| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

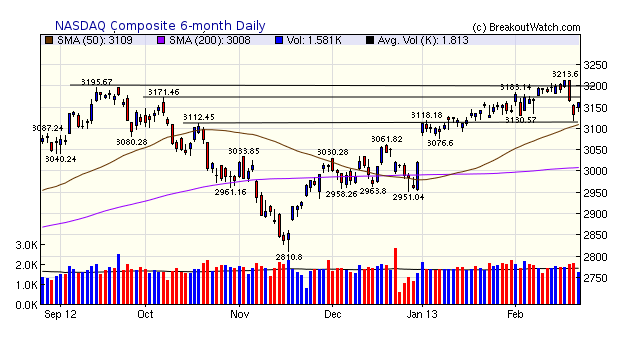

This week brought the correction we had expected but with more severity than we anticipated. On Wednesday the index crashed through first level support but on Thursday recovered as it hit the second level. Friday brought a tepid rally on significantly lower volume. While the index gained an apparently healthy 0.9%, It's tempting to label that a 'dead-cat bounce' because of the lack of volume.

Most commentators believe that sequestration will go into effect at the end of this week. That almost certainly means an uptick in the unemployment rate in the coming weeks, with an inevitable weakening in private sector demand to accompany the imposed steep cuts in public sector expenditure. None of this can be good for the equity markets which are mostly driven by positive earnings.

No new features this week.

This feature will return next week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 14000.6 | 0.13% | 6.84% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3161.82 | -0.95% | 4.71% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1515.6 | -0.28% | 6.27% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is

derived from our proprietary market model. The

market model is described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 6 | 19.62 | 2.91% | 1.2% |

| Last Week | 15 | 20.15 | 5.02% | 0.81% |

| 13 Weeks | 271 | 20.62 | 12.08% |

5.64% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | RGEN | Repligen Corporation | 99 |

| Top Technical | RGEN | Repligen Corporation | 99 |

| Top Fundamental | SLCA | U.S. Silica Holdings Inc | 62 |

| Top Tech. & Fund. | SLCA | U.S. Silica Holdings Inc | 62 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CNDO | Coronado Biosciences Inc | 69 |

| Top Technical | CNDO | Coronado Biosciences Inc | 69 |

| Top Fundamental | CNDO | Coronado Biosciences Inc | 69 |

| Top Tech. & Fund. | CNDO | Coronado Biosciences Inc | 69 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and

the slogan "tomorrow's breakouts today" are service marks

of NBIcharts LLC. All other marks are the property of

their respective owners, and are used for descriptive

purposes only.

BreakoutWatch is not affiliated with Investor's Business

Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.