| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

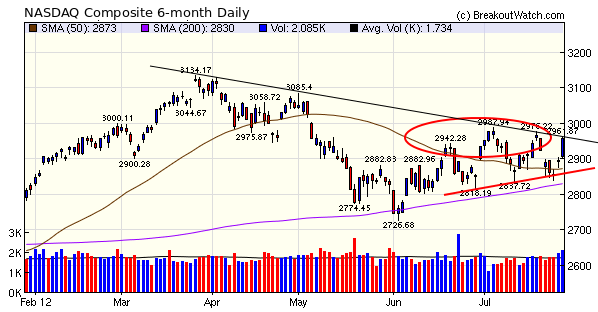

The NASDAQ's bearish head and shoulders top we wrote about last week (ellipse on the chart) barely completed as the index briefly touched the neckline on Wednesday. Thursday's and Friday's gains were in response to the ECB President's promise to 'do whatever it takes' to save the Euro with the expectation that this will be followed by a European version of our own QE. We know the effect of that was to bolster stock prices as financial institutions used their access to virtually free money to drive equities higher, so market participants expect this announcement puts a floor under the downturn. Friday's trading showed strength on higher volume but profit taking set in as the index touched resistance at the downward trend line.

Our trend indicators for the major indexes are now all aligned upwards.

No new features this week.

No top tip this week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 13075.7 | 1.97% | 7.02% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2958.09 | 1.12% | 13.55% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1385.97 | 1.71% | 10.21% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 23 | 12.85 | 6.39% | 4.9% |

| Last Week | 18 | 13.08 | 7.67% | 4.95% |

| 13 Weeks | 236 | 13.85 | 8.28% |

2.74% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ADY | Feihe International Inc | 105 |

| Top Technical | ADY | Feihe International Inc | 105 |

| Top Fundamental | NSM | Nationstar Mortgage Holdings Inc | 52 |

| Top Tech. & Fund. | NSM | Nationstar Mortgage Holdings Inc | 52 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CSFL | Centerstate Banks of Florida, Inc. | 78 |

| Top Technical | KVHI | KVH Industries, Inc. | 43 |

| Top Fundamental | GILD | Gilead Sciences, Inc. | 41 |

| Top Tech. & Fund. | DLX | Deluxe Corporation | 40 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2012 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.