| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

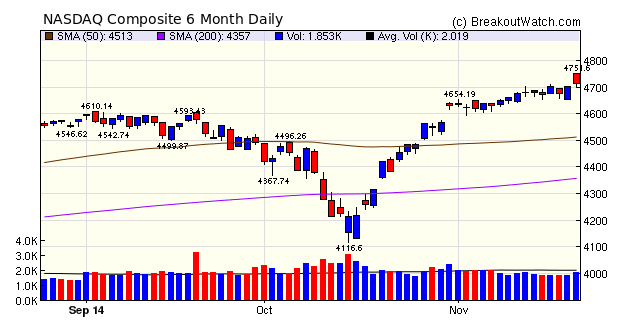

The NASDAQ Composite was essentially unchanged for the week until Friday when the index gapped up at the open following an overnight cut in Chinese interest rates to stimulate their economy. Although the early gains were cut by profit taking, the index still closed at a new 14 year high. Trading on Thursday and Friday produced consecutive accumulation days but volumes remained well below the 50 day average, showing only moderate enthusiasm for the current rising trend. The index's gain for the week of just 0.5% was well below that of the DJI and S&P 500.

The number of breakouts surged to 42 this week but the lower volumes and only moderate overall gain for the NASDAQ kept average gains to just 3.4%. Nevertheless, of the 42 breakouts, only three closed the week in the red.

| Breakouts for Week Beginning 11/17/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 11/18/14 | KONA | CwH | N | 23.17 | 24.06 | 24.81 | 7.08 | 9.54 |

