| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

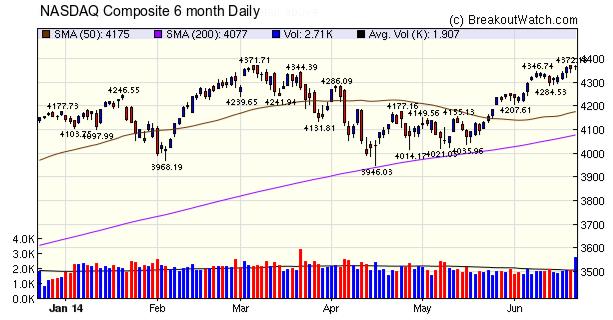

The NASDAQ Composite is testing resistance at 4271. It briefly surpassed that level but closed lower on Thursday. Friday's trading did not test resistance so we may see a brief consolidation before another breakthrough attempt is made. The Big Picture identified several reasons for the gains, despite the rise in oil prices and the Iraq situation:

- Homebuilder sentiment climbed from 45 to 49 vs 47 expected.

- Philly Fed came in higher than expected for the 4th straight month.

- Fed continues to taper $10B a month, market likes, S&P 500 closes at all-time highs.

- Empire manufacturing index came in at its highest level since 2010

- Industrial production grew by 0.6% m/o/m, better than expected, April #’s were revised up.

- Initial jobless claims 4-week moving average moved down to 312k, continuing claims hit the lowest levels

The number of breakouts jumped to 56 this week from just 18 last week. As you can see from the table below, some of the gains were spectacular, with SHPG gaining almost 23% after breakout.

| Breakouts for Week Beginning 06/16/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 06/16/14 | SHPG | CwH | N | 181.41 | 191.11 | 222.89 | 22.87 | 26.48 |

