Breakoutwatch Weekly Summary 09/17/16

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

| Major Indexes Return to Bullish

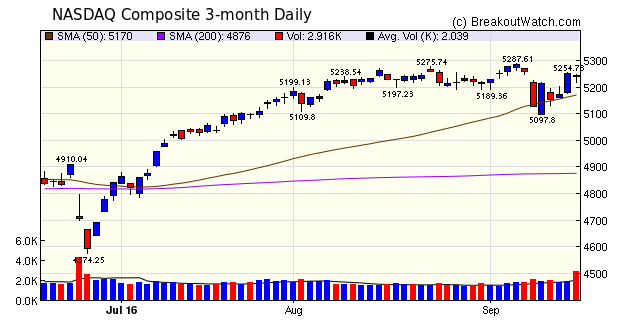

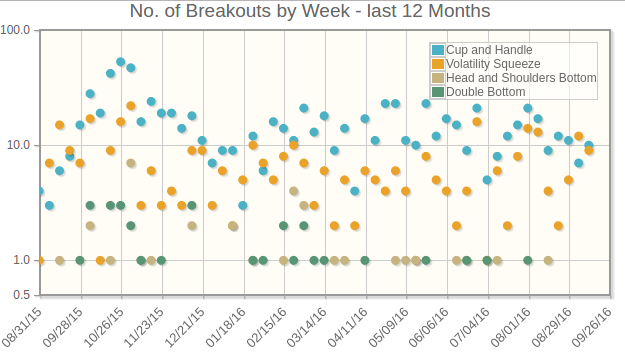

Trend The NASDAQ Composite returned to a positive trend this week with a 2.3% surge over last Friday's close. While the DJI and S&P 500 did not have such a strong performance, it was sufficient to put them back on an upward trend also. Fears of a September rate increase by the Fed appear to have receded as August retail sales fell below expectations. The number of breakouts increased only slightly over last week, 22 compared to 21, but the average gain was positive with cup and handle pattern breakouts averaging 4.5%.  |

| No new features this week. |

|

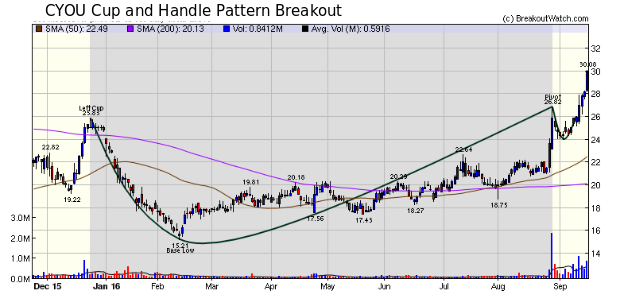

Look for Nearly

Perfect Handle Formation Before Breakout

The top performing cup and handle pattern breakout this week exhibited almost perfect behavior in the handle before breakout. This two-month chart shows how price and volume fell after the pivot was set as traders took profits. Price and volume then rose with volume being above average on the two days before breakout. To understand how cup and handle patterns form and why they are such a powerful tool, read Anatomy of a Cup-with-Handle Chart Pattern.  After breakout on September

13, CYOU went on to gain 12.2% above its pivot.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 10 | 4.53 |

| SQZ | 9 | 1.56 |

| HTF | 3 | -0.11 |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2016-09-13 | CYOU | CWH | n | 26.82 | 27 | 90 | 29.91 | 11.52% | 12.16% |

