May the New Year bring you health, wealth and happiness. It can only get better from here.

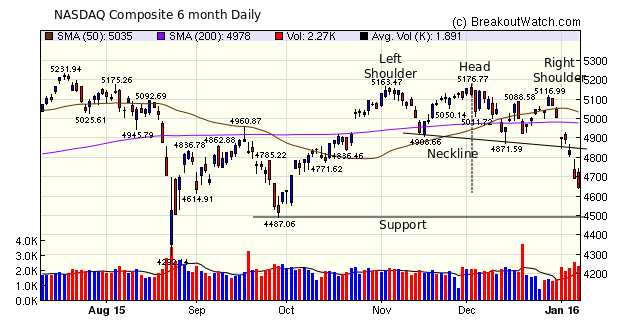

I took a break from writing the newsletter over the holidays. Had I not done so, I would have warned that the NASDAQ was in a head and shoulders top pattern, which is bearish. The pattern was completed on Wednesday when the index crashed through the neckline at the open. Normally, the expected decline after completing the pattern, is equal to the vertical distance between the neckline and the head or 280 points in this case. That predicts a bottom at about 4620 (4900 - 280 ), while the next support line is September's low of 4490.

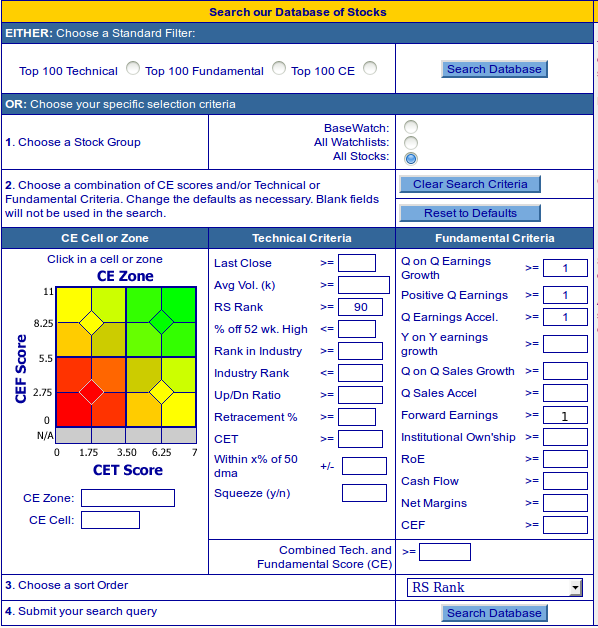

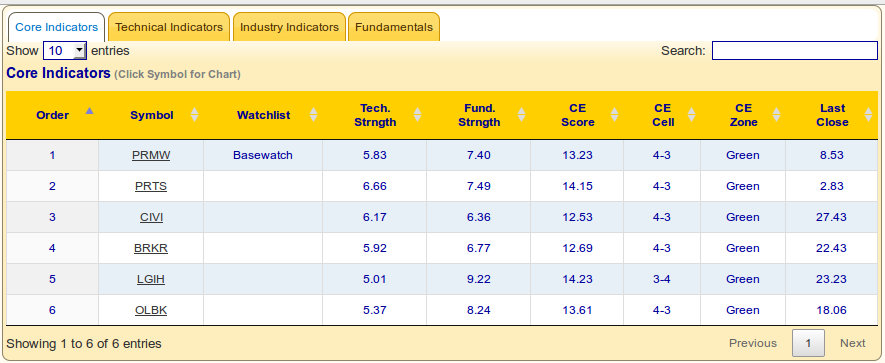

Our market signals remained down since my last newsletter on December 12, so I hope you took my advice then to not open any new positions. I wish I had taken my own advice :(.