| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Although the NASDAQ Composite

trended higher during the week and closed with a small gain, Friday's

profit taking ahead of earnings season left our trend indicator

pointing down, along with that for the S&P 500. The NASDAQ is in an

ascending triangle pattern but volume remains below average indicating

dwindling support for an upside breakout.

Our backtesting shows that

breakouts perform less successfully when the NASDAQ trend indicator is

down, so we continue suggest caution until the trend reverses.

No new features this week.

MTC Breakout Returns Disappoint - New Recommendation

Early in 2010 we introduced our "Meets Target Criteria" (MTC) strategy. At the time backtesting of the strategy showed significantly better returns for MTC breakouts than all CwH breakouts. (see Recommendations for Selecting High Performance Breakouts

As a reminder, our MTC strategy suggests buying CwH breakouts when breakout day volume reaches 2.25 times average daily volume for CwH breakouts that meet the MTC criteria on breakout day. The MTC criteria are:

- Average daily volume >= 100,000

- Breakout price >= $6

- Relative Strength (RS) Rank >= 92

- CANTATA Fundamental Criterion #2 (CEF2) >= 0.6

- CANTATA Fundamental Criterion #3 (CEF3) >= 0.6

- Do not open a new position if our NASDAQ Market trend signal is down

- Sell if the price drops 8% or more below the breakout price (BoP Stop Loss)

- Sell if the price drops by 8% or more from the highest intra-day price to date

- Take a profit at 25% gain

However, over the last year our MTC breakouts have underperformed compared to all CwH breakouts.

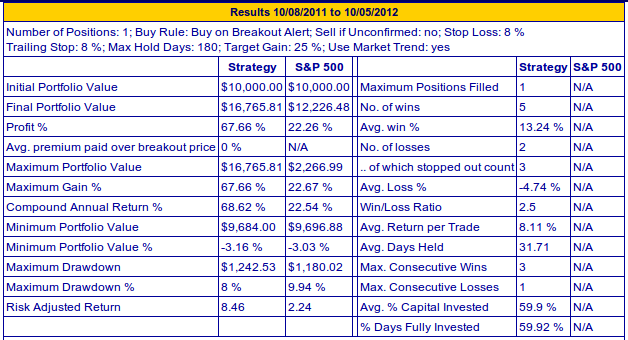

Our CwH Backtest tool (accessed from Evaluate > Analytical Tools) shows returns for MTC breakouts yielded only 19.4% while all CwH breakouts yielded 48.3% (using the default backtest parameters).

We have always found that Relative Strength Rank is the most important determinant of future performance and running the backtest on all CwH breakouts with a filter on those with an RS Rank equal to or greater than 92 lifts the backtest's 12 month return to 67.7%.

I therefore suggest ignoring the MTC indicator and instead limit trading to stocks with an RS Rank >= 92.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 13610.2 | 1.29% | 11.4% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3136.19 | 0.64% | 20.38% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1460.93 | 1.41% | 16.17% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 20 | 20.15 | 4.8% | 1.5% |

| Last Week | 25 | 19.77 | 4.21% | 1.68% |

| 13 Weeks | 293 | 21.54 | 11.64% |

6.62% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ADY | Feihe International Inc | 117 |

| Top Technical | ADY | Feihe International Inc | 117 |

| Top Fundamental | LULU | Lululemon Athletica inc. | 41 |

| Top Tech. & Fund. | LULU | Lululemon Athletica inc. | 41 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | WAL | Western Alliance Bancorporation | 83 |

| Top Technical | VHS | Vanguard Health Systems, Inc. | 58 |

| Top Fundamental | VHS | Vanguard Health Systems, Inc. | 58 |

| Top Tech. & Fund. | VHS | Vanguard Health Systems, Inc. | 58 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2012 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.