| 2016-09-14 | MMYT | CWH | n | 20.28 | 21 | 86 | 21.68 | 6.9% | 7.89% |

| 2016-09-15 | STS | CWH | n | 18.48 | 19 | 98 | 19.73 | 6.76% | 6.76% |

| 2016-09-16 | CC | HTF | n | 13.85 | 15 | 97 | 14.56 | 5.13% | 5.42% |

| 2016-09-15 | XRS | CWH | n | 65.05 | 70 | 93 | 68.23 | 4.89% | 8.22% |

| 2016-09-15 | SUPN | CWH | y | 24.00 | 24 | 91 | 25.09 | 4.54% | 6.17% |

| 2016-09-15 | NERV | CWH | n | 13.70 | 14 | 98 | 14.31 | 4.45% | 4.53% |

| 2016-09-14 | ANET | CWH | n | 81.84 | 83 | 81 | 85.03 | 3.9% | 3.98% |

| 2016-09-16 | SUPN | SQZ | y | 24.21 | 25 | 93 | 25.09 | 3.63% | 5.25% |

| 2016-09-15 | MMYT | SQZ | y | 21.01 | 22 | 89 | 21.68 | 3.19% | 4.14% |

| 2016-09-15 | VPG | CWH | n | 15.62 | 16 | 85 | 16.08 | 2.94% | 3.14% |

| 2016-09-16 | OSG | SQZ | y | 11.14 | 11 | 99 | 11.44 | 2.69% | 2.69% |

| 2016-09-16 | NSTG | SQZ | y | 17.93 | 18 | 82 | 18.22 | 1.62% | 2.06% |

| 2016-09-16 | VPG | SQZ | y | 15.83 | 16 | 85 | 16.08 | 1.58% | 1.77% |

| 2016-09-16 | POWI | SQZ | y | 58.93 | 59 | 82 | 59.42 | 0.83% | 0.97% |

| 2016-09-16 | HNRG | CWH | n | 7.06 | 7 | 91 | 7.09 | 0.42% | 2.69% |

| 2016-09-16 | STKL | SQZ | y | 6.99 | 7 | 86 | 7.01 | 0.29% | 1.14% |

| 2016-09-16 | BZUN | HTF | n | 15.59 | 16 | 98 | 15.63 | 0.26% | 0.58% |

| 2016-09-16 | NSP | SQZ | y | 70.39 | 71 | 87 | 70.5 | 0.16% | 0.16% |

| 2016-09-12 | RSTI | SQZ | y | 32.13 | 32 | 80 | 32.15 | 0.06% | 0.34% |

| 2016-09-12 | SMP | CWH | n | 45.90 | 46 | 87 | 45.41 | -1.07% | 1.22% |

| 2016-09-12 | PBYI | HTF | n | 63.06 | 64 | 83 | 59.46 | -5.71% | 1.21% |

| *RS Rank on day before breakout. | |||||||||

|

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| SKY | 12.29 | 48,702 | Skyline Corporation | Manufactured Housing | 99 | 12.17 |

| TTMI | 11.09 | 1,681,538 | TTM Technologies - Inc. | Printed Circuit Boards | 95 | 10.98 |

| ENBL | 16.39 | 356,412 | Enable Midstream Partners - LP | Oil & Gas Pipelines | 95 | 14.43 |

| RRMS | 28.22 | 169,380 | Rose Rock Midstream - L.P. | Major Integrated Oil & Gas | 95 | 26.92 |

| ARLP | 22.08 | 485,998 | Alliance Resource Partners - L.P. | Industrial Metals & Minerals | 94 | 20.96 |

| CSAL | 32.47 | 1,611,016 | Communications Sales & Leasing,Inc. | REIT - Industrial | 94 | 31.43 |

| CRESY | 18.20 | 190,146 | Cresud S.A.C.I.F. y A. | Farm Products | 93 | 16.93 |

| ARES | 19.14 | 59,931 | Ares Management L.P. | Asset Management | 92 | 18.79 |

| CEQP | 22.14 | 338,804 | Crestwood Equity Partners LP | Oil & Gas Pipelines | 92 | 20.64 |

| N | 110.20 | 2,183,352 | Netsuite Inc | Business Software & Services | 92 | 109.19 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 18123.8 |

0.21% | 4.01% | Up |

| NASDAQ | 5244.57 |

2.31% | 4.74% | Up |

| S&P 500 | 2139.16 |

0.53% | 4.66% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the sitehere.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

NASDAQ Composite 9.25 % |

NASDAQ Composite 9.36 % |

NASDAQ Composite 4.74 % |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Manufactured Housing |

Manufactured Housing |

Silver |

Silver |

| Basic Materials Wholesale 121 |

Telecom Services - Foreign 86 |

Manufactured Housing 213 |

Manufactured Housing 213 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 09/17/2016 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.