| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Trading In-The-Money Options from the Cup and Handle Watchlist

Join us for a webinar on Jun 16, 2014 at 6:00 PM MDT.

Register now!

https://attendee.gotowebinar.com/regist/1239173053251242241

Stocks in a volatility squeeze that breakout from a cup and handle pattern can provide significant gains if traded as in-the-money options. This webinar will cover the theory behind this strategy and how to put it into practice.

After registering, you will receive a confirmation email containing information about joining the webinar.

See more below

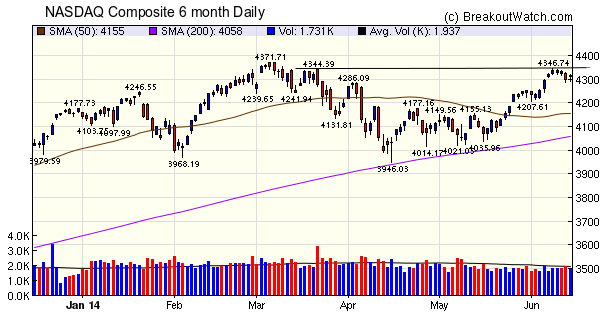

The NASDAQ Composite attempted to break resistance on Monday but slipped back setting the trend for the week with the three major indexes closing for a loss. With tensions rising in the middle east, we are unlikely to see a change in direction in the short term. Our trend indicators remain positive but that is because there is always a short lag while they detect a change in trend.

The number of breakouts fell substantially, reflecting the downward trend for the week.

| Breakouts for Week Beginning 06/09/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 06/09/14 | CLDX | HSB | Y | 15.73 | 16.26 | 17.15 | 9.03 | 12.02 |

| 06/10/14 | ADHD | SQZ | Y | 18.70 | 19 | 19.54 | 4.49 | 10.96 |

| 06/09/14 | GLNG | CwH | N | 47.54 | 48.66 | 51.87 | 9.11 | 9.17 |

| 06/09/14 | ALNY | SQZ | Y | 64.24 | 65.96 | 67.73 | 5.43 | 6.48 |

| 06/09/14 | HW | SQZ | Y | 13.36 | 13.95 | 13.79 | 3.22 | 5.99 |

| 06/09/14 | SCOR | SQZ | Y | 33.44 | 34.23 | 35.1 | 4.96 | 5.05 |

| 06/09/14 | ATRO | SQZ | Y | 59.72 | 61.99 | 55.11 | -7.72 | 4.39 |

| 06/11/14 | MTRX | SQZ | Y | 35.77 | 35.86 | 36.92 | 3.21 | 4.39 |

| 06/10/14 | SGMO | SQZ | Y | 15.61 | 16.27 | 15.77 | 1.02 | 4.29 |

| 06/11/14 | MMYT | CwH | N | 28.97 | 29.45 | 29 | 0.10 | 4.21 |

| 06/09/14 | SWIR | SQZ | Y | 19.58 | 20.09 | 20.05 | 2.40 | 3.98 |

| 06/09/14 | MSL | SQZ | Y | 18.74 | 19 | 18.91 | 0.91 | 3.04 |

| 06/09/14 | NWPX | SQZ | Y | 37.41 | 38.08 | 37.385 | -0.07 | 2.62 |

| 06/09/14 | FISI | SQZ | Y | 24.32 | 24.79 | 22.73 | -6.54 | 2.3 |

| 06/09/14 | PEBO | SQZ | Y | 25.84 | 25.94 | 25.69 | -0.58 | 1.82 |

| 06/12/14 | OAS | SQZ | Y | 51.86 | 52.41 | 52.68 | 1.58 | 1.64 |

| 06/13/14 | TXI | CwH | N | 91.46 | 92.36 | 92.36 | 0.98 | 1.07 |

| 06/10/14 | BSAC | SQZ | Y | 26.21 | 26.23 | 26.29 | 0.31 | 0.72 |

| Weekly Average (18 breakouts) | 1.77 | 4.67 | ||||||

No new Features this week.

Why the Cup and Handle with Squeeze works for Options Trading

We know that stocks that are in a cup and handle pattern have a strong potential to move higher if they break through their breakout price. For this reason alone, CwH breakouts offer a potentially rewarding call options play. When we add the "squeeze" into the mix the potential for exceptional profits is multiplied. Here's why.

As you probably know, options pricing is often done using the Black-Scholes model. Inputs to the model are

- Stock price

- Strike price

- Historical volatility

- Days to expiration

- Risk-free rate of interest.

(see: http://www.investopedia.com/university/optionvolatility/)

It follows that if "historical volatility" is low then the expected future volatility (known as implied volatility) is also low. In other words, option price is a function of volatility.Stocks in a squeeze are experiencing low "historical volatility", so the options price of a CwH stock in a squeeze will be lower than an equivalently priced CwH stock not in a squeeze.

A breakout from a squeeze results in a quickly changing implied volatility and a consequent jump in the call option price. By taking a call position at the time of the breakout we can profit substantially from this change in price. While the underlying stock price may only move 5%, the change in the option price can be many multiples of that.

Our webinar "Trading In-The-Money Options from the Cup and Handle Watchlist" will explain how to execute call option trades from the cup with handle watchlist. Topics covered:

- Review CWH Patterns

- The New Squeeze Filter

- What is a CALL option

- Why Use Options To Trade the CWH Move

- Examples of Trades / Results

- How to Set Filters and Alerts

- Q&A

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16775.7 | -0.88% | 1.2% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4310.65 | -0.25% | 3.21% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1936.16 | -0.68% | 4.75% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SKBI | Skystar Bio-Pharmaceutical Company | 106 |

| Top Technical | SKBI | Skystar Bio-Pharmaceutical Company | 106 |

| Top Fundamental | EPAM | EPAM Systems, Inc. | 45 |

| Top Tech. & Fund. | EPAM | EPAM Systems, Inc. | 45 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | MMYT | MakeMyTrip Limited | 50 |

| Top Technical | MMYT | MakeMyTrip Limited | 50 |

| Top Fundamental | TXI | Texas Industries, Inc. | 35 |

| Top Tech. & Fund. | TXI | Texas Industries, Inc. | 35 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.