| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

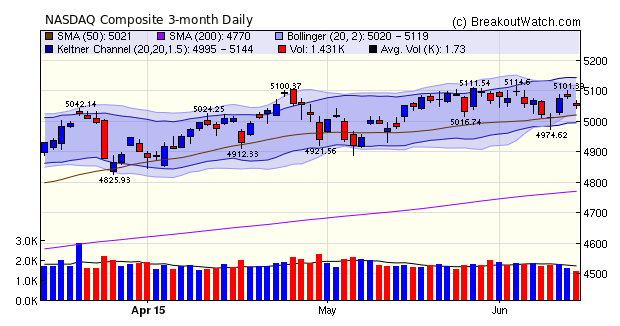

Three "Doji" patterns this week, on Tuesday, Thursday and Friday, indicated the uncertainty generated by the unresolved Greek Debt crisis. Of the three major indexes, the NASDAQ was the only one to close with a small loss for the week but the index is also the only one to close above its 50 day average and the only one for which our trend indicator remains positive. The NASDAQ also remains the clear winner on a year-to-date basis.

A consequence of the index trading within a relatively narrow range is that the Bollinger Band has contracted to within the Keltner Channel, as the chart shows, indicating that a volatility squeeze is in progress. A volatility squeeze is resolved when normal volatility returns which will be when either a strong up or down trend returns.

It is also worth noting that daily volume fell well below the 50 day average on Thursday and even more so on Friday as traders headed off for the weekend. This pattern will likely continue throughout the summer making trading on Friday and Monday somewhat uncertain due to contracting volume.

The volatility squeeze in the NASDAQ as a whole is reflected in the large number of stocks appearing on our volatility squeeze watchlist (SQZ) and the number of breakouts, 46, that come from that list. However, the average gain at weeks end for SQZ breakouts was 1.3% compared to 2.8% for cup and handle breakouts (CwH).

| Breakouts for Week Beginning 06/08/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 06/10/15 | RCPT | SQZ | Y | 160.47 | 180.52 | 98 | 178.31 | 11.12 | 17.54 |

