| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

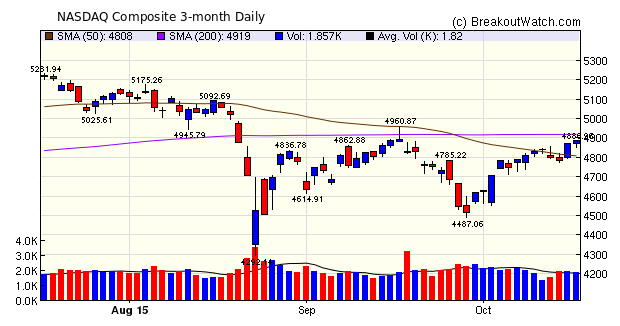

After starting the week with a downward move, the NASDAQ Composite moved sharply higher on Thursday and comfortably outperformed the two other major indexes overall. Thursdays move followed falling CPI and PPI figures which fueled speculation that the Fed will hold off raising rates a while longer. This implies that US markets will continue to move higher due to continued low borrowing costs for speculators and negligible returns in other asset classes.

The downward trend in the first three days of the week held back the number of breakouts to 45 for the week. Volatility Squeeze stocks continued to be in the majority contributing 24 to the total while cup and handle breakouts

contributed 20.

| Breakouts for Week Beginning 10/12/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 10/14/15 | MXIM | CwH | N | 35.44 | 38.33 | 87 | 39.74 | 12.13 | 13.01 |

