| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

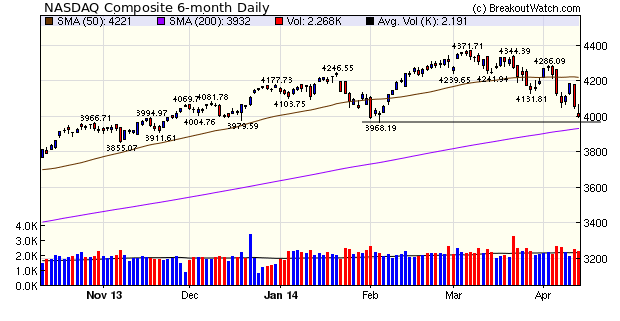

The NASDAQ continues to be hit harder than the other major indexes showing the largest loss for the week and also the largest loss year to date. The index is close to the February support level of 3968 and just below that is the 200 day moving average. These levels are psychologically significant to traders and may provide a measure of relief. Regardless of these levels, watch our market signals and stay on the sidelines until they turn up. The signals turned down on March 31 which should have saved you two weeks of grief. Stay calm now until they turn positive again.

Best performer for the week was QID (ProShares UltraShort SmallCap600). This is an ETF that allows you to go long while benefiting from short sales made by the ETF. Other opportunities to go long were restricted to CwH stocks and once again those that were in a squeeze were among the most profitable.

| Breakouts for Week Beginning 04/07/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 04/10/14 | QID | HSB | N | 58.84 | 61.71 | 63.16 | 7.34 | 7.83 |

| 04/08/14 | PAM | CwH | N | 6.27 | 6.60 | 6.47 | 3.19 | 6.06 |

| 04/10/14 | BXE | CwH | Y | 8.76 | 8.82 | 9.03 | 3.08 | 4 |

| 04/08/14 | GST | CwH | Y | 6.59 | 6.66 | 6.2 | -5.92 | 3.95 |

| 04/10/14 | REI | CwH | Y | 16.88 | 16.96 | 16.99 | 0.65 | 3.85 |

| 04/09/14 | TECD | CwH | Y | 62.59 | 64.83 | 60.96 | -2.60 | 3.58 |

| 04/08/14 | SCIF | CwH | N | 37.24 | 37.28 | 37.75 | 1.37 | 2.82 |

| 04/09/14 | MNKD | CwH | N | 6.99 | 7.00 | 6.41 | -8.30 | 0.14 |

| Weekly Average (8 breakouts) | -0.15 | 4.03 | ||||||

No new features this week.

Squeeze Breakout Directional Options Trading

A subscriber sent me the following explanation of how he is making outrageous profits by options trading from the CwH list....

Hi Mike,

I wanted to share with you an example of the kind of option trades I am doing using your CWH Watchlist-with the new Squeeze Filter. The best trades are those where I buy an ITM (in the money) Call option at the closest strike price to the BOP (and still be ITM).

I wanted to share with you an example of the kind of option trades I am doing using your CWH Watchlist-with the new Squeeze Filter. The best trades are those where I buy an ITM (in the money) Call option at the closest strike price to the BOP (and still be ITM).

I only take trades if the Squeeze = "Y".

I buy the closest expiration unless there are less than 7

days left-in which case I go to the next month. Finally,

I am looking for adequate option volume at the strike price

near BOP and decent bid-ask spreads.

Here's a real example:

Stock: EOG

CWH Alert: 3/26/14 at 7:47 AM (Mountain time) (This

is when I got it on my cell phone)

BOP: 193.22

Option traded: MAR(2014) 192.50 CALL

Purchased at: $2.25

Sold 3/28 at: $5.80

Gain%: 257% in 2 days

This is a good trade - meaning not all of them do this well

- however, it isn't the best one either. Let me know if

you get any questions on these kind of directional trades.

Regards, Jim

Regards, Jim

While JIm is referring to squeeze breakouts from the cup-with-handle list, the strategy can also be applied to the Squeeze Play list.

If you would like to know more about Jim's strategy, post your question to the support forum and let the conversation begin.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16026.8 | -2.35% | -3.32% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3999.73 | -3.1% | -4.23% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1815.69 | -2.65% | -1.77% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | MNKD | MannKind Corporation | 108 |

| Top Technical | MNKD | MannKind Corporation | 108 |

| Top Fundamental | SAM | Boston Beer Company, Inc. (The) | 26 |

| Top Tech. & Fund. | SAM | Boston Beer Company, Inc. (The) | 26 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GST | Gastar Exploration Inc. | 104 |

| Top Technical | SCIF | Market Vectors India Small Cap Index ETF | 11 |

| Top Fundamental | GST | Gastar Exploration Inc. | 104 |

| Top Tech. & Fund. | REI | Ring Energy, Inc. | 62 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.