site.

Stock Trend Reversal Signals

We have adapted our TRS algorithm to work with individual stocks and are pleased to be able to present a beta-test version of this tool. It is accessed from the Evaluate > Analytical tools menu.

The tool is available to all subscribers and guests while in beta test. You can access it directly by clicking this link: Stock Trend Reversal Signals

We are still refining the tool, particularly the graphics, and hope to have an improved version for next weeks newsletter.

We have adapted our TRS algorithm to work with individual stocks and are pleased to be able to present a beta-test version of this tool. It is accessed from the Evaluate > Analytical tools menu.

The tool is available to all subscribers and guests while in beta test. You can access it directly by clicking this link: Stock Trend Reversal Signals

We are still refining the tool, particularly the graphics, and hope to have an improved version for next weeks newsletter.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11983.2 | -2.03% | 3.5% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2686.15 | -1.86% | 1.25% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1253.23 | -2.48% | -0.35% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 746.49 | -1.91% | -4.74% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 13146.7 | -2.28% | -1.08% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 27 | 16.38 | 5.72% | 2.92% |

| Last Week | 88 | 15.23 | 5.99% | 0.95% |

| 13 Weeks | 230 | 17.38 | 8.11% |

0.51% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | KOG | Kodiak Oil & Gas Corp | 129 |

| Top Technical | CONN | CONN'S, Inc. | 95 |

| Top Fundamental | HLF | Herbalife Ltd. | 47 |

| Top Tech. & Fund. | HLF | Herbalife Ltd. | 47 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | SPPI | Spectrum Pharmaceuticals, Inc. | 84 |

| Top Technical | SPPI | Spectrum Pharmaceuticals, Inc. | 84 |

| Top Fundamental | GNC | GNC Holdings Inc | 68 |

| Top Tech. & Fund. | GNC | GNC Holdings Inc | 68 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.