| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

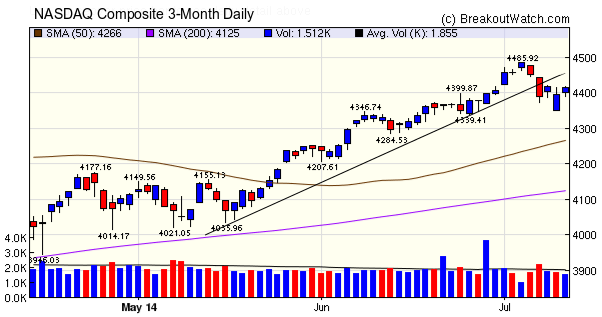

The NASDAQ fell through the support trend line on Tuesday as concerns over another Portuguese bank crisis emerged. Friday's higher close indicated a recovery may be in progress and out trend indicators remain positive.

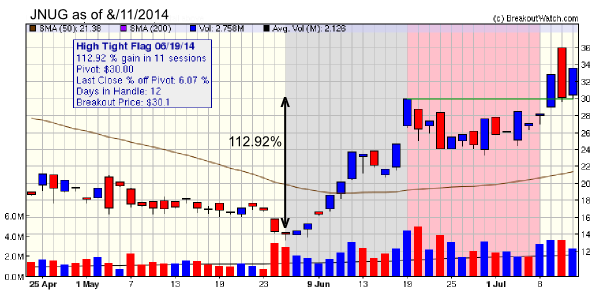

The decline in the NASDAQ meant that the number of breakouts fell to 16 from last week's 29. The cup and handle pattern again dominated the breakout list although the top performer, JNUG could also have been classified as a CwH stock - see the chart lesson below.

| Breakouts for Week Beginning 07/07/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 07/09/14 | JNUG | HTF | N | 30.00 | 32.81 | 33.58 | 11.93 | 11.93 |

| 07/09/14 | PXLW | CwH | N | 7.89 | 8.73 | 8.42 | 6.72 | 10.65 |

| 07/09/14 | GPRE | CwH | N | 34.03 | 35.30 | 36.46 | 7.14 | 7.14 |

| 07/09/14 | SAND | CwH | N | 7.24 | 7.54 | 7.27 | 0.41 | 6.22 |

| 07/09/14 | PZE | CwH | N | 6.83 | 7.05 | 7.19 | 5.27 | 5.42 |

| 07/07/14 | ORBK | SQZ | Y | 15.75 | 16.44 | 15.72 | -0.19 | 4.38 |

| 07/09/14 | SIL | CwH | N | 14.39 | 14.66 | 14.7 | 2.15 | 4.03 |

| 07/09/14 | EGO | CwH | N | 7.64 | 7.91 | 7.72 | 1.05 | 3.53 |

| 07/09/14 | PPP | CwH | N | 8.01 | 8.17 | 8.29 | 3.50 | 3.5 |

| 07/07/14 | TSEM | SQZ | Y | 9.96 | 10.16 | 9.49 | -4.72 | 2.01 |

| 07/09/14 | MXL | CwH | Y | 10.47 | 10.67 | 10.58 | 1.05 | 1.91 |

| 07/11/14 | ESC | CwH | N | 32.55 | 33.00 | 33 | 1.38 | 1.38 |

| 07/11/14 | WDC | CwH | N | 96.54 | 97.77 | 97.77 | 1.27 | 1.27 |

| 07/11/14 | AB | CwH | N | 26.57 | 26.82 | 26.82 | 0.94 | 0.94 |

| 07/08/14 | PRSC | SQZ | Y | 39.11 | 39.23 | 37.64 | -3.76 | 0.31 |

| 07/08/14 | RTI | HSB | N | 26.98 | 27.03 | 26.15 | -3.08 | 0.19 |

| Weekly Average (16 breakouts) | 1.94 | 4.05 | ||||||

No New Features This Week

Chart Lesson: Cup and Handle vs High Tight Flag

Sometimes, if we don't identify a stock as cup and handle we will catch it as a high tight flag. A case occured this week with the breakout of JNUG. The first chart below shows the high tight flag pattern for JNUG. To recognize an HTF pattern, we require that the gain should be at least 100% within 8 weeks. In this case we see JNUG gained 113% in just 2 weeks and then formed a "flag" which looks a lot like a handle. The full requirement for a high tight flag pattern are described here

Looking at JNUG over a longer period, we see that it actually formed a well shaped cup following its sharp decline in March this year. In fact, the decline was so sharp that it fell 70% from the left cup high of 43.14. Our cup with handle algorithm eliminates cups with a depth greater than 60% so JNUG never appeared on our cup with handle watchlist. The full requirements for a cup with (and) handle pattern are described here.

This example shows that although our algorithms for a cup and handle pattern may miss a profitable breakout stock there's a good chance that if it is truly a high flyer our high tight flag algorithm with capture it.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16943.8 | 2.21% | 2.21% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4415.49 | 5.72% | 5.72% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1967.51 | 6.45% | 6.45% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SAND | Sandstorm Gold Ltd | 105 |

| Top Technical | SAND | Sandstorm Gold Ltd | 105 |

| Top Fundamental | EPAM | EPAM Systems, Inc. | 47 |

| Top Tech. & Fund. | QCOR | Questcor Pharmaceuticals, Inc. | 31 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SAND | Sandstorm Gold Ltd | 106 |

| Top Technical | ESC | Emeritus Corporation | 38 |

| Top Fundamental | MXL | MaxLinear, Inc | 66 |

| Top Tech. & Fund. | MXL | MaxLinear, Inc | 66 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.