| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

A brief comment only this week as I am on spring break with the family.

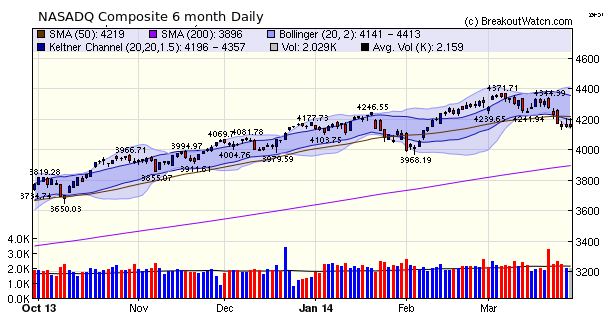

The NASDAQ fell sharply this week to its lowest Bollinger Band level. The index was essentially unchanged for the last three sessions, however, and it is likely to turn up from here. All bets are off, of course, if Russia invades eastern Ukraine. The downturn has also reduced the number of breakouts (see below), although there are still good profits to be had with only one breakout actually in the red at week's close. I expect there will be an improvement in the number next week if the NASDAQ turns back up, as I expect.

| Breakouts for Week Beginning 03/24/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 03/28/14 | BWEN | SQZ | Y | 9.75 | 9.82 | 11.38 | 16.72 | 16.72 |

| 03/26/14 | STKL | CwH | Y | 11.09 | 11.34 | 11.76 | 6.04 | 6.04 |

| 03/25/14 | SONC | CwH | N | 22.31 | 23.23 | 22.56 | 1.12 | 4.12 |

| 03/27/14 | LULU | HSB | N | 50.04 | 51.20 | 51.89 | 3.70 | 3.7 |

| 03/28/14 | GPOR | SQZ | Y | 67.48 | 69.65 | 69.65 | 3.22 | 3.22 |

| 03/28/14 | IVAC | CwH | Y | 8.61 | 8.84 | 8.84 | 2.67 | 2.67 |

| 03/26/14 | MITL | CwH | Y | 10.50 | 10.74 | 10.49 | -0.10 | 2.57 |

| 03/28/14 | BFR | SQZ | Y | 7.94 | 8.09 | 8.09 | 1.89 | 1.89 |

| 03/27/14 | AA | CwH | Y | 12.38 | 12.59 | 12.48 | 0.81 | 1.7 |

| 03/26/14 | EQM | SQZ | Y | 68.60 | 68.9 | 69.5 | 1.31 | 1.31 |

| 03/28/14 | MEIP | CwH | Y | 11.45 | 11.54 | 11.54 | 0.79 | 0.79 |

| 03/28/14 | TCO | HTF | N | 70.04 | 70.04 | 70.04 | 0.00 | 0 |

No new features this week.

This feature will return next week with results of a new study on how to profit from Squeeze Play alerts.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16323.06 |

0.12% | -1.5% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4155.76 | -2.8% | -0.4% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1857.62 |

0.4% | 0.5% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | NYNY | Empire Resorts, Inc. | 99 |

| Top Technical | NYNY | Empire Resorts, Inc. | 99 |

| Top Fundamental | BWLD | Buffalo Wild Wings, Inc. | 34 |

| Top Tech. & Fund. | NGVC | Natural Grocers by Vitamin Cottage, Inc. | 29 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | IVAC | Intevac, Inc. | 81 |

| Top Technical | MITL | Mitel Networks Corporation | 69 |

| Top Fundamental | SONC | Sonic Corp. | 50 |

| Top Tech. & Fund. | SONC | Sonic Corp. | 50 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.