| 06/08/15 | MXL | CwH | N | 10.76 | 10.89 | 89 | 12.38 | 15.06 | 15.06 |

| 06/11/15 | HTHT | CwH | N | 27.30 | 29.02 | 84 | 30.89 | 13.15 | 13.15 |

| 06/12/15 | XNET | CwH | N | 12.14 | 13.70 | 96 | 13.7 | 12.85 | 12.85 |

| 06/09/15 | CCRN | SQZ | Y | 10.89 | 11.27 | 82 | 11.88 | 9.09 | 9.09 |

| 06/09/15 | LLY | CwH | N | 79.85 | 82.77 | 84 | 84.21 | 5.46 | 8.44 |

| 06/10/15 | LAYN | SQZ | Y | 8.98 | 9.66 | 89 | 9.72 | 8.24 | 8.24 |

| 06/09/15 | CMN | CwH | Y | 48.54 | 52.00 | 85 | 51.93 | 6.98 | 7.13 |

| 06/09/15 | HELE | SQZ | Y | 89.82 | 90.9 | 94 | 94.79 | 5.53 | 5.53 |

| 06/10/15 | CCRN | SQZ | Y | 11.29 | 11.73 | 89 | 11.88 | 5.23 | 5.23 |

| 06/08/15 | PTLA | CwH | N | 42.72 | 42.84 | 94 | 44.32 | 3.75 | 5.2 |

| 06/08/15 | XON | SQZ | Y | 45.47 | 47.65 | 96 | 44.75 | -1.58 | 4.79 |

| 06/11/15 | HTBX | SQZ | Y | 6.91 | 7.24 | 89 | 7.23 | 4.63 | 4.78 |

| 06/11/15 | RCPT | SQZ | Y | 180.27 | 188.62 | 98 | 178.31 | -1.09 | 4.63 |

| 06/09/15 | FLXN | SQZ | Y | 22.05 | 22.32 | 82 | 22.06 | 0.05 | 4.35 |

| 06/10/15 | HELE | SQZ | Y | 90.85 | 92.92 | 94 | 94.79 | 4.34 | 4.34 |

| 06/10/15 | WETF | CwH | N | 21.93 | 22.88 | 95 | 22.4 | 2.14 | 4.33 |

| 06/10/15 | OXM | SQZ | Y | 81.05 | 84.55 | 93 | 83.95 | 3.58 | 4.32 |

| 06/09/15 | LXRX | HTF | Y | 8.01 | 8.29 | 99 | 8 | -0.12 | 4.12 |

| 06/09/15 | VDSI | CwH | N | 29.60 | 30.76 | 96 | 30.21 | 2.06 | 3.92 |

| 06/10/15 | FRED | CwH | N | 18.83 | 19.07 | 84 | 19.49 | 3.51 | 3.51 |

| 06/12/15 | LOGM | SQZ | Y | 64.26 | 66.49 | 92 | 66.49 | 3.47 | 3.47 |

| 06/09/15 | XNCR | CwH | N | 19.36 | 20.00 | 96 | 19.38 | 0.10 | 3.31 |

| 06/09/15 | HTLF | SQZ | Y | 35.34 | 35.85 | 91 | 36.41 | 3.03 | 3.25 |

| 06/10/15 | MSTR | SQZ | Y | 176.53 | 181.76 | 80 | 178.75 | 1.26 | 2.96 |

| 06/09/15 | ILMN | CwH | N | 211.54 | 215.59 | 81 | 215.27 | 1.76 | 2.96 |

| 06/10/15 | CORT | CwH | N | 6.55 | 6.73 | 98 | 6.66 | 1.68 | 2.75 |

| 06/10/15 | CME | SQZ | Y | 96.38 | 98.58 | 82 | 96.93 | 0.57 | 2.58 |

| 06/11/15 | EDU | SQZ | Y | 25.38 | 26.02 | 80 | 25.52 | 0.55 | 2.52 |

| 06/10/15 | RUTH | SQZ | Y | 15.30 | 15.46 | 83 | 15.68 | 2.48 | 2.48 |

| 06/08/15 | BOFI | SQZ | Y | 97.98 | 98.49 | 84 | 99.52 | 1.57 | 2.46 |

| 06/11/15 | HELE | SQZ | Y | 92.73 | 94.09 | 94 | 94.79 | 2.22 | 2.22 |

| 06/10/15 | NWL | SQZ | Y | 40.38 | 41.01 | 81 | 41.11 | 1.81 | 2.18 |

| 06/11/15 | COT | CwH | Y | 9.87 | 9.96 | 88 | 10.08 | 2.13 | 2.13 |

| 06/09/15 | IRS | SQZ | Y | 18.62 | 18.99 | 80 | 18.48 | -0.75 | 1.99 |

| 06/08/15 | LOCK | SQZ | Y | 16.49 | 16.51 | 83 | 16.53 | 0.24 | 1.94 |

| 06/09/15 | NVIV | CwH | N | 14.99 | 15.19 | 99 | 15.25 | 1.73 | 1.93 |

| 06/08/15 | NBIX | CwH | Y | 44.49 | 45.28 | 98 | 42.93 | -3.51 | 1.78 |

| 06/10/15 | CFI | SQZ | Y | 27.45 | 27.78 | 92 | 27.93 | 1.75 | 1.75 |

| 06/08/15 | WUBA | SQZ | Y | 80.43 | 81.8 | 97 | 77.42 | -3.74 | 1.7 |

| 06/10/15 | HTLF | SQZ | Y | 35.89 | 36.41 | 92 | 36.41 | 1.45 | 1.67 |

| 06/09/15 | CFP | CwH | N | 16.95 | 16.99 | 96 | 17.02 | 0.41 | 1.65 |

| 06/10/15 | GEVA | HTF | N | 219.30 | 222.19 | 99 | 222.79 | 1.59 | 1.59 |

| 06/11/15 | AEO | SQZ | Y | 16.90 | 17.07 | 85 | 17.15 | 1.48 | 1.48 |

| 06/12/15 | CALD | SQZ | Y | 15.10 | 15.31 | 85 | 15.31 | 1.39 | 1.39 |

| 06/08/15 | CENTA | SQZ | Y | 10.32 | 10.46 | 81 | 10.22 | -0.97 | 1.36 |