| 10/15/15 | BSQR | CwH | N | 7.85 | 8.20 | 98 | 8.47 | 7.90 | 11.46 |

| 10/15/15 | VRTU | SQZ | Y | 52.42 | 55.49 | 94 | 56.99 | 8.72 | 10 |

| 10/15/15 | IPHI | CwH | N | 26.43 | 27.88 | 98 | 28.75 | 8.78 | 9.99 |

| 10/12/15 | NHTC | CwH | N | 37.76 | 39.86 | 99 | 37.32 | -1.17 | 9.75 |

| 10/12/15 | CISG | SQZ | Y | 8.69 | 8.78 | 94 | 8.88 | 2.19 | 6.9 |

| 10/14/15 | RNG | SQZ | Y | 18.67 | 18.85 | 94 | 19.58 | 4.87 | 6.48 |

| 10/15/15 | WNS | CwH | N | 30.89 | 32.00 | 95 | 31.54 | 2.10 | 5.54 |

| 10/15/15 | RNG | SQZ | Y | 18.87 | 19.71 | 95 | 19.58 | 3.76 | 5.35 |

| 10/12/15 | ALGT | SQZ | Y | 217.92 | 227.86 | 97 | 214.75 | -1.45 | 4.99 |

| 10/12/15 | DAL | SQZ | Y | 47.24 | 48.5 | 90 | 49.12 | 3.98 | 4.74 |

| 10/16/15 | DATE | SQZ | Y | 6.44 | 6.52 | 90 | 6.52 | 1.24 | 4.66 |

| 10/16/15 | TNK | CwH | N | 7.95 | 8.23 | 97 | 8.23 | 3.52 | 4.65 |

| 10/15/15 | FDEF | SQZ | Y | 36.54 | 37.85 | 86 | 38.04 | 4.11 | 4.63 |

| 10/15/15 | MSCC | CwH | N | 36.07 | 36.52 | 93 | 37.36 | 3.58 | 4.46 |

| 10/15/15 | PFSW | CwH | N | 14.89 | 15.15 | 93 | 15.05 | 1.07 | 4.16 |

| 10/15/15 | NXPI | SQZ | Y | 91.41 | 94.09 | 87 | 93.22 | 1.98 | 4.1 |

| 10/15/15 | MSG | HTF | N | 178.00 | 182.69 | 99 | 177.08 | -0.52 | 3.65 |

| 10/16/15 | GE | CwH | N | 28.20 | 28.98 | 85 | 28.98 | 2.77 | 3.51 |

| 10/15/15 | FSL | SQZ | Y | 38.11 | 39.13 | 97 | 38.82 | 1.86 | 3.44 |

| 10/13/15 | CLGX | CwH | N | 39.54 | 40.00 | 88 | 40.74 | 3.03 | 3.21 |

| 10/14/15 | CEVA | CwH | N | 22.39 | 22.67 | 94 | 22.77 | 1.70 | 3.17 |

| 10/15/15 | OMAB | SQZ | Y | 40.73 | 41.83 | 81 | 41.17 | 1.08 | 3.12 |

| 10/16/15 | MANH | SQZ | Y | 65.80 | 67.56 | 96 | 67.56 | 2.67 | 3.02 |

| 10/15/15 | CVRR | CwH | N | 20.87 | 20.93 | 93 | 21.28 | 1.96 | 3.02 |

| 10/13/15 | PZZA | SQZ | Y | 69.80 | 70.35 | 89 | 68.28 | -2.18 | 2.77 |

| 10/16/15 | ELNK | SQZ | Y | 8.10 | 8.32 | 98 | 8.32 | 2.72 | 2.72 |

| 10/14/15 | MVG | CwH | N | 8.14 | 8.35 | 83 | 8 | -1.72 | 2.58 |

| 10/16/15 | IBKR | SQZ | Y | 38.51 | 39.38 | 90 | 39.38 | 2.26 | 2.47 |

| 10/16/15 | HCKT | SQZ | Y | 14.26 | 14.52 | 98 | 14.52 | 1.82 | 2.31 |

| 10/15/15 | SPNS | SQZ | Y | 11.30 | 11.39 | 96 | 11.45 | 1.33 | 2.3 |

| 10/13/15 | SSNI | CwH | N | 14.72 | 14.74 | 98 | 14.22 | -3.40 | 1.9 |

| 10/15/15 | MPWR | CwH | N | 56.60 | 57.17 | 95 | 56.95 | 0.62 | 1.89 |

| 10/15/15 | MCD | CwH | N | 103.47 | 103.66 | 85 | 104.82 | 1.30 | 1.67 |

| 10/16/15 | PETS | SQZ | Y | 16.26 | 16.47 | 80 | 16.47 | 1.29 | 1.66 |

| 10/16/15 | MKL | SQZ | Y | 822.19 | 830.95 | 82 | 830.95 | 1.07 | 1.59 |

| 10/15/15 | NAVG | CwH | N | 83.24 | 83.84 | 86 | 83.66 | 0.50 | 1.44 |

| 10/15/15 | ALDW | SQZ | Y | 24.39 | 24.58 | 98 | 24.32 | -0.29 | 1.23 |

| 10/15/15 | ORI | CwH | N | 16.65 | 16.66 | 87 | 16.76 | 0.66 | 1.14 |

| 10/15/15 | ERI | SQZ | Y | 9.40 | 9.41 | 98 | 9.41 | 0.11 | 0.96 |

| 10/16/15 | FDEF | SQZ | Y | 37.89 | 38.04 | 88 | 38.04 | 0.40 | 0.9 |

| 10/16/15 | MKTX | SQZ | Y | 96.50 | 96.73 | 91 | 96.73 | 0.24 | 0.84 |

