Breakoutwatch Weekly Newsletter 04/10/16

You are receiving this email because you are or were a BreakoutWatch.com

subscriber, or have subscribed to our weekly newsletter. This newsletter

summarizes the breakout events of the week and provides additional

guidance that does not fit into our daily format. It is published each

weekend.

Weekly Commentary

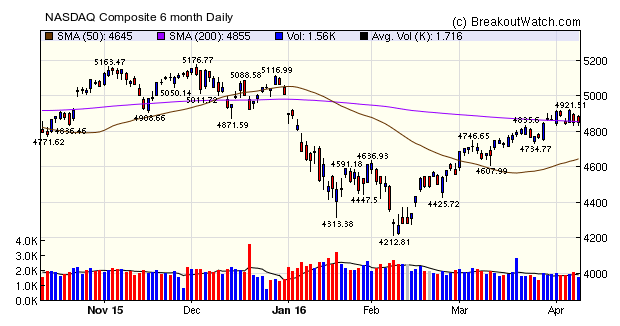

Although our market

trend indicators are still pointing up, I fear that we may soon see

a reversal. The NASDAQ Composite tested support at the 50 day

average level this week and although it did indeed find

support, the 50 day average line is itself trending down.

There were two distribution days, and only one accumulation day (on

Wednesday). Although the NASDAQ and other major indexes did close

modestly higher on Friday, they did so on low volume and each closed

the week with a more than 1% loss.

The Bureau of Economic Analysis will release its estimate of

first quarter GDP growth on April 28, but the Federal Reserve

Bank of Atlanta's GDPNow model predicts growth will only be at an

annualized rate of 0.1%. If this estimate proves accurate, it will

be a significant fall from the 4th quarter's 1.4% growth and will

likely move markets downward.