| 11/21/14 | TCK | HSB | N | 16.22 | 17.73 | 17.73 | 9.31 | 9.31 |

| 11/19/14 | MAC | CwH | N | 71.33 | 76.58 | 77.74 | 8.99 | 8.99 |

| 11/20/14 | ROST | CwH | Y | 82.79 | 83.21 | 89.3 | 7.86 | 7.86 |

| 11/19/14 | BBY | CwH | N | 35.49 | 35.54 | 38.03 | 7.16 | 7.16 |

| 11/17/14 | XON | CwH | N | 24.40 | 24.93 | 26.07 | 6.84 | 7.13 |

| 11/19/14 | DLTR | CwH | N | 62.11 | 62.63 | 66.39 | 6.89 | 6.89 |

| 11/19/14 | MTSI | CwH | N | 23.14 | 23.99 | 24.72 | 6.83 | 6.83 |

| 11/17/14 | Z | SQZ | Y | 113.81 | 117.86 | 115.02 | 1.06 | 6.28 |

| 11/21/14 | NOAH | CwH | N | 17.17 | 18.24 | 18.24 | 6.23 | 6.23 |

| 11/17/14 | TRLA | SQZ | Y | 48.55 | 49.79 | 49.24 | 1.42 | 5.64 |

| 11/18/14 | BKD | SQZ | Y | 33.92 | 34.28 | 35.37 | 4.27 | 4.27 |

| 11/21/14 | ADSK | CwH | N | 59.66 | 61.95 | 61.95 | 3.84 | 3.84 |

| 11/20/14 | CRMT | CwH | N | 48.70 | 50.25 | 50.56 | 3.82 | 3.82 |

| 11/21/14 | CRMT | CwH | N | 48.70 | 50.56 | 50.56 | 3.82 | 3.82 |

| 11/17/14 | KMR | SQZ | Y | 97.46 | 99.05 | 98.33 | 0.89 | 3.64 |

| 11/18/14 | AVNR | HTF | N | 13.41 | 13.70 | 13.88 | 3.50 | 3.5 |

| 11/21/14 | PCTY | CwH | N | 29.05 | 30.03 | 30.03 | 3.37 | 3.37 |

| 11/20/14 | CATO | CwH | N | 37.72 | 38.89 | 38.14 | 1.11 | 3.1 |

| 11/19/14 | JBLU | CwH | N | 13.09 | 13.24 | 13.25 | 1.22 | 2.67 |

| 11/18/14 | COO | CwH | N | 166.08 | 170.15 | 167.15 | 0.64 | 2.45 |

| 11/21/14 | PGNX | CwH | N | 6.61 | 6.77 | 6.77 | 2.42 | 2.42 |

| 11/18/14 | GWPH | SQZ | Y | 78.66 | 80.5 | 78.95 | 0.37 | 2.34 |

| 11/18/14 | RBA | CwH | N | 25.31 | 25.48 | 25.89 | 2.29 | 2.29 |

| 11/17/14 | KMI | SQZ | Y | 40.07 | 40.25 | 39.75 | -0.80 | 2.17 |

| 11/19/14 | GTT | CwH | N | 13.39 | 13.53 | 13.66 | 2.02 | 2.02 |

| 11/20/14 | APO | HSB | N | 23.72 | 23.75 | 24.11 | 1.64 | 1.64 |

| 11/21/14 | MIDU | CwH | N | 95.33 | 96.84 | 96.84 | 1.58 | 1.58 |

| 11/21/14 | BERY | CwH | N | 26.86 | 27.27 | 27.27 | 1.53 | 1.53 |

| 11/19/14 | FL | DB | N | 56.17 | 56.19 | 54.55 | -2.88 | 1.48 |

| 11/19/14 | BPL | SQZ | Y | 81.50 | 81.65 | 82.58 | 1.33 | 1.33 |

| 11/20/14 | CSTE | CwH | N | 61.58 | 62.39 | 61.49 | -0.15 | 1.32 |

| 11/21/14 | CATO | CwH | N | 37.72 | 38.14 | 38.14 | 1.11 | 1.11 |

| 11/21/14 | ACAD | CwH | N | 28.21 | 28.43 | 28.43 | 0.78 | 0.78 |

| 11/21/14 | EPI | CwH | N | 23.37 | 23.55 | 23.55 | 0.77 | 0.77 |

| 11/21/14 | PIN | CwH | N | 22.67 | 22.77 | 22.77 | 0.44 | 0.44 |

| 11/21/14 | EQM | CwH | Y | 90.74 | 91.13 | 91.13 | 0.43 | 0.43 |

| 11/19/14 | MONT | CwH | N | 22.50 | 22.59 | 24.72 | N/A | 0.4 |

| 11/21/14 | LQ | SQZ | Y | 21.14 | 21.2 | 21.2 | 0.28 | 0.28 |

| 11/21/14 | INDL | CwH | N | 102.49 | 102.68 | 102.68 | 0.19 | 0.19 |

| 11/18/14 | MCRI | CwH | N | 17.19 | 17.20 | 16.75 | -2.56 | 0.06 |

| 11/20/14 | PLNR | HTF | N | 7.68 | 7.68 | 7.29 | -5.08 | -0 |

| Weekly Average (42 breakouts) | 2.43 | 3.36 | ||||||

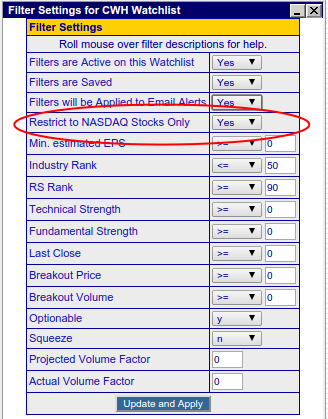

New Filter for NASDAQ Only Breakouts

You can now filter our watchlists to restrict display and alerts to only those stocks listed on the NASDAQ exchange. To do so, set the "Restrict to NASDAQ Stocks Only" filter to 'Yes' as shown below. If not set to yes, then stocks from all exchanges will be shown.

Focus Like a Laser on Higher Returns

Last week (see NASDAQ Delivers More Breakouts and Higher Returns), I showed how breakouts listed on the NASDAQ exchange outperformed both the NYSE and AmEx exchanges. To allow you to more easily take advantage of this knowledge, use the new NASDAQ Filter to limit the stocks shown on our watchlist to only those on the NASDAQ exchange. This will mean fewer stocks on which you will need to do due diligence, and should lead to higher gains on average, when combined with other selective filters (see Important Strategy Revisions).

As a reminder, I reproduce the results of last week's study.

| Successful Breakouts 2014 | |||||

| Exchange | No. BrkOuts by Exchange |

Avg Max Gain by Exchange |

WatchList | No. Brkouts by Watchlist |

Avg Max Gain by Watchlist |

|---|---|---|---|---|---|

| NASDAQ | 418 | 23% | CWH | 252 | 25% |

| DB | 7 | 17% | |||

| HSB | 0 | 0% | |||

| HTF | 24 | 27% | |||

| SQZ | 135 | 19% | |||

| NYSE | 386 | 12% | CWH | 238 | 12% |

| DB | 14 | 16% | |||

| HSB | 2 | 6% | |||

| HTF | 1 | 0% | |||

| SQZ | 131 | 11% | |||

| AMEX | 11 | 17% | CWH | 6 | 13% |

| DB | 0 | 0% | |||

| HSB | 1 | 33% | |||

| HTF | 0 | 0% | |||

| SQZ | 4 | 21% | |||

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17810.1 | 0.99% | 7.44% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4712.97 | 0.52% | 12.84% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2063.5 | 1.16% | 11.64% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | JRJC | China Finance Online Co. Limited | 100 |

| Top Technical | JRJC | China Finance Online Co. Limited | 100 |

| Top Fundamental | CMG | Chipotle Mexican Grill, Inc. | 28 |

| Top Tech. & Fund. | CMG | Chipotle Mexican Grill, Inc. | 28 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GTT | GTT Communications, Inc. | 78 |

| Top Technical | INDA | Ishares MSCI India ETF | 0 |

| Top Fundamental | EQM | EQT Midstream Partners, LP | 0 |

| Top Tech. & Fund. | EQM | EQT Midstream Partners, LP | 0 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.