| 10/14/15 | ALTR | CwH | N | 52.54 | 52.72 | 96 | 52.73 | 0.36 | 0.67 |

| 10/16/15 | CALM | CwH | N | 60.10 | 60.40 | 95 | 60.4 | 0.50 | 0.57 |

| 10/16/15 | UFCS | SQZ | Y | 35.44 | 35.52 | 86 | 35.52 | 0.23 | 0.45 |

| Weekly Average (45 breakouts) | 1.99 | 3.85 | |||||||

| *RS Rank on day before breakout. | |||||||||

New Report Formats

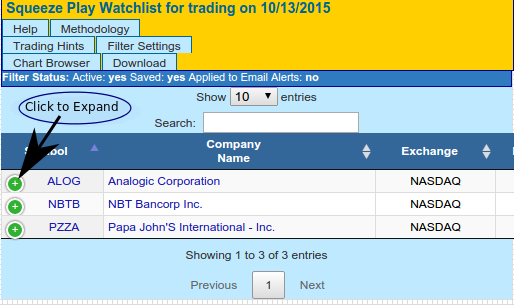

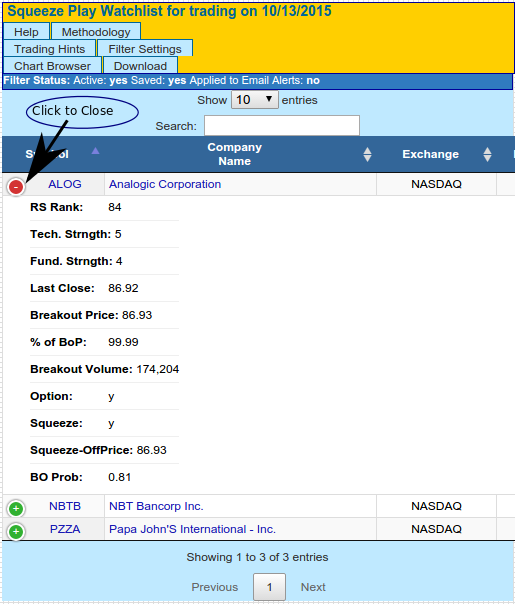

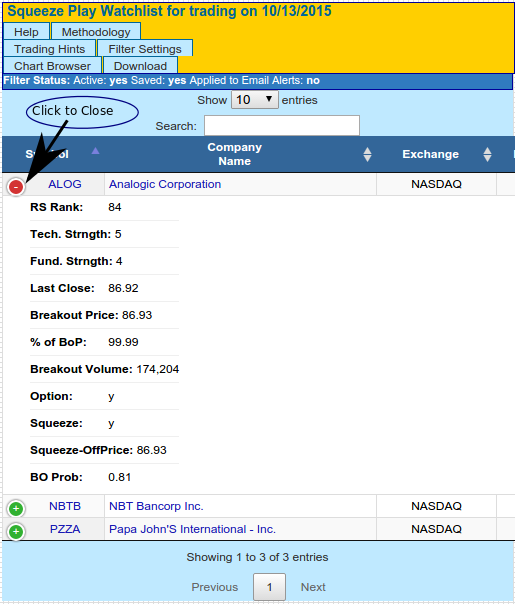

The majority of the information on our site is presented in tabular form. This presents challenges if viewing the data on tablets or smartphones, whose use is increasingly prevalent. Consequently have begun the process of modifying the tables so that they can be viewed in a "responsive" way. "Responsive" is a term of art that refers to tables that automatically adjust their width and structure so thay can be viewed on different sized viewports.

You will notice these changes first on the Watchlists and Recent Breakouts reports and they will be extended to all other tables in the coming days and weeks.

A nice feature of teh new formats is that you can adjust the number of rows displayed on a "page" and also search the table for stocks, industries, companies etc.

The new formats have been tested on Firefox and Chrome. They may or may not function correctly on IE. If not, please use either Firefox or Chrome as your preferred browser.

Viewing

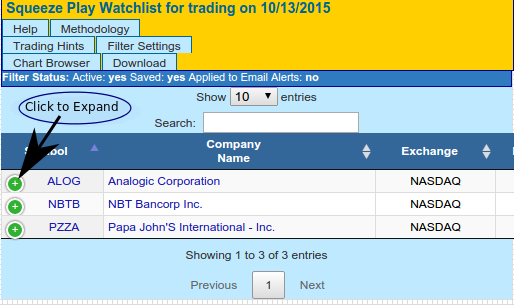

Collapsed Responsive Tables

Depending on the width of the viewport in your browser, tablet or phone, you may find that the new table formats are collapsed, meaning that some columns are not immediately viewable. For example, if you may find the watchlists shown as follows:

Clicking the + icon reveals the hidden column data

Depending on the width of the viewport in your browser, tablet or phone, you may find that the new table formats are collapsed, meaning that some columns are not immediately viewable. For example, if you may find the watchlists shown as follows:

Clicking the + icon reveals the hidden column data

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17216 | 0.77% | -3.41% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4886.69 | 1.16% | 3.18% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2033.11 | 0.9% | -1.25% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | ACFC | Atlantic Coast Financial Corporation | 101 |

| Top Technical | ACFC | Atlantic Coast Financial Corporation | 101 |

| Top Fundamental | ASC | Ardmore Shipping Corporation | 69 |

| Top Tech. & Fund. | NHTC | Natural Health Trends Corp. | 60 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | TNK | Teekay Tankers Ltd. | 105 |

| Top Technical | NHTC | Natural Health Trends Corp. | 58 |

| Top Fundamental | NHTC | Natural Health Trends Corp. | 58 |

| Top Tech. & Fund. | NHTC | Natural Health Trends Corp. | 58 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.