Breakoutwatch Weekly Newsletter 04/30/16

You are receiving this email because you are or were a BreakoutWatch.com

subscriber, or have subscribed to our weekly newsletter. This newsletter

summarizes the breakout events of the week and provides additional

guidance that does not fit into our daily format. It is published each

weekend.

Weekly Commentary

Our market trend indicators for the three major indexes

turned south on Thursday as investors became wary of slowing

economic growth and AAPL, GOOGL and MSFT missed earnings

estimates. With all three major indexes trending down, this is a

risky time to consider opening long positions.

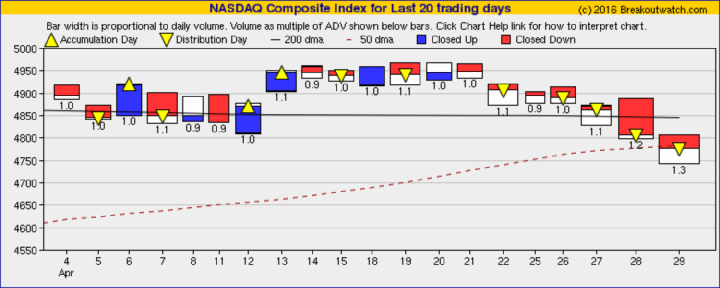

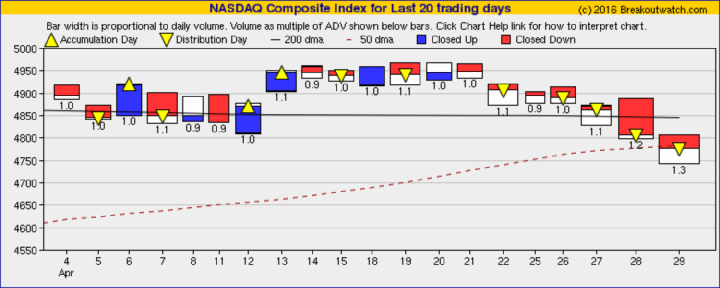

The NASDAQ looks particularly grim with 4 distribution days

in the last week as our equivolume chart for the NASDAQ

shows.

You can see that volumes (width of the bars relative to the 50 day

average volume) were progressively higher ending with a 30%

increase over the 50 DMA on Friday. Note also that the index

closed just below its 200 day average.

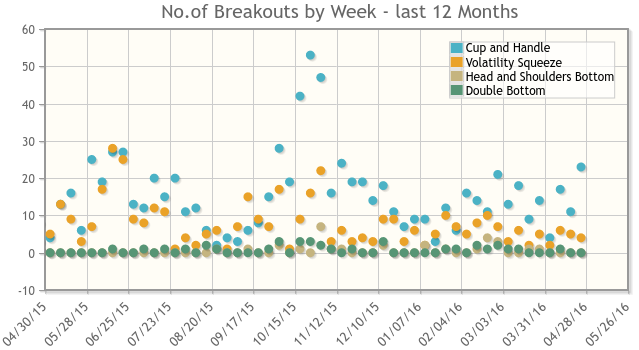

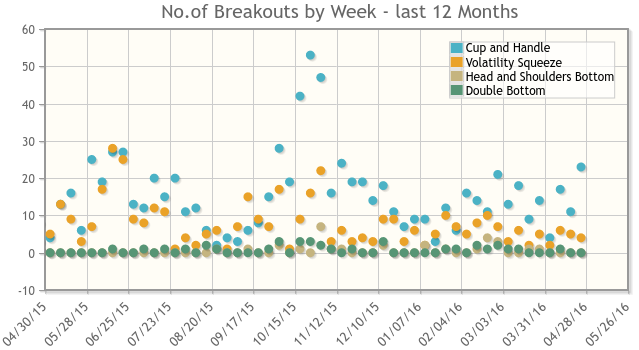

Despite the downward trend, there was a surprising uptick in the

number of cup and handle breakouts to 24 compared to just 11 last

week while Volatility Squeeze breakouts fell from 16 to 11.

