You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

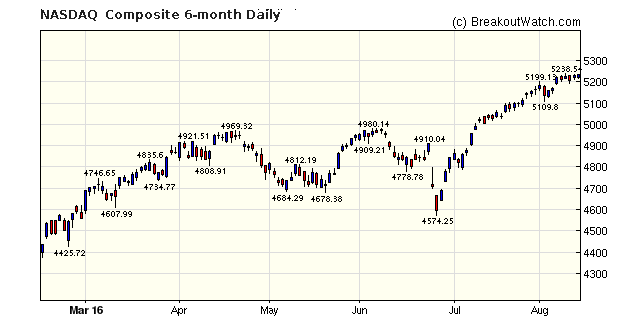

The recent strong rise in the markets

appears to be leveling off as the NASDAQ Chart shows. Some

consolidation is to be expected and we will likely see an increase

in the number of cup and handle chart patterns as handles form and

also Volatility Squeeze patterns as volatility falls.

|

A 30 day trial of Breakoutwatch.com is now FREEGo to http://www.breakoutwatch.com and choose "Test Drive" from the top menu bar. |

|

Our latest strategy

suggestions are here.

|

| Strong markets delivering new highs for the three major indexes (on Thursday) produced 29 breakouts this week. The Volatility Squeeze chart pattern produced the best returns as stocks that had been marking time responded to the strong upward trend. The table below shows exceptionally strong gains were available. | ||

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 16 | 3.69 |

| SQZ | 13 | 5.39 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 | |

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2016-08-10 | AOSL | SQZ | y | 14.87 | 15 | 92 | 19.63 | 32.01% | 32.01% |

| 2016-08-09 | CC | CWH | y | 9.78 | 10 | 85 | 11.45 | 17.08% | 23.82% |

| 2016-08-10 | XONE | CWH | n | 11.70 | 13 | 82 | 13.47 | 15.13% | 19.66% |

| 2016-08-09 | DTSI | SQZ | y | 29.13 | 33 | 81 | 32.6 | 11.91% | 17.71% |

| 2016-08-09 | CECE | CWH | y | 9.49 | 10 | 84 | 10.33 | 8.85% | 10.01% |

| 2016-08-09 | ECA | SQZ | y | 8.73 | 9 | 93 | 9.39 | 7.56% | 9.28% |

| 2016-08-11 | VRTV | SQZ | y | 45.00 | 48 | 84 | 48.34 | 7.42% | 9.76% |

| 2016-08-11 | BZUN | CWH | n | 8.79 | 9 | 91 | 9.43 | 7.28% | 9.67% |

| 2016-08-09 | CDZI | CWH | y | 7.38 | 7 | 88 | 7.8 | 5.69% | 8.4% |

| 2016-08-10 | CDZI | SQZ | y | 7.40 | 8 | 91 | 7.8 | 5.41% | 8.11% |

| 2016-08-10 | CECE | SQZ | y | 9.82 | 10 | 89 | 10.33 | 5.19% | 5.5% |

| 2016-08-09 | SN | SQZ | y | 7.75 | 8 | 91 | 8.13 | 4.9% | 6.71% |

| 2016-08-11 | CCLP | CWH | y | 9.09 | 9 | 81 | 9.5 | 4.51% | 4.51% |

| 2016-08-11 | YNDX | SQZ | y | 22.37 | 23 | 92 | 23.21 | 3.76% | 5.23% |

| 2016-08-11 | OEC | CWH | n | 17.40 | 18 | 80 | 18.01 | 3.51% | 4.66% |

| 2016-08-11 | MDVN | SQZ | y | 64.00 | 66 | 92 | 66.02 | 3.16% | 3.42% |

| 2016-08-08 | CIA | CWH | n | 9.27 | 10 | 85 | 9.55 | 3.02% | 7.01% |

| 2016-08-10 | ORN | CWH | n | 6.26 | 6 | 88 | 6.44 | 2.88% | 3.99% |

| 2016-08-08 | DTLK | CWH | n | 9.69 | 10 | 87 | 9.96 | 2.79% | 4.85% |

| 2016-08-12 | CCLP | SQZ | y | 9.26 | 10 | 85 | 9.5 | 2.59% | 2.59% |

| 2016-08-12 | ATEN | CWH | n | 8.00 | 8 | 80 | 8.19 | 2.37% | 2.37% |

| 2016-08-09 | AMPH | CWH | n | 17.80 | 18 | 87 | 18.1 | 1.69% | 5.56% |

| 2016-08-09 | DTLK | CWH | n | 9.82 | 10 | 87 | 9.96 | 1.43% | 3.46% |

| 2016-08-10 | BGFV | CWH | n | 12.95 | 13 | 81 | 13.05 | 0.77% | 2.32% |

| 2016-08-08 | PCTY | SQZ | y | 47.26 | 47 | 88 | 45.54 | -3.64% | 5.06% |

| 2016-08-08 | MB | SQZ | y | 18.26 | 19 | 92 | 17.45 | -4.44% | 5.81% |

| 2016-08-08 | ITCI | SQZ | y | 42.73 | 43 | 88 | 40.29 | -5.71% | 3.02% |

| 2016-08-08 | DQ | CWH | n | 25.45 | 26 | 87 | 23.4 | -8.06% | 8.45% |

| 2016-08-08 | TCX | CWH | n | 30.49 | 32 | 83 | 27.47 | -9.9% | 5.05% |

| *RS Rank on day before breakout. | |||||||||

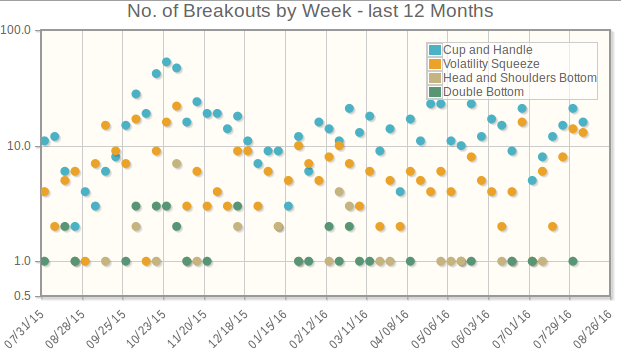

| This chart allows you to see how the frequency of this week's breakouts compare to the last year. Note that the trend has been upwards for the last 4-5 weeks. |

|

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| COT | 17.09 | 1,506,520 | Cott Corporation | Beverages - Soft Drinks | 94 | 16.91 |

| TTMI | 10.70 | 1,214,040 | TTM Technologies - Inc. | Printed Circuit Boards | 94 | 10.25 |

| OFG | 11.25 | 679,227 | OFG Bancorp | Money Center Banks | 92 | 10.60 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. As of Friday,

there were just three meeting the tests. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 18576.5 |

0.18% | 6.61% | Up |

| NASDAQ | 5232.9 |

0.23% | 4.5% | Up |

| S&P 500 | 2184.05 |

0.05% | 6.85% | Up |

|

1The Market Trend is derived from our

proprietary market model. The market model is described on the

sitehere.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite 0.23 % |

NASDAQ Composite 10.92 % |

NASDAQ Composite 20.64 % |

S&P 500 6.85 % |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Silver | Silver | Silver | Silver |

| Manufactured Housing + 212 |

Basic Materials Wholesale + 116 |

Manufactured Housing + 212 |

Manufactured Housing + 212 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 08/13/2016 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All other

marks are the property of their respective owners, and are used for

descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.