| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

I am still nursing a stiff right arm

so commentary is again limited this week.

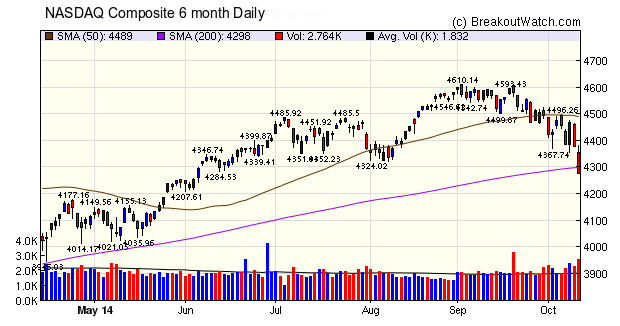

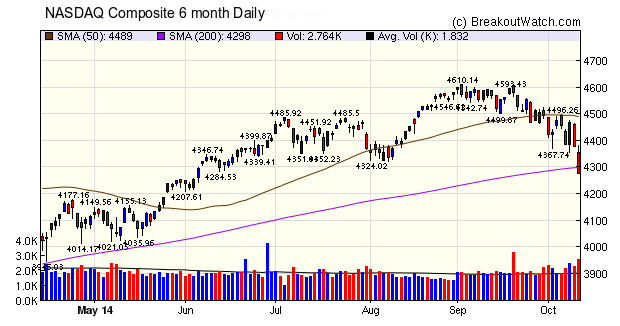

The NASDAQ gapped down at Friday's open but a short rally could not be sustained and the index closed below its 200 day moving average and was 7% off its recent high. The high volatility of recent days is good for day traders but not for swing or medium term investors,. Although there will be profitable breakouts, they will be hard to pick and its best to stay on the sidelines until a recovery begins.

The NASDAQ gapped down at Friday's open but a short rally could not be sustained and the index closed below its 200 day moving average and was 7% off its recent high. The high volatility of recent days is good for day traders but not for swing or medium term investors,. Although there will be profitable breakouts, they will be hard to pick and its best to stay on the sidelines until a recovery begins.

| Breakouts for Week Beginning 10/06/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 10/08/14 | TWM | HSB | Y | 55.40 | 59.80 | 63.58 | 14.77 | 14.77 |

| 10/09/14 | RENT | CwH | N | 66.75 | 72.07 | 71.84 | 7.63 | 7.97 |

| 10/07/14 | LPSN | CwH | N | 13.19 | 13.25 | 13.73 | 4.09 | 5.08 |

| 10/08/14 | RDUS | HTF | N | 22.24 | 23.31 | 20.7 | -6.92 | 4.81 |

| 10/09/14 | AUXL | CwH | N | 31.18 | 32.44 | 31.77 | 1.89 | 4.04 |

| 10/10/14 | TWM | CwH | N | 61.56 | 63.58 | 63.58 | 3.28 | 3.28 |

| 10/06/14 | BCR | DB | N | 147.23 | 149.24 | 149.89 | 1.81 | 2.89 |

| 10/08/14 | SAFT | SQZ | Y | 55.39 | 55.94 | 56.8 | 2.55 | 2.55 |

| 10/08/14 | MNST | SQZ | Y | 94.63 | 96.47 | 94.84 | 0.22 | 1.94 |

| 10/10/14 | INFY | CwH | N | 61.75 | 62.82 | 62.82 | 1.73 | 1.73 |

| 10/07/14 | CF | CwH | N | 279.22 | 282.76 | 266.11 | -4.70 | 1.27 |

| 10/08/14 | PETS | HSB | N | 13.29 | 13.43 | 13.02 | -2.03 | 1.05 |

| 10/08/14 | LYV | CwH | N | 24.48 | 24.68 | 22.79 | -6.90 | 0.82 |

| 10/10/14 | ROST | CwH | Y | 76.97 | 77.53 | 77.53 | 0.73 | 0.73 |

| 10/08/14 | DTE | CwH | N | 78.83 | 79.10 | 78.73 | -0.13 | 0.34 |

| 10/09/14 | CBOE | CwH | N | 55.81 | 55.90 | 55.62 | -0.34 | 0.16 |

| 10/09/14 | GIL | SQZ | Y | 55.90 | 55.94 | 55.98 | 0.14 | 0.14 |

| 10/10/14 | GPX | CwH | N | 29.17 | 29.18 | 29.18 | 0.03 | 0.03 |

| Weekly Average (18 breakouts) | 0.99 | 2.98 | ||||||

No new Features this week.

Nothing to add this week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16544.1 | -2.74% | -0.2% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4276.24 | -4.45% | 2.39% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1906.13 | -3.14% | 3.13% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | HPJ | Highpower International Inc | 102 |

| Top Technical | HPJ | Highpower International Inc | 102 |

| Top Fundamental | SXI | Standex International Corporation | 21 |

| Top Tech. & Fund. | SXI | Standex International Corporation | 21 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | LYV | Live Nation Entertainment, Inc. | 43 |

| Top Technical | LPSN | LivePerson, Inc. | 42 |

| Top Fundamental | GPX | GP Strategies Corporation | 0 |

| Top Tech. & Fund. | GPX | GP Strategies Corporation | 0 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.