| 06/20/14 | FLML | CwH | N | 13.06 | 15.17 | 15.17 | 16.16 | 20.6 |

| 06/17/14 | GEVA | SQZ | Y | 88.17 | 89.87 | 101.39 | 14.99 | 15.83 |

| 06/20/14 | GNCA | SQZ | Y | 20.98 | 22.7 | 22.7 | 8.20 | 13.92 |

| 06/18/14 | PRCP | SQZ | Y | 12.14 | 13.24 | 13.02 | 7.25 | 10.79 |

| 06/19/14 | CNL | SQZ | Y | 53.23 | 55.98 | 57.6 | 8.21 | 10.11 |

| 06/18/14 | ENTA | SQZ | Y | 42.32 | 44.24 | 46.12 | 8.98 | 9.74 |

| 06/17/14 | PPP | CwH | N | 7.15 | 7.20 | 7.68 | 7.41 | 8.67 |

| 06/17/14 | SGMA | SQZ | Y | 11.32 | 11.79 | 12.18 | 7.60 | 7.69 |

| 06/17/14 | HZNP | CwH | N | 15.42 | 15.83 | 16.23 | 5.25 | 7 |

| 06/20/14 | RNA | HTF | N | 11.78 | 12.46 | 12.46 | 5.77 | 6.96 |

| 06/20/14 | CRME | SQZ | Y | 7.80 | 8 | 8.07 | 3.46 | 6.92 |

| 06/19/14 | INVE | HTF | N | 9.54 | 9.61 | 10.01 | 4.93 | 6.29 |

| 06/20/14 | ALKS | CwH | Y | 48.84 | 50.88 | 50.88 | 4.18 | 6.01 |

| 06/20/14 | KS | CwH | N | 31.53 | 33.21 | 33.21 | 5.33 | 5.84 |

| 06/17/14 | RSPP | SQZ | Y | 30.30 | 31.23 | 32.04 | 5.74 | 5.74 |

| 06/19/14 | CVCO | SQZ | Y | 77.89 | 78.75 | 81.79 | 5.01 | 5.35 |

| 06/17/14 | SUNE | SQZ | Y | 21.61 | 22.15 | 22.38 | 3.56 | 4.95 |

| 06/20/14 | SLXP | SQZ | Y | 118.61 | 124.02 | 124.02 | 4.56 | 4.88 |

| 06/19/14 | CVTI | CwH | N | 12.03 | 12.32 | 12.59 | 4.66 | 4.74 |

| 06/17/14 | OZRK | CwH | N | 64.40 | 65.02 | 66.85 | 3.80 | 4.61 |

| 06/19/14 | CWEI | SQZ | Y | 134.83 | 136 | 136.66 | 1.36 | 4.49 |

| 06/19/14 | SCS | SQZ | Y | 17.10 | 17.47 | 17.7 | 3.51 | 4.44 |

| 06/19/14 | GIL | SQZ | Y | 55.96 | 57.41 | 57.95 | 3.56 | 4.27 |

| 06/17/14 | HALL | CwH | N | 10.45 | 10.51 | 10.87 | 4.02 | 4.11 |

| 06/16/14 | BURL | SQZ | Y | 30.49 | 30.51 | 31.6 | 3.64 | 4.1 |

| 06/17/14 | MTSI | CwH | N | 22.38 | 23.02 | 22.68 | 1.34 | 3.62 |

| 06/17/14 | GMCR | SQZ | Y | 121.72 | 125.49 | 121.82 | 0.08 | 3.59 |

| 06/16/14 | ARAY | SQZ | Y | 9.22 | 9.32 | 9.4 | 1.95 | 3.36 |

| 06/17/14 | ATML | CwH | N | 9.33 | 9.63 | 9.45 | 1.29 | 3.22 |

| 06/20/14 | YPF | CwH | N | 33.41 | 33.76 | 33.76 | 1.05 | 3.17 |

| 06/17/14 | TSLA | SQZ | Y | 224.71 | 231.67 | 229.59 | 2.17 | 3.1 |

| 06/20/14 | PJC | CwH | N | 48.67 | 50.04 | 50.04 | 2.81 | 3 |

| 06/20/14 | LCI | CwH | N | 48.61 | 49.76 | 49.76 | 2.37 | 2.86 |

| 06/20/14 | FARM | SQZ | Y | 20.79 | 21.27 | 21.27 | 2.31 | 2.85 |

| 06/16/14 | SNAK | SQZ | Y | 12.87 | 13.21 | 12.28 | -4.58 | 2.64 |

| 06/18/14 | TEVA | CwH | N | 52.16 | 53.02 | 52.97 | 1.55 | 2.55 |

| 06/18/14 | TEF | CwH | N | 16.99 | 17.33 | 17.4 | 2.41 | 2.47 |

| 06/18/14 | NOK | CwH | N | 8.13 | 8.33 | 7.75 | -4.67 | 2.46 |

| 06/17/14 | FENG | SQZ | Y | 10.84 | 10.95 | 10.9 | 0.55 | 2.4 |

| 06/20/14 | AKRX | CwH | N | 29.28 | 29.77 | 29.77 | 1.67 | 2.22 |

| 06/19/14 | MTX | SQZ | Y | 64.07 | 64.95 | 65.41 | 2.09 | 2.14 |

| 06/18/14 | MHG | CwH | N | 13.12 | 13.37 | 13.09 | -0.23 | 1.91 |

| 06/19/14 | STZ | SQZ | Y | 86.06 | 86.53 | 87.48 | 1.65 | 1.84 |

| 06/20/14 | IRDM | CwH | N | 8.27 | 8.37 | 8.37 | 1.21 | 1.57 |

| 06/18/14 | KEG | SQZ | Y | 8.90 | 8.91 | 8.92 | 0.22 | 1.18 |

| 06/20/14 | PSX | SQZ | Y | 85.36 | 85.94 | 85.94 | 0.68 | 1.08 |

| 06/20/14 | CONE | SQZ | Y | 24.10 | 24.1 | 24.1 | 0.00 | 1.04 |

| 06/18/14 | RSE | HSB | Y | 17.37 | 17.38 | 17.46 | 0.52 | 0.86 |

| 06/17/14 | DBD | SQZ | Y | 38.97 | 39.13 | 39.13 | 0.41 | 0.77 |

| 06/19/14 | CHMI | SQZ | Y | 19.79 | 19.83 | 19.89 | 0.51 | 0.66 |

| 06/20/14 | HF | CwH | N | 34.94 | 35.11 | 35.11 | 0.49 | 0.52 |

| 06/20/14 | DRH | CwH | N | 12.83 | 12.89 | 12.89 | 0.47 | 0.47 |

| 06/19/14 | MDU | SQZ | Y | 34.16 | 34.2 | 33.67 | -1.43 | 0.41 |

| 06/20/14 | SHLM | CwH | N | 37.30 | 37.37 | 37.37 | 0.19 | 0.35 |

| 06/20/14 | EEFT | CwH | N | 49.21 | 49.23 | 49.23 | 0.04 | 0.22 |

| Weekly Average (56 breakouts) | 3.45 | 4.88 | ||||||

Following the success of the squeeze indicator, I've developed a more comprehensive report that lists all optionable stocks that are in a squeeze, no matter what pattern they are in. This report is "responsive" meaning that it adapts to the viewport of the device on which it is being displayed. Try it on your mobile device(s).

This is a beta test version that will undergo further enhancement in the future.

Trading In-The-Money Options from the Cup and Handle Pattern

The video from this webinar is now available at https://www.youtube.com/watch?v=fcanN7bSIvE

The slides are available in the Support Forum.

If you have questions, please post them to the support forum.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16947.1 | 1.02% | 2.23% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4368.04 | 1.33% | 4.58% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1962.87 | 1.38% | 6.2% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PZE | Petrobras Argentina S.A. | 109 |

| Top Technical | PZE | Petrobras Argentina S.A. | 109 |

| Top Fundamental | EPAM | EPAM Systems, Inc. | 44 |

| Top Tech. & Fund. | EPAM | EPAM Systems, Inc. | 44 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | IRDM | Iridium Communications Inc | 92 |

| Top Technical | LCI | Lannett Co Inc | 54 |

| Top Fundamental | HF | HFF, Inc. | 51 |

| Top Tech. & Fund. | HF | HFF, Inc. | 51 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.