|

Weekly Breakout Report

The number of breakouts fell to just 16 this week. Although

the Volatility Squeeze pattern produced the majority, it was

Head and Shoulders Bottom pattern breakouts that produced the higher

average gains. |

Breakouts Summary by Watchlist for Week Beginning 04/04/16

| List |

Breakouts |

Avg. Gain |

| CwH |

4 |

2.65 |

| SQZ |

6 |

2.48 |

| HTF |

2 |

0.63 |

| HSB |

4 |

4.53 |

Breakouts Detail for Week Beginning 04/04/16

| Brkout Date |

Symbol |

Base |

Squeeze |

BrkoutOut Price |

Brkout Day Close |

RS Rank* |

Last Close |

Current % off BOP |

Gain at Intraday High |

| 04/04/16 |

MCRB |

HSB |

N |

27.73 |

28.32 |

23 |

30.98 |

11.72 |

13.6 |

| 04/06/16 |

CPXX |

HTF |

N |

12.73 |

13.03 |

99 |

12.9 |

1.34 |

8.09 |

| 04/04/16 |

TBPH |

SQZ |

Y |

19.75 |

20.36 |

97 |

20.98 |

6.23 |

6.23 |

| 04/07/16 |

ASA |

CwH |

N |

10.76 |

10.85 |

91 |

11.34 |

5.39 |

5.48 |

| 04/06/16 |

LYTS |

CwH |

N |

11.81 |

12.35 |

86 |

12.315 |

4.28 |

4.74 |

| 04/08/16 |

ASA |

SQZ |

Y |

10.86 |

11.34 |

94 |

11.34 |

4.42 |

4.51 |

| 04/04/16 |

TGS |

SQZ |

Y |

6.34 |

6.47 |

95 |

6.55 |

3.31 |

3.47 |

| 04/05/16 |

SPWH |

HSB |

N |

11.90 |

11.95 |

27 |

12.26 |

3.03 |

3.03 |

| 04/08/16 |

PFSW |

HSB |

N |

13.10 |

13.41 |

61 |

13.41 |

2.37 |

2.67 |

| 04/07/16 |

SHW |

SQZ |

Y |

290.78 |

292.38 |

86 |

297.085 |

2.17 |

2.23 |

| 04/06/16 |

NSAM |

HSB |

N |

11.84 |

11.87 |

22 |

11.96 |

1.01 |

1.01 |

| 04/06/16 |

CHD |

SQZ |

Y |

93.81 |

94.44 |

84 |

94.06 |

0.27 |

0.67 |

| 04/07/16 |

CAG |

CwH |

N |

45.84 |

46.07 |

83 |

46.045 |

0.45 |

0.65 |

| 04/05/16 |

FIX |

CwH |

N |

32.43 |

32.58 |

85 |

32.59 |

0.49 |

0.59 |

| 04/04/16 |

LKQ |

SQZ |

Y |

32.13 |

32.265 |

84 |

31.635 |

-1.54 |

0.5 |

| 04/04/16 |

CDORP |

HTF |

N |

12.05 |

12.06 |

99 |

12.04 |

-0.08 |

0.17 |

| Weekly Average (16 breakouts) |

2.8 |

3.6 |

| *RS Rank on day before breakout. |

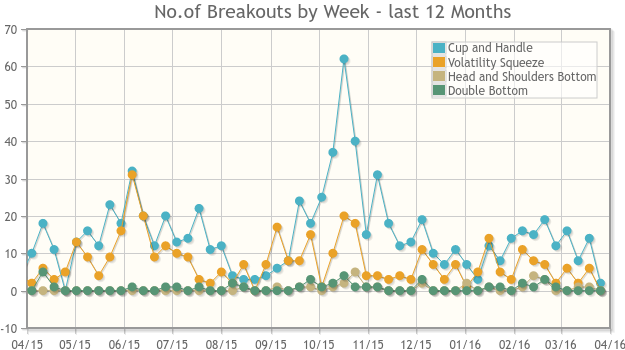

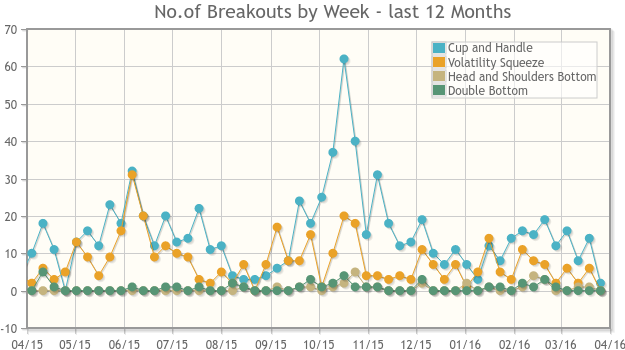

12 Month Successful Breakout History

|

New Features This Week

You will see above a chart of the number of breakouts per week over

the last twelve months. The purpose of the chart is to show two

things:

- the relative frequency of breakouts from each long position

pattern we follow

- the trend over recent weeks.

More discussion below.

|

Top Tip of the Week

Number

of Successful Breakouts Trending Down

The chart above shows that the frequency of breakouts from a cup and

handle pattern is higher than for the Volatility Squeeze pattern

which is higher than the Head and Shoulders bottom pattern. Double

Bottom breakouts are much less common.

While a high performing breakout can come from any pattern, as shown

by this week's HSB breakouts, this analysis suggests that when

looking for breakout candidates, one should focus on the Cup

and Handle and Volatility Squeeze patterns.

We can also see that the recent trend is for fewer successful

breakouts. This implies that a more conservative approach to trading

breakouts is suggested as there are likely to be fewer successes.

|

Top 10 Cup and Handle Stocks as of Friday April 08, 2016

| Symbol |

BO

Price |

BO

Vol. |

Company |

Industry |

RS

Rank |

Last

Close |

| CSC |

34.35 |

2,581,716 |

Computer Sciences Corporation |

Information Technology |

98 |

33.32 |

| USCR |

63.67 |

497,013 |

U S Concrete - Inc. |

General Building Materials |

98 |

62.44 |

| SBS |

6.80 |

3,397,618 |

Companhia de saneamento Basico Do Estado De Sao Pa |

Water Utilities |

97 |

6.53 |

| FIZZ |

45.30 |

170,805 |

National Beverage Corp. |

Beverages - Soft Drinks |

97 |

45.19 |

| ROCK |

28.75 |

364,196 |

Gibraltar Industries - Inc. |

Steel & Iron |

97 |

27.14 |

| PSAU |

18.52 |

59,280 |

PowerShares Global Gold & Precious Metals Portfoli |

Closed-End Fund - Equity |

96 |

18.39 |

| TX |

18.76 |

541,401 |

Ternium S.A. |

Steel & Iron |

96 |

18.47 |

| MFLX |

23.44 |

352,132 |

Multi-Fineline Electronix - Inc. |

Printed Circuit Boards |

95 |

23.35 |

| BYD |

21.25 |

2,323,719 |

Boyd Gaming Corporation |

Resorts & Casinos |

95 |

21.20 |

| FIX |

32.62 |

393,051 |

Comfort Systems USA - Inc. |

General Contractors |

95 |

32.59 |

Major Index Summary

| Index |

Value |

Change Week |

Change YTD |

Trend1 |

| Dow |

17577

|

-1.21% |

0.87% |

Up

|

| NASDAQ |

4850.69

|

-1.3% |

-3.13% |

Up

|

| S&P 500 |

2047.6

|

-1.21% |

0.18% |

Up

|

1The Market Trend is derived from our

proprietary market model. The market model is described on the site.

2The site also shows industry rankings based on

fundamentals, combined technical and fundamentals, and on price

alone. The site also shows daily industry movements.

|

Best Performing Index

| 1 Week |

13 Weeks |

26 Weeks |

Year-to-Date |

Dow Jones

-1.21 % |

Dow Jones

7.53 % |

Dow Jones

2.88 % |

Dow Jones

0.87 % |

Best Performing Industry (by average technical score over each

period)

| 1 Week |

3 Weeks |

13 Weeks |

26 Weeks |

| Silver |

Silver |

Water Utilities |

Auto Parts Stores |

Most Improved Industry (by change in technical rank2)

Music & Video Stores

+ 51 |

Consumer Services

+ 91 |

Silver

+ 170 |

Silver

+ 191 |

| Charts of each industry rank

and performance over 12 months are available on the site |

If you received this newsletter from a friend and you would like to

receive it regularly please go to the BreakoutWatch.com site and enter as

a Guest. You will then be able to register to receive the newsletter.

Copyright (c) 04/10/2016 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All other

marks are the property of their respective owners, and are used for

descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with

Mr. William O'Neil. Our site, research and analysis is supported entirely

by subscription and is free from advertising.