| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

The three major indexes all suffered steep declines this week and the NASDAQ Composite suffered most with two big distribution days on Tuesday and Wednesday. On Thursday, the NASDAQ found support at the 50 day moving average level and went on to have the biggest gains of the three on Friday. The NASDAQ is the only one of the three to be above the 50 day average and the only one that our trend indicator considers on an upward trend.

The steep decline kept the number of breakouts to a low 7 with an average gain of negative 0.7% heavily influenced by the steep failure of High Tight Flag pattern (HTF) breakout CBMG. NVEE, the top performer, conformed to the classic cup and handle pattern, exhibiting almost perfect cup and then handle price and volume behavior (see Anatomy of a Cup-with-Handle Chart Pattern)

| Breakouts for Week Beginning 03/23/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 03/23/15 | NVEE | CwH | N | 14.84 | 15.50 | 94 | 16 | 7.82 | 8.36 |

| 03/26/15 | CMC | HSB | N | 15.26 | 15.28 | 20 | 15.5 | 1.57 | 1.57 |

| 03/27/15 | WUBA | CwH | N | 49.10 | 49.83 | 80 | 49.83 | 1.49 | 1.49 |

| 03/23/15 | CBMG | HTF | N | 46.45 | 47.06 | 99 | 40.1 | -13.67 | 1.31 |

| 03/27/15 | JIVE | HSB | N | 5.12 | 5.17 | 9 | 5.17 | 0.98 | 0.98 |

| 03/23/15 | FLTX | CwH | N | 45.58 | 46.01 | 90 | 43.74 | -4.04 | 0.94 |

| 03/27/15 | RPTP | CwH | N | 11.88 | 11.97 | 80 | 11.97 | 0.76 | 0.76 |

| Weekly Average (7 breakouts) | -0.73 | 2.2 | |||||||

| *RS Rank on day before breakout. | |||||||||

No new Features this week.

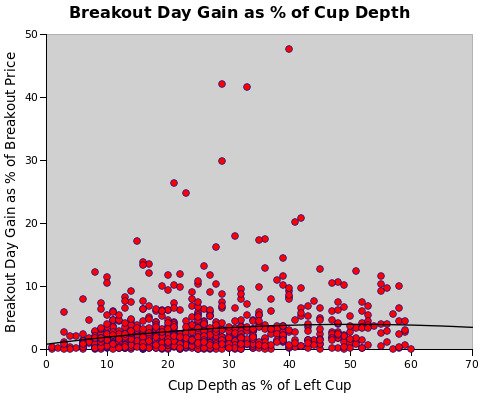

Cup Depth of Little Importance to Breakout Day Performance

Following last week's analysis of the significance of handle depth to breakout day performance, I was asked if there was an optimal cup depth.

The chart below shows a scatter plot of breakout day gain versus cup depth as a % of left cup for all successful breakouts since January 2014. Cup depth is measured from the left cup high to the base low and then expressed as a % of the left cup high .

The red line is a polynomial regression line, or line of best fit, through the observations.

Firstly, notice that there are very few breakouts with cup depths less than 8%, although breakout day gains of up to 8% are possible although rare.

Secondly, most breakouts occur between cup depths of 10% to 40% but there are still many breakouts at even deeper depths. The cut-off at 60% is due to our not listing cups with a depth greater than 60% on our cup and handle watchlist.

Finally, although there are some high gain breakouts for cup depths between 30% and 40%, they are rare and outliers to the general trend.

Conclusion

There is no optimal cup depth for strong breakout day gains from the cup and handle watchlist, but shallow cup depths (less than 8%) rarely produce breakouts.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17712.7 | -2.29% | -0.62% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4891.22 | -2.69% | 3.28% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2061.02 | -2.23% | 0.1% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | MWW | Monster Worldwide, Inc. | 101 |

| Top Technical | MWW | Monster Worldwide, Inc. | 101 |

| Top Fundamental | GTN | Gray Television, Inc. | 68 |

| Top Tech. & Fund. | GTN | Gray Television, Inc. | 68 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | RPTP | Raptor Pharmaceutical Corp. | 73 |

| Top Technical | FLTX | Fleetmatics Group PLC | 47 |

| Top Fundamental | FLTX | Fleetmatics Group PLC | 47 |

| Top Tech. & Fund. | FLTX | Fleetmatics Group PLC | 47 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.