| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Webinar: Trading In-The-Money Options from the Cup-with-Handle Watchlist

We are offering a "webinar" on how to use alerts from the cup-in-handle watchlist to trade in-the-money options on Monday, 16th June at 6pm Mountain Time. This strategy focuses on using alerts from the CwH watchlist that are also in a "squeeze" and offers the promise of strong returns at low risk.

If you are interested in attending, please send me an email and details on how to attend the webinar will be forwarded to you in the week beginning June 9th.

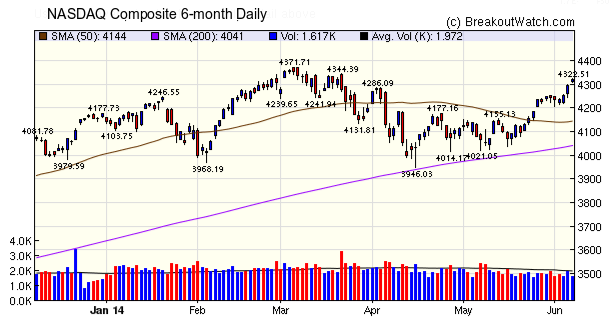

The NASDAQ continued its rise and again outpaced the other two major indexes. Volume levels continue to be below average with even Thursday's accumulation day failing to better the 50 day average. Nevertheless, the outlook is promising after resistance at 4286 was pierced. The next challenge comes at 4344.

The number of breakouts continued to rise. Only one failed to stay positive at Friday's close.

| Breakouts for Week Beginning 06/02/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 06/02/14 | NPSP | SQZ | Y | 31.23 | 32.6 | 34.6 | 10.79 | 10.79 |

