Breakoutwatch Weekly Summary 10/12/19

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

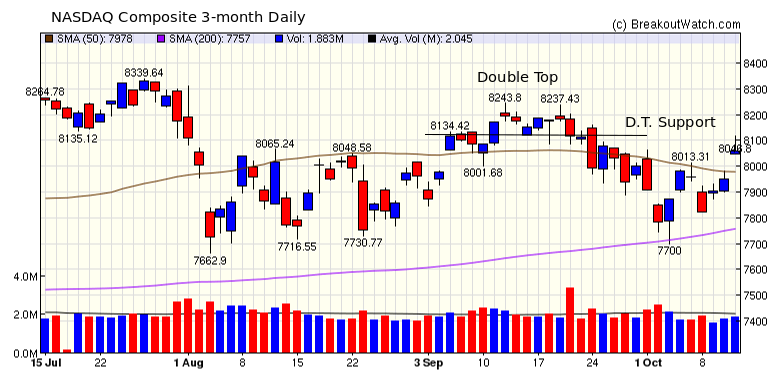

| NASDAQ Bearish Double Top Continues Although the NASDAQ made a modest gain this week of 0.9%, it remains below the Double Top support level and so the bearish double top pattern remains in place. Our trend indicator for the index, and indeed that of the S&P 500 and DJI, continues to be negative. Trade issues continue to dominate market sentiment. At the beginning of the week 28 Chinese companies were put on a blacklist that blocks them from doing business with U.S. companies without a special license. This was followed by indications that trade talks were going well and the markets surged on Friday with the announcement of Stage one of a trade deal. Details were scant, however, and it seems possible that the markets were suckered again into believing progress is being made.  |

| The Industry Browser is available

again in a new format. This is part of an ongoing effort to make

the site more user friendly for smart phone users. I hope to

make the revised site fully available shortly. |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 1 | 1.69 |

| SQZ | 4 | 1.56 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2019-10-08 | CHDN | SQZ | y | 128.71 | 129.77 | 94 | 131.25 | 1.97% | 2.93% |

| 2019-10-10 | RDVT | SQZ | y | 13.66 | 13.7 | 98 | 13.9 | 1.76% | 6.58% |

| 2019-10-11 | TSEM | CWH | n | 20.74 | 21.09 | 89 | 21.09 | 1.69% | 2.36% |

| 2019-10-11 | RDVT | SQZ | y | 13.71 | 13.9 | 98 | 13.9 | 1.39% | 5.32% |

| 2019-10-09 | CHDN | SQZ | y | 129.78 | 130.08 | 95 | 131.25 | 1.13% | 2.08% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| ALDR | 18.99 | 4,915,612 | Alder BioPharmaceuticals - Inc. | Biotechnology | 98 | 18.87 |

| AMKR | 10.01 | 1,160,766 | Amkor Technology - Inc. | Semiconductor - Integrated Circuits | 94 | 9.76 |

| AKTS | 8.77 | 674,316 | Akoustis Technologies - Inc. | Communication Equipment | 94 | 8.00 |

| CZR | 12.03 | 16,626,627 | Caesars Entertainment Corporation | Resorts & Casinos | 88 | 11.95 |

| WSC | 16.89 | 720,855 | WillScot Corporation | Rental & Leasing Services | 87 | 15.80 |

| PSDO | 16.96 | 2,043,286 | Presidio - Inc. | Information Technology | 87 | 16.76 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 26816.6 |

0.91% | 14.96% | Down |

| NASDAQ | 8057.04 |

0.93% | 21.43% | Down |

| S&P 500 | 2970.27 |

0.62% | 18.49% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

S&P 500 -1.44 % |

S&P 500 2.16 % |

NASDAQ Composite 21.43 % |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Water Utilities |

Electric Utilities |

Auto Dealerships |

Insurance Brokers |

| Personal Services 95 |

Drug Delivery 182 |

Personal Computers 193 |

Drug Delivery 187 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 10/12/2019 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.