| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

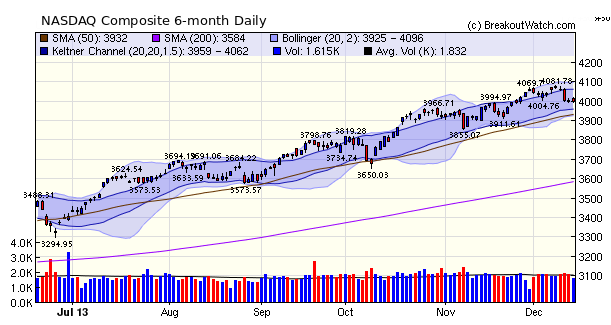

The NASDAQ Composite has formed a double top. This may just be a sign of consolidation but watch for a head and shoulders top (HST) forming in the next few days. if it does, that would be bearish, particularly if the HST is confirmed when the price drops through the neck line. Meanwhile, all our market trend remain upward although two distribution days for the NASDAQ, a drop in daily volume and just 4 breakouts for the week, suggest that caution in chasing new alerts is advisable.

My family is arriving from Australia for the holidays so this will be the last newsletter for 2013. I wish you all a safe and happy holiday and will see you in the New Year.

No new features this week.

No tip this week although work is continuing at a somewhat slower pace on devising a strategy built on our new squeeze indicator.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 15755.4 | -1.65% | 20.23% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4000.98 | -1.51% | 32.5% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1775.32 | -1.65% | 24.48% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 4 | 11 | 4.71% | 1.5% |

| Last Week | 7 | 10.92 | 19.99% | 14.42% |

| 13 Weeks | 141 | 11.46 | 31.75% |

5.07% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PZZI | Pizza Inn, Inc. | 106 |

| Top Technical | PZZI | Pizza Inn, Inc. | 106 |

| Top Fundamental | MPEL | Melco Crown Entertainment Ltd (ADR) | 47 |

| Top Tech. & Fund. | MPEL | Melco Crown Entertainment Ltd (ADR) | 47 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CSTE | Caesarstone Sdot-Yam Ltd | 71 |

| Top Technical | CSTE | Caesarstone Sdot-Yam Ltd | 71 |

| Top Fundamental | CSTE | Caesarstone Sdot-Yam Ltd | 71 |

| Top Tech. & Fund. | CSTE | Caesarstone Sdot-Yam Ltd | 71 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.