| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

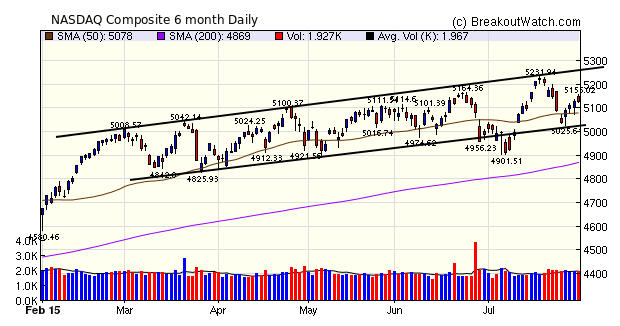

Stocks rallied this week after shrugging off an 8.5% plunge in China's Shanghai Composite. The markets gained further momentum on Wednesday as the FOMC declined to raise interest rates yet again. With no meeting now until mid-September, I see no reason that the pattern of rising stock prices constrained by the upper and lower trend lines shown on the chart should not continue, barring an unforeseeable external shock. That gives a target for the NASDAQ over the next week or so of 5270 or thereabouts.

The number of breakouts pulled back from 37 last week to 30 this week. Of the 30, only 3 were under water at Friday's close and the average weekly gain was a healthy 3%. Cup and Handle stocks dominated the breakouts with 20 compared to 10 from a Volatility Squeeze. CwH breakouts gave a weekly gain of 4.2%.

| Breakouts for Week Beginning 07/27/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 07/30/15 | WWE | CwH | N | 17.61 | 19.36 | 91 | 19.57 | 11.13 | 11.3 |

| 07/28/15 | MSTR | CwH | N | 187.39 | 202.01 | 80 | 203.735 | 8.72 | 9.3 |

| 07/30/15 | HPY | CwH | N | 57.10 | 57.26 | 80 | 62.26 | 9.04 | 9.23 |

| 07/30/15 | BLDR | CwH | N | 13.95 | 14.75 | 98 | 15.065 | 7.99 | 8.03 |

| 07/29/15 | WOOF | CwH | N | 57.07 | 60.10 | 72 | 61.55 | 7.85 | 8.01 |

| 07/29/15 | VNTV | CwH | N | 40.99 | 42.77 | 71 | 44.02 | 7.39 | 7.45 |

| 07/30/15 | MWW | CwH | N | 6.60 | 6.89 | 87 | 7.045 | 6.74 | 6.82 |

| 07/29/15 | PGTI | SQZ | Y | 15.16 | 15.59 | 91 | 16.05 | 5.87 | 6 |

| 07/27/15 | AGN | CwH | N | 322.44 | 326.98 | 91 | 331.64 | 2.85 | 5.29 |

| 07/30/15 | EXLS | CwH | N | 37.23 | 37.52 | 87 | 38.71 | 3.98 | 4.14 |

| 07/28/15 | JJSF | CwH | Y | 114.16 | 115.90 | 81 | 118.34 | 3.66 | 3.73 |

| 07/28/15 | FGL | CwH | Y | 25.20 | 25.73 | 83 | 26.03 | 3.29 | 3.29 |

| 07/27/15 | STZ | SQZ | Y | 116.45 | 117.34 | 80 | 120.05 | 3.09 | 3.19 |

| 07/29/15 | NOC | CwH | N | 170.35 | 173.44 | 76 | 173.11 | 1.62 | 2.97 |

| 07/31/15 | GMK | SQZ | Y | 51.02 | 52.41 | 80 | 52.41 | 2.72 | 2.84 |

| 07/31/15 | MOH | CwH | N | 73.43 | 75.43 | 93 | 75.43 | 2.72 | 2.81 |

| 07/29/15 | BJRI | SQZ | Y | 50.30 | 51.08 | 94 | 51.59 | 2.56 | 2.58 |

| 07/31/15 | AMGN | CwH | N | 172.74 | 176.83 | 82 | 176.83 | 2.37 | 2.46 |

| 07/30/15 | HFC | CwH | N | 47.22 | 48.15 | 83 | 48.26 | 2.20 | 2.29 |

| 07/30/15 | RGR | CwH | N | 58.88 | 60.15 | 84 | 60.085 | 2.05 | 2.17 |

| 07/29/15 | EFX | SQZ | Y | 100.19 | 102.21 | 89 | 102.11 | 1.92 | 2.02 |

| 07/29/15 | PLT | SQZ | Y | 57.19 | 57.59 | 75 | 58.05 | 1.50 | 1.63 |

| 07/31/15 | WWWW | CwH | N | 24.57 | 24.86 | 87 | 24.86 | 1.18 | 1.34 |

| 07/29/15 | GNE | SQZ | Y | 10.77 | 10.9 | 91 | 10.34 | -3.99 | 1.21 |

| 07/29/15 | MKC | SQZ | Y | 81.14 | 81.4 | 78 | 81.96 | 1.01 | 1.08 |

| 07/29/15 | OMAB | CwH | N | 44.48 | 44.91 | 81 | 44.4 | -0.18 | 0.97 |

| 07/30/15 | HTLF | SQZ | Y | 37.55 | 37.75 | 93 | 37.69 | 0.37 | 0.53 |

| 07/29/15 | HCSG | CwH | N | 35.10 | 35.23 | 84 | 34.91 | -0.54 | 0.37 |

| 07/27/15 | FFKT | SQZ | Y | 28.37 | 28.41 | 90 | 25.5 | -10.12 | 0.14 |

| 07/31/15 | QLTY | CwH | N | 15.92 | 15.92 | 96 | 15.92 | 0.00 | 0 |

| Weekly Average (30 breakouts) | 2.97 | 3.77 | |||||||

| *RS Rank on day before breakout. | |||||||||

No new features this week.

Mea Culpa: Do Not Day Trade Based on Close Up Prediction

Last week I introduced a new Cup and Handle watchlist filter to select stocks that are predicted to close up at the next session. This filter is based on a model that backtested to predict stocks that will close up with 68.5% accuracy. I have now identified a flaw in the model which reduces its reliability.

The aim of the model was to identify stocks that could be bought at the next day's open and be rewarded with a gain on the day 68.5% of the time. Theoretically, over time this would return a substantial gain because there would be two winners for every loser.

The flaw in the model was in failing to account for the situation where the stock gaps up at the next day's open and then closes below the open price, even though it may close higher than the previous day's close as correctly predicted.

Consequently, I cannot recommend trading based on the predictions of this filter at this time.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17689.9 | 0.69% | -0.75% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 5128.28 | 0.78% | 8.28% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2103.84 | 1.16% | 2.18% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PMFG | PMFG, Inc. | 108 |

| Top Technical | PMFG | PMFG, Inc. | 108 |

| Top Fundamental | ANET | Arista Networks, Inc. | 35 |

| Top Tech. & Fund. | ANET | Arista Networks, Inc. | 35 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | QLTY | Quality Distribution, Inc. | 65 |

| Top Technical | FGL | Fidelity and Guaranty Life | 33 |

| Top Fundamental | MOH | Molina Healthcare Inc | 38 |

| Top Tech. & Fund. | MOH | Molina Healthcare Inc | 38 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.