| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

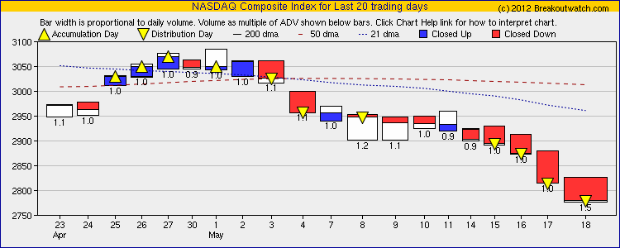

Our market trend signal for the

NASDAQ, which had been a hold-out while the other signals turned

negative a while ago, finally succumed in the face of Tuesday's

distribution day, which also coincided with the index breaking through

the 2900 support level. The index now looks as though it will test the

200 day moving average at 2740 unless the G8 meeting this weekend

produces a miracle cure for the European debt crisis. With Greece

facing a second round of elections, that does not seem likely. Also,

the domestic economic trend is not too encouraging with a surprising

fall in the Philadelphia manufacturing index and a rise in unemployment

claims, although this may be due to people re-entering the workforce -

a sign of optimism that the job availability is improving.

Friday's spike in volume was likely due to the Facebook IPO but the underlying trend of consecutive distribution days is a signal to stay out of the market or go short until the trend reverses.

Friday's spike in volume was likely due to the Facebook IPO but the underlying trend of consecutive distribution days is a signal to stay out of the market or go short until the trend reverses.

No new features this week.

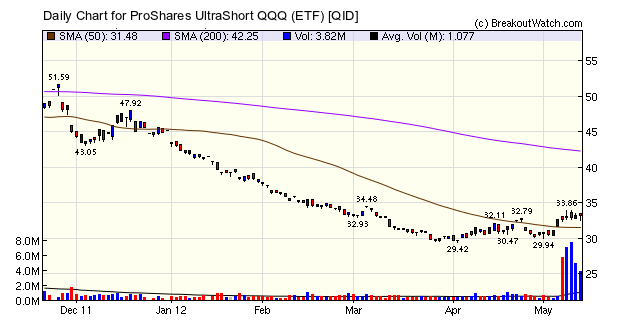

Breakoutwatch Short Candidates and Short ETF's

We do not send breakdown alerts by default, so if you would like to make money on the short side, you may wish to activate our breakdown alert service. To do so, see http://www.breakoutwatch.com/newsletter/archive/2011-09-10.php#6.

When you take a long position, the most you can lose is 100% of your investment if the price goes to zero. When shorting a stock, however, your risk is potentially infinite because there is no limit to the potential price move against you. This, among other factors, makes shorting a very risky game.

Investing in a short ETF, however, allows you to bet against the market, while limiting your loss in the same way that going long does. That's because the value of the short ETF can never fall below zero. While 'shorting' the market with these ETF's you are in fact taking a long position.

For example, to take advantage of the fall in the NASDAQ, one could have gone 'long' in QID

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12369.4 | -3.52% | 1.24% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2778.79 | -5.28% | 6.67% | Down |

||||||||||||||||||||||||||||||||||||

| S&P 500 | 1295.22 | -4.3% | 2.99% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 747.21 | -5.42% | 0.85% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 3 | 14.77 | 1.55% | -3.92% |

| Last Week | 37 | 17.23 | -0.46% | -4.75% |

| 13 Weeks | 237 | 17.54 | 8.27% |

-7.12% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | KBALB | Kimball International | 91 |

| Top Technical | KBALB | Kimball International | 91 |

| Top Fundamental | BWLD | Buffalo Wild Wings | 45 |

| Top Tech. & Fund. | LOPE | Grand Canyon Education Inc | 53 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CORE | Core-Mark Holding Company, Inc. | 41 |

| Top Technical | CORE | Core-Mark Holding Company, Inc. | 41 |

| Top Fundamental | CORE | Core-Mark Holding Company, Inc. | 41 |

| Top Tech. & Fund. | CORE | Core-Mark Holding Company, Inc. | 41 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2012 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.