| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

I'd like to welcome a number of new subscribers this week. For their benefit, I'd like to mention that in our weekly newsletter we first look at the performance for the week of the NASDAQ Composite as it is from stocks included in that index that mor breakouts occur.

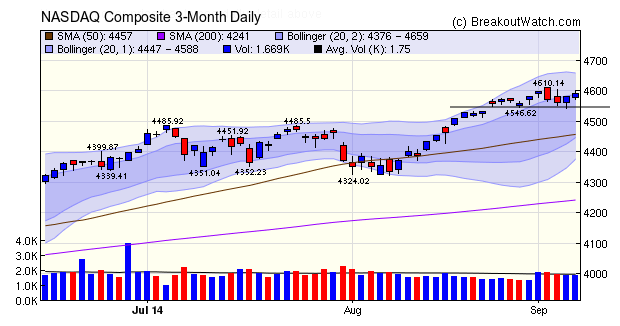

The index continued to move sideways as it consolidates gains made in August. Support at 4546 was tested on Wednesday and Thursday, as it was in the previous week, That level has proved quite robust on three occasions now and a break below it would be decidedly bearish in the short term, although as long as interest rates remain low, the longer term outlook for stocks is positive

Despite the sideways movement of the NASDAQ index, breakouts remained numerous and quite strong. Land's End was the standout performer as institutions bought heavily on Wednesday and Thursday. We issued an alert at 9:36 eastern time when the stock was still within buyable range. Quick action at that time could have delivered a 20+% gain in two days.

| Alert Price: | $36.880 |

| Breakout Price: | $35.64 |

| The 5% maximum price: | $37.42 |

| Breakouts for Week Beginning 09/08/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 09/10/14 | LE | DB | N | 35.64 | 40.20 | 44.77 | 25.62 | 25.62 |

| 09/09/14 | CMRX | CwH | N | 25.92 | 28.54 | 28.27 | 9.07 | 15.86 |

| 09/10/14 | RCPT | CwH | N | 53.36 | 58.28 | 59.67 | 11.83 | 13.19 |

| 09/11/14 | TAM | CwH | N | 23.99 | 26.21 | 26.53 | 10.59 | 10.59 |

| 09/11/14 | AMRI | SQZ | Y | 20.68 | 21.87 | 21.83 | 5.56 | 5.75 |

| 09/08/14 | RMBS | SQZ | Y | 12.47 | 12.59 | 13.07 | 4.81 | 4.81 |

| 09/08/14 | MMYT | DB | N | 30.28 | 31.25 | 29.98 | -0.99 | 3.83 |

| 09/11/14 | RDNT | SQZ | Y | 7.58 | 7.87 | 7.64 | 0.79 | 3.83 |

| 09/11/14 | IBKR | SQZ | Y | 24.50 | 24.6 | 25.29 | 3.22 | 3.22 |

| 09/11/14 | LOGM | SQZ | Y | 45.02 | 45.34 | 46.39 | 3.04 | 3.04 |

| 09/08/14 | FOLD | HTF | N | 7.27 | 7.47 | 6.72 | -7.57 | 2.75 |

| 09/12/14 | YHOO | CwH | N | 41.81 | 42.88 | 42.88 | 2.56 | 2.56 |

| 09/10/14 | APL | CwH | N | 37.13 | 37.53 | 36.91 | -0.59 | 2.15 |

| 09/12/14 | PGI | DB | Y | 13.25 | 13.53 | 13.53 | 2.11 | 2.11 |

| 09/09/14 | GMLP | CwH | N | 38.35 | 39.00 | 37.27 | -2.82 | 1.69 |

| 09/11/14 | MACK | SQZ | Y | 7.19 | 7.31 | 7.27 | 1.11 | 1.67 |

| 09/11/14 | PBYI | HTF | N | 269.82 | 273.68 | 270.83 | 0.37 | 1.43 |

| 09/12/14 | ACAD | CwH | N | 27.93 | 28.24 | 28.24 | 1.11 | 1.11 |

| 09/08/14 | ALJ | CwH | N | 16.70 | 16.87 | 15.66 | -6.23 | 1.02 |

| 09/12/14 | PNFP | SQZ | Y | 37.15 | 37.49 | 37.49 | 0.92 | 0.92 |

| 09/12/14 | TASR | CwH | N | 18.27 | 18.43 | 18.43 | 0.88 | 0.88 |

| 09/11/14 | CFN | CwH | N | 46.45 | 46.77 | 46.39 | -0.13 | 0.69 |

| 09/09/14 | BKS | CwH | N | 23.94 | 24.09 | 23.44 | -2.09 | 0.63 |

| 09/11/14 | CAAS | CwH | N | 10.47 | 10.51 | 10.5 | 0.29 | 0.38 |

| 09/08/14 | IIIN | CwH | N | 24.00 | 24.04 | 23.04 | -4.00 | 0.17 |

| 09/08/14 | PTCT | CwH | N | 33.87 | 33.92 | 32.72 | -3.40 | 0.15 |

| Weekly Average (26 breakouts) | 2.16 | 4.23 | ||||||

No new features this week.

How to Use out T/A Charts.

T/A stands for technical analysis. Since our chart pattern recognition methodologies all rely on technical analysis, it's natural that the charts we present are all T/A based.

How we use them on our watchlists, how to use the Chart Browser, and how you can use them is the subject of a short video I've prepared. You can see it here.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | -100% | -100% | Up | |||||||||||||||||||||||||||||||||||||

| NASDAQ | 17137.4 | 273.94% | 310.32% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 4582.9 | 128.27% | 147.94% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | HPJ | Hong Kong Highpower Technology | 110 |

| Top Technical | HPJ | Hong Kong Highpower Technology | 110 |

| Top Fundamental | FNHC | Federated National Holding Company | 59 |

| Top Tech. & Fund. | FNHC | Federated National Holding Company | 59 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CAAS | China Automotive Systems, Inc. | 73 |

| Top Technical | PTCT | PTC Therapeutics, Inc. | 52 |

| Top Fundamental | IIIN | Insteel Industries, Inc. | 54 |

| Top Tech. & Fund. | IIIN | Insteel Industries, Inc. | 54 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.