| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

This month we celebrate our 10th anniversary and we are giving thanks with a Thanksgiving sale.

Watch for big savings that will be announced next week.

Watch for big savings that will be announced next week.

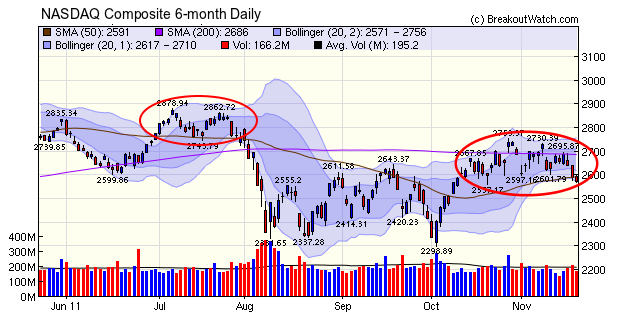

The NASDAQ Composite is beginning to show behavior very similar to that just before the last vote to raise the debt ceiling and the subsequent downgrade by Standard and Poors. Notice how there was a double top before the drift down began which ended with a 550 point (19%) loss. The chart looks quite similar as we approach the Super Committee deadline of November 23. There is more choppiness than last time because of the volatility surrounding the European saga, but a similar trend is evident. With only three business days to go before the committee must report to Congress, the signs are that a compromise is not reachable. Of course, these things nearly always get resolved at 1 minute to midnight so a positive outcome is still possible, but if a compromise is not achieved, the 2300 support level could get tested.

The trend signal for the NASDAQ and Russell 2000 continues to be positive although that could change with another losing day. Despite the losses for the indexes for the week, there were some nice gains to be had for the nimble. CFX (Colfax) had an intraday gain of 13.7% from a cup-with-handle base and DLB (Dolby Labs) jumped 15.6% from a Head and Shoulders bottom.

No new features this week.

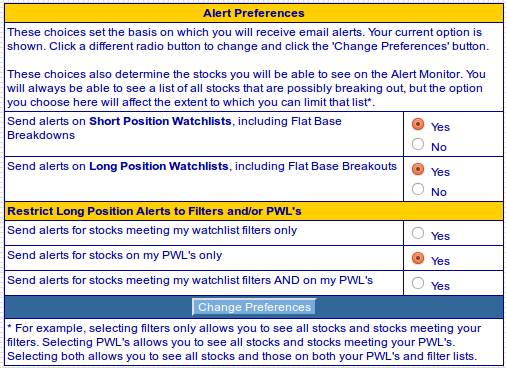

A common question from new subscribers is how can they limit the number and type of alerts they receive, so here is a summary of the various options.

The type of alerts you will receive are controlled from the Alert Preferences menu under Take Action - Alerts!. Here you can choose to receive Long position alerts, short position alerts, both or neither.

If you choose to receive alerts for long positions, then you can further refine your selection to restrict alerts by watchlist filters and/or your personal watchlist(s).

That will set your alert

preferences at the macro level. To limit alerts further you need to go

to the individual long position watchlists and set parameters by which

to limit the alerts from each list.

Note that the filter settings can be "Active on this watchlist" which is a toggle used to filter the list or not.

When you have the filter settings you want you can save them, and finally you can make them active or not.

Note that the filter settings can be "Active on this watchlist" which is a toggle used to filter the list or not.

When you have the filter settings you want you can save them, and finally you can make them active or not.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11796.2 | -2.94% | 1.89% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2572.5 | -3.97% | -3.03% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1215.65 | -3.81% | -3.34% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 719.42 | -3.39% | -8.2% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 744.64 | -94.4% | -94.4% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 14 | 18 | 5.22% | 0.32% |

| Last Week | 19 | 17.15 | 9.92% | 2.56% |

| 13 Weeks | 242 | 18.38 | 8.79% |

-1.86% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | FSM | Fortuna Silver Mines Inc Ordinary Shares (Canada)& | 120 |

| Top Technical | XRTX | Xyratex Ltd. | 55 |

| Top Fundamental | CBI | Chicago Bridge & Iron Company N.V. | 54 |

| Top Tech. & Fund. | CBI | Chicago Bridge & Iron Company N.V. | 54 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | VITC | Vitacost.com, Inc. | 107 |

| Top Technical | GLNG | Golar LNG Limited (USA) | 54 |

| Top Fundamental | CBM | 103 | |

| Top Tech. & Fund. | CBM | 103 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.