| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

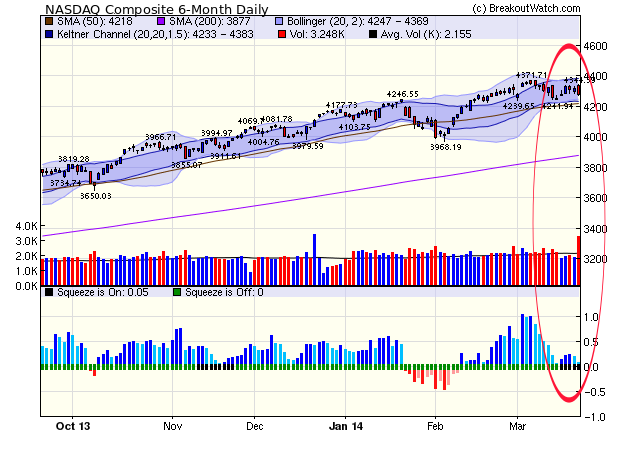

The NASDAQ Composite made a modest gain this week but the chart shows the index essentially moving sideways on lower volume, except for Friday. The sideways move has lowered volatility resulting in the Bollinger Band moving inside the Keltner Channel resulting in a squeeze situation. Notice that momentum is falling and on the brink of turning negative which improves the odds of a move further down from here.

There were 23 breakouts this week and the Squeeze Play watchlist continued to deliver the best performers with Solar Holdings (JASO) and Flamel Technologies (FLML) leading the way. The charts of these two stocks give a hint as to when Squeeze Play breakouts are about to occur. More below.

| Breakouts for Week Beginning 03/17/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 03/18/14 | JASO | SQZ | Y | 9.53 | 10.07 | 11.05 | 15.95 | 29.59 |

| 03/18/14 | FLML | SQZ | Y | 11.74 | 13.19 | 14.32 | 21.98 | 25.21 |

| 03/17/14 | KONG | CwH | N | 10.49 | 10.53 | 11.6 | 10.58 | 10.58 |

| 03/18/14 | Z | SQZ | Y | 90.90 | 91.68 | 100.24 | 10.28 | 10.28 |

| 03/17/14 | Z | SQZ | Y | 90.90 | 91.68 | 100.24 | 10.28 | 10.28 |

| 03/17/14 | YOD | HTF | N | 6.16 | 6.65 | 5.39 | -12.50 | 7.95 |

| 03/21/14 | PEIX | HTF | N | 16.30 | 17.56 | 17.56 | 7.73 | 7.73 |

| 03/17/14 | ANAC | SQZ | Y | 21.66 | 21.68 | 21.21 | -2.08 | 6.42 |

| 03/18/14 | ANAC | SQZ | Y | 21.66 | 21.68 | 21.21 | -2.08 | 6.42 |

| 03/18/14 | GTAT | HTF | Y | 18.02 | 18.24 | 18.61 | 3.27 | 6.22 |

| 03/17/14 | EGHT | CwH | Y | 10.88 | 11.22 | 11.08 | 1.84 | 5.33 |

| 03/19/14 | SGY | CwH | Y | 37.42 | 38.49 | 39.41 | 5.32 | 5.32 |

| 03/19/14 | GNW | CwH | N | 17.18 | 17.56 | 18 | 4.77 | 4.77 |

| 03/21/14 | CAAS | CwH | Y | 8.52 | 8.89 | 8.89 | 4.34 | 4.34 |

| 03/19/14 | UGP | HSB | N | 22.11 | 22.36 | 23.01 | 4.07 | 4.07 |

| 03/18/14 | POWI | CwH | Y | 64.66 | 66.54 | 66.64 | 3.06 | 3.6 |

| 03/17/14 | CLB | SQZ | Y | 196.19 | 197.63 | 199.67 | 1.77 | 2.98 |

| 03/18/14 | CLB | SQZ | Y | 196.19 | 197.63 | 199.67 | 1.77 | 2.98 |

| 03/17/14 | CEL | CwH | Y | 13.14 | 13.46 | 12.98 | -1.22 | 2.44 |

| 03/21/14 | SNAK | CwH | Y | 14.00 | 14.16 | 14.16 | 1.14 | 1.14 |

| 03/21/14 | FOE | CwH | Y | 14.54 | 14.68 | 14.68 | 0.96 | 0.96 |

| 03/18/14 | THG | SQZ | Y | 60.08 | 60.15 | 60.11 | 0.05 | 0.9 |

| 03/21/14 | DW | CwH | Y | 54.05 | 54.10 | 54.1 | 0.09 | 0.09 |

| Weekly Average (23 breakouts) | 3.97 | 6.94 | ||||||

No new features this week.

How to Anticipate Squeeze Play Breakouts

The breakout of FLML and JASO this week give an indication of when a profitable breakout from the Squeeze Play watchlist might occur. In both cases on the day before the breakout, the stocks closed at their upper Keltner Channel level and on above average volume with improving momentum. FLML offers the clearest example:

JASO shows the same characteristics. Note that in the 8 days before breakout it had closed near the KC but on each day volume was below average and a breakout didn't follow. On breakout day, it closed well below its intraday high but was still profitable.

Conclusion

For Squeeze Play stocks look for three conditions to be filled:

- Stock should close at or near the top of the Keltner Channel

- Volume must be above average

- Momentum must be improving.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16302.8 | 1.48% | -1.65% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4276.79 | 0.74% | 2.4% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1866.52 | 1.38% | 0.98% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | REED | Reeds, Inc. | 85 |

| Top Technical | REED | Reeds, Inc. | 85 |

| Top Fundamental | REI | Ring Energy, Inc. | 54 |

| Top Tech. & Fund. | REI | Ring Energy, Inc. | 54 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | EGHT | 8x8 Inc | 66 |

| Top Technical | GNW | Genworth Financial Inc | 45 |

| Top Fundamental | SGY | Stone Energy Corporation | 38 |

| Top Tech. & Fund. | SGY | Stone Energy Corporation | 38 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.