| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

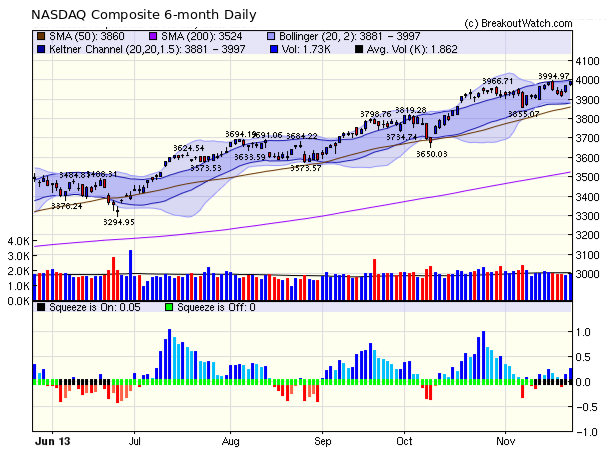

As a reminder to new subscribers, we follow the NASDAQ Composite Index each week because historically we have found most breakouts come from stocks listed on the NASDAQ exchange. The index is still moving higher although its momentum is slowing compared to the larger cap indexes. You will see from the chart that the index is in a "squeeze", showing that volatility has fallen and the trend is mainly sideways. From a squeeze, there can be a breakout either to the upside or downside so caution is indicated. the FOMC minutes released this week indicate that the Fed's QE policies will continue, at least until unemployment falls to 6.5%, so the probability is that the trend will strengthen again to the upside.

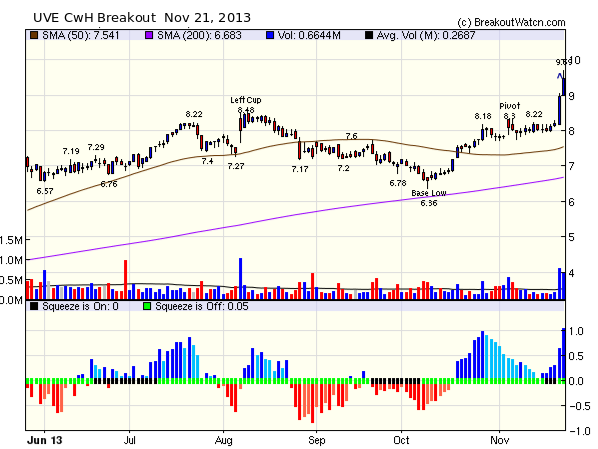

The star breakout of the week was Universal Insurance Holdings (UVE) which broke out of a cup-with-handle pattern on Thursday and gained over 16% intraday. It closed Friday with a 14% gain. More on this below.

Alpha Test of New Mobile App

I am working on a new mobile friendly version of the site. I invite you to point your mobile device to http://www.breakoutwatch.com/mobile/jqTest.php. Please let me know how it works for you and the device you used.

More on Handle Squeezes

Last week I suggested that cup-with-handle alerts issued when a stock is, or has been, in a squeeze in the handle were highly reliable. If you took this advice, then you would have made a handy gain on UVE as mentioned above. On the chart below, you will see three black bars just before Thursday's breakout, indicating that the stock was in a squeeze. The blue and red bars show the momentum strength. Notice that just before the breakout, the momentum was positive and increasing.

Despite this positive outcome for the squeeze indicator, I must back away from the advice given last week. That was based on performance this year but it has not stood up to examination over a period going back to January 2008. An alert when a squeeze is in play is not as reliable as I thought and should be used with caution. That said, I am still interested in the possibilities of using the squeeze indicator and research will continue.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16064.8 | 0.65% | 22.59% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3991.65 | 0.14% | 32.2% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1804.76 | 0.37% | 26.54% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 9 | 11 | 5.77% | 4.45% |

| Last Week | 13 | 10.77 | 9.37% | 4.92% |

| 13 Weeks | 143 | 11.46 | 19.32% |

7.08% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PZZI | Pizza Inn, Inc. | 106 |

| Top Technical | PZZI | Pizza Inn, Inc. | 106 |

| Top Fundamental | PAG | Penske Automotive Group, Inc. | 37 |

| Top Tech. & Fund. | PAG | Penske Automotive Group, Inc. | 37 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | FLML | Flamel Technologies S.A. (ADR) | 91 |

| Top Technical | FNGN | Financial Engines Inc | 49 |

| Top Fundamental | FNGN | Financial Engines Inc | 49 |

| Top Tech. & Fund. | FNGN | Financial Engines Inc | 49 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.