| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

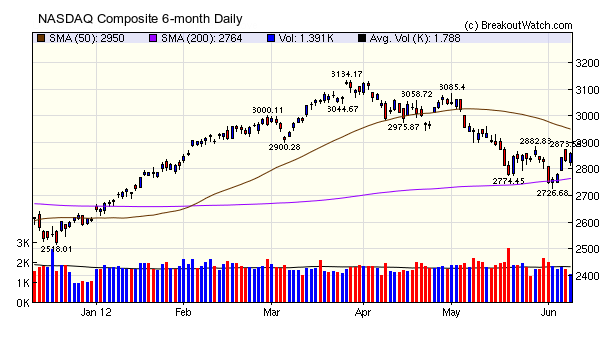

The NASDAQ rallied by a healthy 4% this week after finding support at the 200 dma level and all the major indexes are now back in the black for the year. Our trend model for the NASDAQ remains down, however, due to the below average and falling volume. Thursday's pullback as the index approached the May 29 high is an indication that the index may struggle to move higher in the short term.

No new features this week.

Subscriber Strategy Analysis

I was asked to analyse the following strategy:

1. Buy MTC stocks on breakout if BoP is above 8 day exponential moving average (EMA) and 21 day EMA.

2. Only buy if NASDAQ in uptrend

3. Sell at next open when 8 day EMA is lower than previous day

Since one of the constraints was that the NASDAQ be in an uptrend, I chose to only analyse breakouts since 2009 and only those from a CwH pattern. I also found that there were only a handful of stocks that met all the criteria so I instead chose to use stocks with a Relative Strength Rank (RS) >= 92 (the most important of the MTC requirements).

There were 387 breakouts that met the criteria. I quickly found that applying the sell when 8 ema is lower than the previous day was open to interpretation - for example, by how much less? I chose to round to 1 decimal place although in retrospect it would have been better to apply a % change requirement. If there is enough interest I will repeat the analysis for different tolerances.

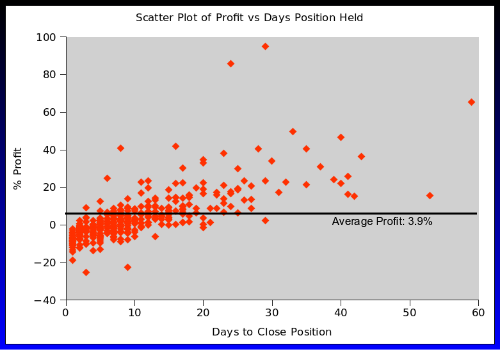

The results are superficially quite promising. A scatter plot of all the returns vs the number of days that the position was held follows. You will see that the average return is 3.9% but that most losses occur in the first 20 days. This suggests that the profit margin can be improved if positions held for more than 20 days can be strengthened for a modest premium over the breakout price.

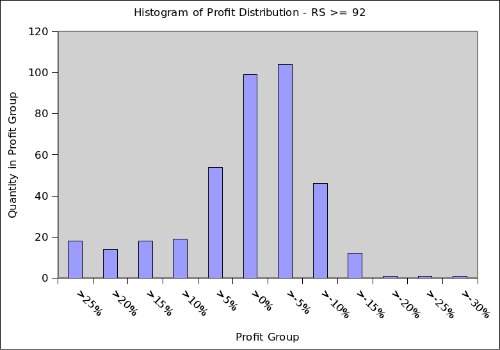

A histogram shows the number of breakouts in each 5% profit group:

While the results show a modest profit on average, they assume that one opens the position at exactly the breakout price and an overnight sell order would execute at the next day's opening price. In practice I suspect that slippage would eat into the potential profit by 1-2%.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12554.2 | 3.59% | 2.76% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2858.42 | 4.04% | 9.72% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1325.66 | 3.73% | 5.41% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 18 | 12.62 | 4.01% | 2.66% |

| Last Week | 10 | 12.69 | 5.73% | 0.39% |

| 13 Weeks | 203 | 14 | 5.88% |

-3.59% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | AHS | AMN Healthcare Services, Inc. | 95 |

| Top Technical | AHS | AMN Healthcare Services, Inc. | 95 |

| Top Fundamental | LOPE | Grand Canyon Education Inc | 56 |

| Top Tech. & Fund. | LOPE | Grand Canyon Education Inc | 56 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | WWWW | Web.com Group, Inc. | 73 |

| Top Technical | CSU | Capital Senior Living Corporation | 68 |

| Top Fundamental | ECPG | Encore Capital Group, Inc. | 45 |

| Top Tech. & Fund. | BGS | B&G Foods, Inc. | 37 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2012 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.