|

Breakouts Summary by Watchlist for Week Beginning 04/25/16

| List |

Breakouts |

Avg. Gain |

| CWH |

23 |

2.93 |

| SQZ |

4 |

3.33 |

| HTF |

2 |

4.24 |

| HSB |

0

|

0 |

| DB |

0

|

0 |

Breakouts Detail for Week Beginning 04/25/16

| Brkout Date |

Symbol |

Base |

Squeeze |

BrkoutOut Price |

Brkout Day Close |

RS Rank* |

Last Close |

Current % off BOP |

Gain at Intraday High |

| 2016-04-29 |

SKYW |

CWH |

n |

21.14 |

24 |

94 |

23.5 |

11.16% |

16.56% |

| 2016-04-26 |

AMSC |

CWH |

n |

9.05 |

10 |

97 |

9.96 |

10.06% |

12.15% |

| 2016-04-28 |

HEES |

CWH |

y |

18.81 |

19 |

86 |

20.23 |

7.55% |

10.15% |

| 2016-04-28 |

NEFF |

CWH |

y |

7.95 |

9 |

80 |

8.55 |

7.55% |

15.09% |

| 2016-04-26 |

ETH |

CWH |

y |

31.92 |

34 |

85 |

34.04 |

6.64% |

10.62% |

| 2016-04-29 |

BOOM |

CWH |

n |

9.18 |

10 |

81 |

9.77 |

6.43% |

7.41% |

| 2016-04-28 |

MDVN |

CWH |

n |

54.55 |

56 |

86 |

57.8 |

5.96% |

9.84% |

| 2016-04-27 |

NS |

CWH |

n |

47.68 |

49 |

83 |

50.44 |

5.79% |

5.91% |

| 2016-04-29 |

HEES |

SQZ |

y |

19.16 |

20 |

94 |

20.23 |

5.58% |

8.14% |

| 2016-04-29 |

CDE |

HTF |

n |

7.68 |

8 |

99 |

8.1 |

5.47% |

5.99% |

| 2016-04-26 |

SLCA |

SQZ |

y |

24.28 |

25 |

91 |

25.55 |

5.23% |

12.27% |

| 2016-04-26 |

CYNO |

CWH |

y |

46.60 |

50 |

92 |

48.94 |

5.02% |

10.71% |

| 2016-04-27 |

AA |

CWH |

n |

10.74 |

11 |

89 |

11.17 |

4% |

7.08% |

| 2016-04-29 |

GGN |

CWH |

n |

6.83 |

7 |

95 |

7.09 |

3.81% |

4.25% |

| 2016-04-28 |

SWC |

CWH |

n |

11.80 |

12 |

95 |

12.2 |

3.39% |

8.81% |

| 2016-04-26 |

CWCO |

CWH |

n |

13.48 |

14 |

82 |

13.89 |

3.04% |

3.04% |

| 2016-04-29 |

AG |

HTF |

n |

10.33 |

11 |

99 |

10.64 |

3% |

3.78% |

| 2016-04-26 |

MWA |

CWH |

n |

10.55 |

11 |

87 |

10.75 |

1.9% |

5.5% |

| 2016-04-27 |

SLCA |

SQZ |

y |

25.14 |

27 |

92 |

25.55 |

1.63% |

8.43% |

| 2016-04-29 |

GIMO |

CWH |

n |

32.22 |

33 |

83 |

32.59 |

1.15% |

8.69% |

| 2016-04-29 |

LANC |

SQZ |

y |

115.48 |

117 |

87 |

116.5 |

0.88% |

2.61% |

| 2016-04-27 |

TTI |

CWH |

n |

7.16 |

7 |

87 |

7.2 |

0.56% |

8.24% |

| 2016-04-27 |

MTZ |

CWH |

n |

22.54 |

23 |

95 |

22.66 |

0.53% |

5.94% |

| 2016-04-26 |

OMN |

CWH |

n |

7.15 |

7 |

82 |

7.15 |

0% |

4.9% |

| 2016-04-27 |

GRMN |

CWH |

n |

43.17 |

44 |

81 |

42.63 |

-1.25% |

2.9% |

| 2016-04-28 |

AVD |

CWH |

n |

16.84 |

17 |

95 |

16.55 |

-1.72% |

3.38% |

| 2016-04-26 |

COH |

CWH |

n |

41.45 |

42 |

92 |

40.27 |

-2.85% |

1.64% |

| 2016-04-26 |

SINA |

CWH |

n |

51.68 |

52 |

80 |

50.09 |

-3.08% |

0.23% |

| 2016-04-26 |

IIVI |

CWH |

n |

22.72 |

23 |

89 |

20.87 |

-8.14% |

2.95% |

| *RS Rank on day before breakout. |

12 Month Successful Breakout History

|

