| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

As the week ended the markets were becoming calmer following the departure of Greece's Prime Minister on Monday and the impending departure of Italy's Berlusconi this weekend. It remains to be seen if their replacements can make progress on resolving the sovereign debt issues of their respective countries and we seem destined to revisit the problems of restructuring their economies in the not to distant future. At home there was cause for cautious optimism also as the number of new unemployment claims fell below 400,000 and consumer confidence rose in the University of Michigan's monthly survey.

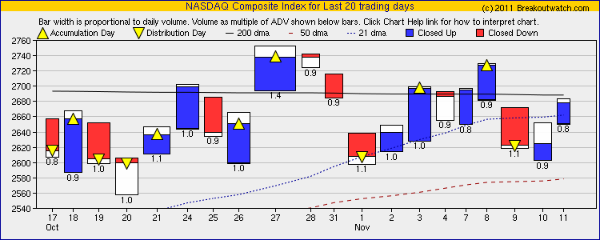

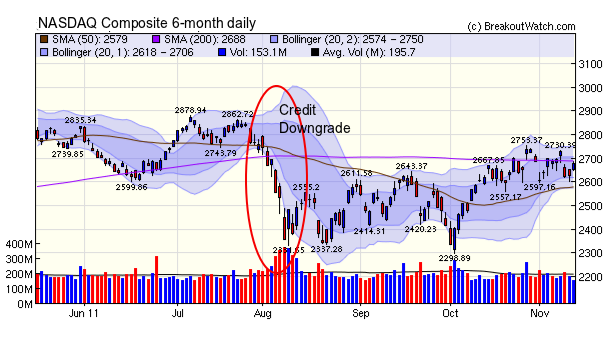

Our trend indicator for the NASDAQ Composite continues to be positive but the index is moving sideways with the 200 day moving average providing resistance to attempts to move higher. In the last two weeks the index has powered through the 200 day level on stronger volume only to quickly fall back. While we may see further attempts to move higher as the focus on Europe lessens, there looms the pending report to Congress of the "super committee" due by November 23. A failure to produce an agreement will threaten the country's credit rating and likely trigger a big market sell-off.

With Standard and Poor's committing

another faux pas on Thursday with the accidental downgrading of

France's credit rating, surely the credit rating agency has lost so

much credibility that another downgrade of the US will not have the

waterfall effect it had in early August, but the damage will

nevertheless be severe. The last downgrade reset the NASDAQ's trading

range lower by 300 points (10%).

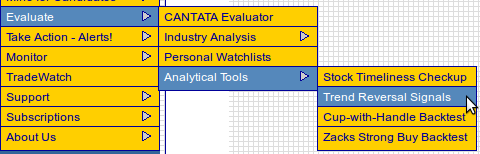

No new features this week but did you check out our Trend Reversal Indicator for individual stocks?

This feature will return next week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12153.7 | 1.42% | 4.98% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2678.75 | -0.28% | 0.98% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1263.85 | 0.85% | 0.49% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 744.64 | -0.25% | -4.98% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 746.49 | -94.32% | -94.38% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 19 | 17.15 | 7.4% | 4.3% |

| Last Week | 27 | 16.38 | 7.36% | 4.01% |

| 13 Weeks | 234 | 17.69 | 8.67% |

0.53% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | FSM | Fortuna Silver Mines Inc Ordinary Shares (Canada)& | 120 |

| Top Technical | XRTX | Xyratex Ltd. | 56 |

| Top Fundamental | PCLN | priceline.com Incorporated | 31 |

| Top Tech. & Fund. | PCLN | priceline.com Incorporated | 31 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | KOG | Kodiak Oil & Gas Corp | 117 |

| Top Technical | TSLA | Tesla Motors Inc | 52 |

| Top Fundamental | TDG | TransDigm Group Incorporated | 44 |

| Top Tech. & Fund. | TDG | TransDigm Group Incorporated | 44 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.