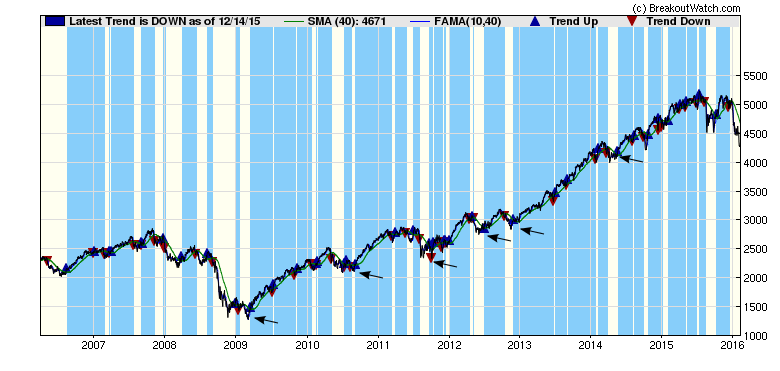

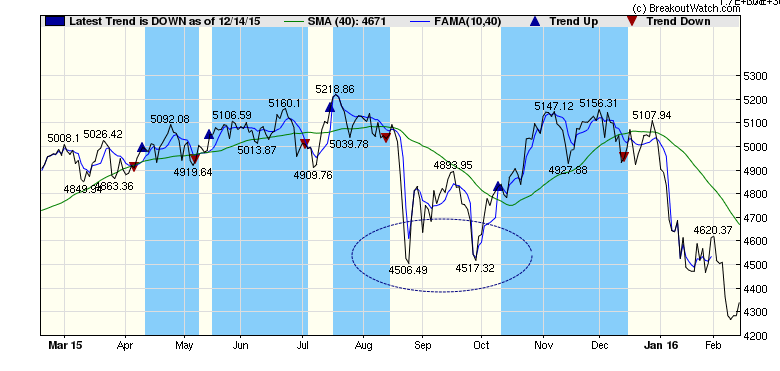

The NASDAQ has now fallen 17% from last July's high to a level not seen since October 2014, having crashed through the double bottom set in October last year. The next support level is at 4213 which would be a 19% decline, just short of the somewhat arbitrary definition of a "correction" at 20%.

Our market signals still register a negative trend and so we do not advise opening new long positions, although some breakouts can still give strong short term gains as our Weekly Breakout Report shows.