| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

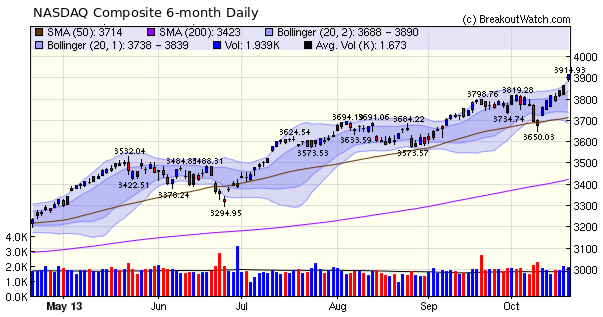

The NASDAQ has risen steeply since finding support at the 50 dma level on October 9. Although it is now outside the 2 standard deviation Bollinger Band, that does not mean that a pull back is inevitable, although a short period of consolidation is likely. I expect the uptrend to continue as, after all, there is no where else for money to go but into stocks, and with Janet Yellen taking over at the Fed, relatively cheap money is likely to persist until unemployment is below 6%.

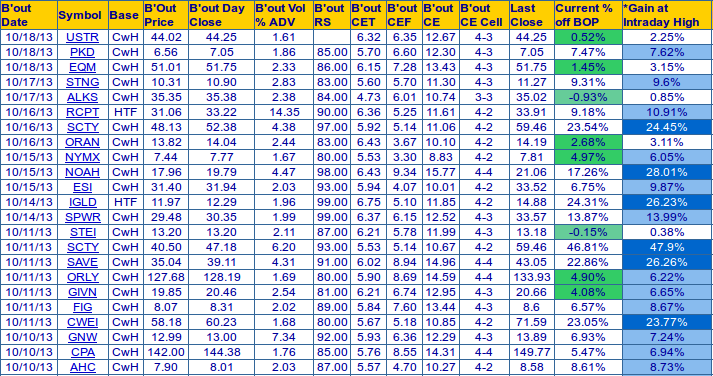

Breakout returns since the October 9 reversal have been truly outstanding. Here's a look at our Breakout Report since then. Five stocks have risen by more than 20%, two by more than 10% and all but two by more than 5%.

Optionable Filter

At the request of a subscriber, I've added an Option column to each of our watchlists and you can now filter for optionable stocks and also restrict alerts to only optionable stocks.

If a stock is optionable, then you will see a 'y' in the options column. All the stocks so indicated are optionable weekly. Stocks optionable quarterly at not flagged as there is only a handful of them.

To filter for optionable stocks, click the Filter Settings tab on the watchlist and set the Optionable Filter.

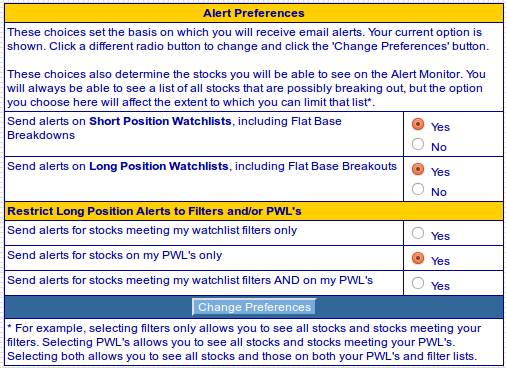

Restricting Alerts by Setting Alert Preferences

A common question from new subscribers is how can they limit the number and type of alerts they receive. With the addition of the new "Optionable" filter, we will revisit that topic for the benefit of new subscribers.

I have shown how to set your watchlist filters above - just remember to check 'yes' in the first three rows of the filter settings table and click "Update and Apply".

There is one more step to activating your filters.

The type of alerts you will receive are controlled from the Alert Preferences menu under Take Action - Alerts!. Here you can choose to receive Long position alerts, short position alerts, both or neither.

If you choose to receive alerts for long positions, then you can further refine your selection to restrict alerts by watchlist filters and/or your personal watchlist(s). To learn about Personal Watchlists go here.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 15399.7 | 1.07% | 17.52% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3914.28 | 3.23% | 29.63% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1744.5 | 2.42% | 22.32% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 13 | 10.23 | 11.24% | 9.26% |

| Last Week | 12 | 9.69 | 13.23% | 11.93% |

| 13 Weeks | 134 | 11 | 17.77% |

10.85% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PZZI | Pizza Inn, Inc. | 103 |

| Top Technical | PZZI | Pizza Inn, Inc. | 103 |

| Top Fundamental | BOFI | BofI Holding, Inc. | 36 |

| Top Tech. & Fund. | BOFI | BofI Holding, Inc. | 36 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | NYMX | Nymox Pharmaceutical Corporation | 81 |

| Top Technical | ORAN | Orange SA (ADR) | 38 |

| Top Fundamental | EQM | EQT Midstream Partners LP | 39 |

| Top Tech. & Fund. | EQM | EQT Midstream Partners LP | 39 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.