| 06/04/14 | MEAS | SQZ | Y | 67.66 | 70.5 | 74.73 | 10.45 | 10.45 |

| 06/03/14 | VLCCF | CwH | N | 14.27 | 14.65 | 15.74 | 10.30 | 10.3 |

| 06/03/14 | OPHT | CwH | N | 41.00 | 41.75 | 45.14 | 10.10 | 10.1 |

| 06/03/14 | GIII | SQZ | Y | 76.02 | 82.54 | 82.67 | 8.75 | 9.41 |

| 06/03/14 | AMAT | CwH | N | 20.58 | 21.42 | 21.82 | 6.03 | 6.03 |

| 06/03/14 | UHS | CwH | N | 90.14 | 92.83 | 94.82 | 5.19 | 5.68 |

| 06/05/14 | VPFG | SQZ | Y | 25.83 | 26.72 | 27.28 | 5.61 | 5.61 |

| 06/04/14 | TPX | CwH | Y | 56.03 | 57.43 | 59.02 | 5.34 | 5.34 |

| 06/05/14 | BBVA | CwH | N | 12.87 | 13.17 | 13.53 | 5.13 | 5.13 |

| 06/05/14 | KFY | CwH | N | 30.75 | 31.81 | 32.28 | 4.98 | 4.98 |

| 06/06/14 | GRFS | CwH | N | 43.50 | 45.37 | 45.37 | 4.30 | 4.3 |

| 06/04/14 | CAVM | CwH | N | 49.38 | 49.88 | 50.65 | 2.57 | 4.29 |

| 06/03/14 | BDC | SQZ | Y | 73.11 | 73.85 | 76.06 | 4.04 | 4.04 |

| 06/05/14 | TSU | CwH | Y | 28.44 | 28.53 | 29.47 | 3.62 | 3.62 |

| 06/03/14 | CBF | SQZ | Y | 24.46 | 24.54 | 25.34 | 3.60 | 3.6 |

| 06/06/14 | MCS | SQZ | Y | 17.53 | 18.12 | 18.12 | 3.37 | 3.37 |

| 06/05/14 | CNX | SQZ | Y | 45.96 | 47.41 | 47.45 | 3.24 | 3.24 |

| 06/05/14 | SHEN | SQZ | Y | 28.96 | 29.89 | 29.87 | 3.14 | 3.21 |

| 06/05/14 | SNMX | SQZ | Y | 8.13 | 8.39 | 8.31 | 2.21 | 3.2 |

| 06/06/14 | TSU | SQZ | Y | 28.63 | 29.47 | 29.47 | 2.93 | 2.93 |

| 06/05/14 | RLD | SQZ | Y | 12.40 | 12.61 | 12.76 | 2.90 | 2.9 |

| 06/05/14 | TPX | SQZ | Y | 57.53 | 57.61 | 59.02 | 2.59 | 2.59 |

| 06/06/14 | EEFT | CwH | N | 47.99 | 49.21 | 49.21 | 2.54 | 2.54 |

| 06/06/14 | PAY | SQZ | Y | 35.82 | 36.72 | 36.72 | 2.51 | 2.51 |

| 06/03/14 | AMRI | SQZ | Y | 16.94 | 17.28 | 17.21 | 1.59 | 2.01 |

| 06/06/14 | BNCN | SQZ | Y | 17.65 | 17.98 | 17.98 | 1.87 | 1.87 |

| 06/05/14 | RXN | SQZ | Y | 28.04 | 28.22 | 28.56 | 1.85 | 1.85 |

| 06/05/14 | STI | SQZ | Y | 38.93 | 39.2 | 39.64 | 1.82 | 1.82 |

| 06/03/14 | TSM | CwH | Y | 20.89 | 21.24 | 21.09 | 0.96 | 1.68 |

| 06/05/14 | HPTX | CwH | N | 29.41 | 29.75 | 26.95 | -8.36 | 1.16 |

| 06/05/14 | HEES | SQZ | Y | 37.78 | 38.16 | 37.66 | -0.32 | 1.01 |

| 06/05/14 | OFC | SQZ | Y | 28.04 | 28.27 | 28.28 | 0.86 | 0.86 |

| 06/06/14 | AAON | SQZ | Y | 32.89 | 33.12 | 33.12 | 0.70 | 0.7 |

| 06/05/14 | PAG | SQZ | Y | 48.22 | 48.35 | 48.53 | 0.64 | 0.64 |

| 06/06/14 | TRNX | CwH | N | 22.26 | 22.40 | 22.4 | 0.63 | 0.63 |

| 06/03/14 | ROL | SQZ | Y | 31.08 | 31.18 | 31.1 | 0.06 | 0.45 |

| 06/06/14 | BDSI | CwH | N | 9.96 | 10.00 | 10 | 0.40 | 0.4 |

| 06/06/14 | STAG | SQZ | Y | 24.94 | 25.01 | 25.01 | 0.28 | 0.28 |

| 06/02/14 | SYY | SQZ | Y | 37.63 | 37.64 | 37.68 | 0.13 | 0.13 |

| 06/06/14 | SPR | SQZ | Y | 33.68 | 33.69 | 33.69 | 0.03 | 0.03 |

| Weekly Average (41 breakouts) | 3.16 | 3.55 | ||||||

Cup with Handle Squeeze Breakout Probability

In our April 5, 2014 newsletter, I described how I was able to calculate the probability that a stock on the Squeeze Play watchlist would reach its squeeze-off price. This calculation has now been extended to the cup with handle watchlist. Please note that the probability refers to the "Squeeze Off" (SO) price and not the breakout price (which is the handle pivot).

Interpreting the Cup with Handle Squeeze Off Probability

So we have new metric, now how can we use it? Lets look at a stock setting up for a breakout on Monday, June 9, 2014.

As of Friday, June 6, 2014, GMCR had the highest probability of a SO breakout (0.81). You can see from it's chart below that the close price (122.07) was just below the handle pivot breakout price (123.62) and the SO price was 124.6. The SO price is above the pivot so if there is a high probability that GMCR will reach the SO price then it follows that there is a high probability that it will reach the breakout price.

Note: just because a stock reaches its breakout price does not mean that it is classed as a breakout, as we require volume to be at least 150% of the 50 day ADV. However, what we are really interested in is gain in price, regardless of volume, so the high probability of a breakout on price is attractive.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16924.3 | 1.24% | 2.1% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4321.4 | 1.86% | 3.47% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1949.44 | 1.34% | 5.47% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SKBI | Skystar Bio-Pharmaceutical Company | 101 |

| Top Technical | SKBI | Skystar Bio-Pharmaceutical Company | 101 |

| Top Fundamental | TPLM | Triangle Petroleum Corporation | 67 |

| Top Tech. & Fund. | TPLM | Triangle Petroleum Corporation | 67 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | BDSI | BioDelivery Sciences International, Inc. | 81 |

| Top Technical | TRNX | Tornier N.V. | 42 |

| Top Fundamental | EEFT | Euronet Worldwide, Inc. | 32 |

| Top Tech. & Fund. | EEFT | Euronet Worldwide, Inc. | 32 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.