| 06/11/15 | SQBK | SQZ | Y | 27.41 | 27.65 | 87 | 27.77 | 1.31 | 1.31 |

| 06/11/15 | NUAN | CwH | N | 17.95 | 18.18 | 84 | 17.91 | -0.22 | 1.28 |

| 06/11/15 | CCRN | SQZ | Y | 11.73 | 11.81 | 89 | 11.88 | 1.28 | 1.28 |

| 06/11/15 | XRS | SQZ | Y | 37.66 | 38 | 88 | 38.11 | 1.19 | 1.19 |

| 06/08/15 | GSIG | CwH | Y | 15.30 | 15.40 | 84 | 15.36 | 0.39 | 1.18 |

| 06/10/15 | TREC | CwH | N | 14.35 | 14.38 | 80 | 14.51 | 1.11 | 1.11 |

| 06/11/15 | JMBA | SQZ | Y | 15.33 | 15.45 | 80 | 15.5 | 1.11 | 1.11 |

| 06/12/15 | COT | SQZ | Y | 9.97 | 10.08 | 89 | 10.08 | 1.10 | 1.1 |

| 06/12/15 | SONC | SQZ | Y | 31.20 | 31.53 | 84 | 31.53 | 1.06 | 1.06 |

| 06/12/15 | WX | SQZ | Y | 43.56 | 44 | 88 | 44 | 1.01 | 1.01 |

| 06/12/15 | MGNX | SQZ | Y | 33.64 | 33.97 | 86 | 33.97 | 0.98 | 0.98 |

| 06/09/15 | KMG | SQZ | Y | 31.24 | 31.52 | 97 | 29.36 | -6.02 | 0.9 |

| 06/10/15 | KYTH | CwH | N | 55.94 | 56.43 | 91 | 54.66 | -2.29 | 0.88 |

| 06/08/15 | RUBI | SQZ | Y | 18.38 | 18.54 | 91 | 16.78 | -8.71 | 0.87 |

| 06/11/15 | PENN | SQZ | Y | 17.60 | 17.73 | 91 | 17.54 | -0.34 | 0.74 |

| 06/08/15 | DENN | SQZ | Y | 11.32 | 11.35 | 90 | 11.34 | 0.18 | 0.62 |

| 06/11/15 | FCN | SQZ | Y | 41.16 | 41.38 | 80 | 41 | -0.39 | 0.53 |

| 06/11/15 | CFI | SQZ | Y | 27.82 | 27.88 | 92 | 27.93 | 0.40 | 0.4 |

| 06/10/15 | NVO | CwH | N | 57.90 | 58.02 | 87 | 57.43 | -0.81 | 0.21 |

| 06/10/15 | CCIH | CwH | N | 15.50 | 15.53 | 84 | 15.1 | -2.58 | 0.19 |

| 06/12/15 | TSCO | SQZ | Y | 90.09 | 90.19 | 87 | 90.19 | 0.11 | 0.11 |

| 06/11/15 | HVB | SQZ | Y | 26.90 | 26.93 | 86 | 26.92 | 0.07 | 0.11 |

| 06/10/15 | ELLI | SQZ | Y | 65.29 | 65.32 | 97 | 64.91 | -0.58 | 0.05 |

| 06/08/15 | MSFG | SQZ | Y | 0.00 | 20.67 | 80 | 20.96 | 0.00 | 0 |

| 06/12/15 | CFI | SQZ | Y | 27.93 | 27.93 | 92 | 27.93 | 0.00 | 0 |

| Weekly Average (71 breakouts) | 1.79 | 3.16 | |||||||

| *RS Rank on day before breakout. | |||||||||

Announcing

the Breakoutwatch Blog

I've instituted a blog this week which is drawn from the weekly top tip articles in the newsletter going back to January 2014.

It's accessed from the home page or the sidebar if you are logged in.

I've instituted a blog this week which is drawn from the weekly top tip articles in the newsletter going back to January 2014.

It's accessed from the home page or the sidebar if you are logged in.

After implementing the blog, there is no time for a top tip this week.

This feature will return next week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17898.8 | 0.28% | 0.42% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 5051.1 | -0.34% | 6.65% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2094.11 | 0.06% | 1.71% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PMFG | PMFG, Inc. | 108 |

| Top Technical | PMFG | PMFG, Inc. | 108 |

| Top Fundamental | ATHM | Autohome Inc. | 47 |

| Top Tech. & Fund. | VDSI | VASCO Data Security International, Inc. | 57 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CORT | Corcept Therapeutics Incorporated | 102 |

| Top Technical | CFP | Cornerstone Progressive Return Fund | 54 |

| Top Fundamental | ILMN | Illumina, Inc. | 28 |

| Top Tech. & Fund. | VDSI | VASCO Data Security International, Inc. | 61 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.