New Features This Week

No new features this week.

|

Top Tip of the Week

|

Curb your enthusiasm and be wary of opening new long positions.

|

Top 10 Cup and Handle Stocks as of Wednesday April 20, 2016

| Symbol |

BO

Price |

BO

Vol. |

Company |

Industry |

RS

Rank |

Last

Close |

| ASA |

12.75 |

300,663 |

ASA Gold and Precious Metals Limited |

Asset Management |

97 |

12.16 |

| AVNU |

20.54 |

62,079 |

Avenue Financial Holdings - Inc. |

Regional - Southeast Banks |

97 |

20.35 |

| INO |

10.08 |

2,582,032 |

Inovio Pharmaceuticals - Inc. |

Biotechnology |

97 |

9.74 |

| CSC |

34.39 |

2,395,830 |

Computer Sciences Corporation |

Information Technology |

97 |

33.16 |

| LXRX |

14.46 |

1,120,389 |

Lexicon Pharmaceuticals - Inc. |

Biotechnology |

96 |

13.71 |

| NHTC |

38.50 |

507,066 |

Natural Health Trends Corp. |

Personal Products |

96 |

34.90 |

| BUFF |

25.98 |

1,602,381 |

Blue Buffalo Pet Products - Inc. |

Food - Major Diversified |

96 |

24.90 |

| FIZZ |

47.00 |

152,744 |

National Beverage Corp. |

Beverages - Soft Drinks |

95 |

43.33 |

| MSG |

170.01 |

214,252 |

MSG Networks Inc. |

Entertainment - Diversified |

95 |

159.76 |

| ROCK |

28.75 |

351,741 |

Gibraltar Industries - Inc. |

Steel & Iron |

95 |

27.95 |

Major Index Summary

| Index |

Value |

Change Week |

Change YTD |

Trend1 |

| Dow |

17773.6

|

-1.28% |

2% |

Down

|

| NASDAQ |

4775.36

|

-2.67% |

-4.63% |

Down

|

| S&P 500 |

2065.3

|

-1.26% |

1.05% |

Down

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site.

2The site also shows industry rankings based on

fundamentals, combined technical and fundamentals, and on price

alone. The site also shows daily industry movements.

|

Best Performing Index

| 1 Week |

13 Weeks |

26 Weeks |

Year-to-Date |

S&P 500

-1.26 % |

Dow Jones

7.94 % |

Dow Jones

0.62 % |

Dow Jones

2 % |

Best Performing Industry (by average technical score over each

period)

| 1 Week |

3 Weeks |

13 Weeks |

26 Weeks |

| Silver |

Silver |

Water Utilities |

REIT - Industrial |

Most Improved Industry (by change in technical rank2)

Trucks & Other Vehicles

+ 92 |

Trucks & Other Vehicles

+ 117 |

Copper

+ 191 |

Gold

+ 191 |

| Charts of each industry

rank and performance over 12 months are available on the site |

If you received this newsletter from a friend and you would like to

receive it regularly please go to the BreakoutWatch.com site and enter as

a Guest. You will then be able to register to receive the newsletter.

Copyright (c) 04/30/2016 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All other

marks are the property of their respective owners, and are used for

descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with

Mr. William O'Neil. Our site, research and analysis is supported entirely

by subscription and is free from advertising.