| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

The NASDAQ Composite set a new 13 year high on Friday before profit taking caused the index to close lower for the day. Look for another period of consolidation now as doubts about the robustness of the economy emerge. Friday's housing news (existing home sales fell 5.1% in January, housing starts fell 16% month-on-month, mortgage applications dropped 4.1% from last week, home builder confidence fell) was disappointing but seen in the context of the bleak weather experienced across much of the country, there is no reason to be alarmed.

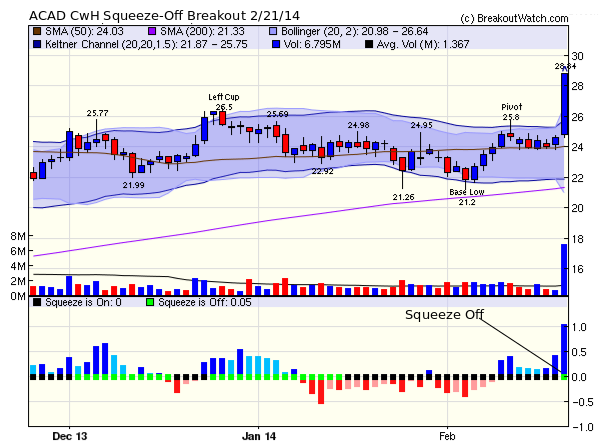

I've changed the format of the newsletter to now include a complete list of the week's breakouts. As you can see, there were several big performances led by SSTK which broke out from our new Squeeze Play watchlist. Unfortunately you would have needed inside information to profit from it, as it gaped up 15% following the previous evening's earnings report. Another strong performer was ACAD which broke out from a CwH pattern with squeeze. More about that below.

|

Breakouts for Week Beginning

2/17/14

|

||||||||

| B'out Date |

Symbol | Base | Squeeze | B'Out Price |

B'out Day Close |

Last Close |

Current % off BOP |

*Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 02/21/14 | USCR | SQZ | Y | 24.15 | 24.79 | 24.79 | 2.65% | 2.65% |

| 02/21/14 | UEIC | SQZ | Y | 38.25 | 40.12 | 40.12 | 4.89% | 4.89% |

| 02/21/14 | SSTK | SQZ | Y | 83.16 | 98 | 98 | 17.85% | 17.85% |

| 02/21/14 | ALNY | SQZ | Y | 89.40 | 90.64 | 90.64 | 1.39% | 1.39% |

| 02/21/14 | NLNK | HTF | Y | 42.99 | 46.50 | 46.5 | 8.16% | 8.16% |

| 02/21/14 | REGN | CwH | Y | 334.83 | 334.98 | 334.98 | 0.04% | 0.04% |

| 02/21/14 | NYNY | CwH | N | 7.28 | 7.36 | 7.36 | 1.10% | 1.1% |

| 02/21/14 | CSGP | CwH | Y | 185.77 | 197.97 | 197.97 | 6.57% | 6.57% |

| 02/21/14 | ACAD | CwH | Y | 25.80 | 28.84 | 28.84 | 11.78% | 11.78% |

| 02/20/14 | RBCN | CwH | N | 11.77 | 12.28 | 12.23 | 3.91% | 6.29% |

| 02/20/14 | NOA | CwH | Y | 6.28 | 6.57 | 6.59 | 4.94% | 7.17% |

| 02/20/14 | ICLR | CwH | Y | 45.93 | 48.70 | 46.7 | 1.68% | 7.71% |

| 02/19/14 | SUNE | SQZ | Y | 15.58 | 15.76 | 16.54 | 6.16% | 6.16% |

| 02/19/14 | CNX | SQZ | Y | 39.30 | 39.79 | 39.69 | 0.99% | 4.34% |

| 02/18/14 | PRLB | SQZ | Y | 81.46 | 81.75 | 79.7 | -2.16% | 3.12% |

| 02/18/14 | OMER | CwH | Y | 12.91 | 13.26 | 13.78 | 6.74% | 12.32% |

| 02/18/14 | GA | CwH | Y | 11.25 | 11.32 | 11.38 | 1.16% | 1.96% |

| 02/18/14 | FANG | CwH | Y | 59.84 | 61.02 | 63.99 | 6.94% | 6.94% |

Cup-with-Handle Squeeze-Off Price

A new column was added to the cup with handle watchlist called "Squeeze-off Price". This is the price that the stock must rise to for the squeeze to come off. In other words its the price that will move the upper Bollinger Band above the upper Keltner Channel. Usually, this price is above the CwH pivot, or breakout price, and leads to a stronger and more successful breakout.

This will become clearer when you read the next section.

"Squeeze Off" Cup-with-Handle Breakouts

My analysis of breakouts from a cup-with-handle (CwH) pattern over the last five years shows that breakouts are more likely to be confirmed when the normal breakout occurs when the squeeze comes off. This occurs more rarely, but when it does this leads to a successful breakout 75% of the time.

One would play these "Squeeze-Off" breakouts by acting when the intraday price hits the squeeze of price.

ACAD's breakout on Friday illustrates what I mean. In this case, the squeeze-off price was 24.68 and lower than the pivot, so the trade could have been entered earlier the the usual BoP giving a greater profit potential. Why was the squeeze-off price less than the pivot? That's because the squeeze started before the pivot was formed, which will not usually be the case.

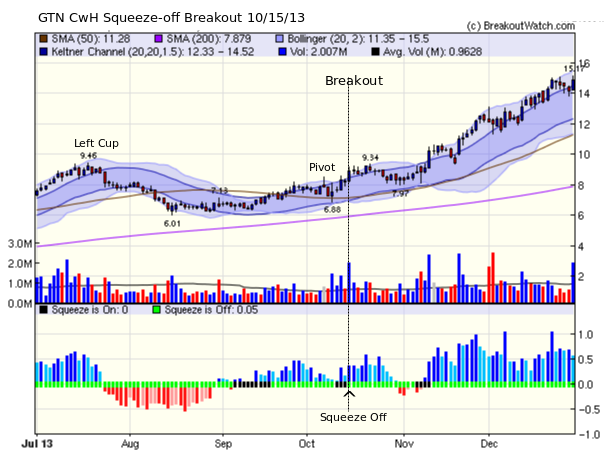

GTN provides another example

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16103.3 | -0.32% | -2.86% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4263.41 | 0.46% | 2.08% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1836.25 | -0.13% | -0.66% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GST | Gastar Exploration Inc | 97 |

| Top Technical | GST | Gastar Exploration Inc | 97 |

| Top Fundamental | CMG | Chipotle Mexican Grill, Inc. | 30 |

| Top Tech. & Fund. | CMG | Chipotle Mexican Grill, Inc. | 30 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | NYNY | Empire Resorts Inc | 100 |

| Top Technical | NYNY | Empire Resorts Inc | 100 |

| Top Fundamental | REGN | Regeneron Pharmaceuticals Inc | 40 |

| Top Tech. & Fund. | REGN | Regeneron Pharmaceuticals Inc | 40 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.