Breakoutwatch Weekly Summary 03/28/20

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

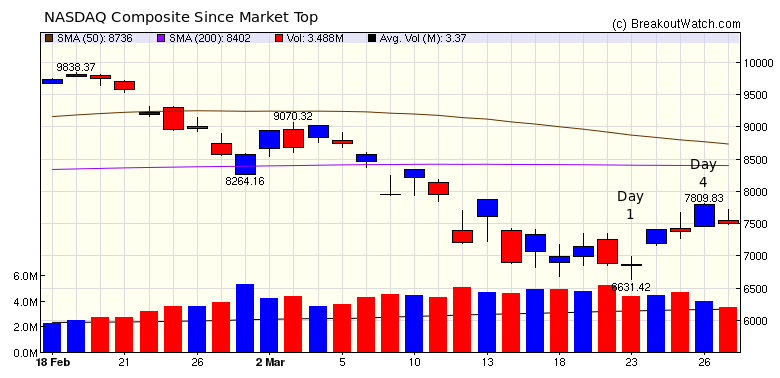

| Patiently Waiting for a Follow

Through Day The NASDAQ set a new intraday low on Monday but went on to close 13% above that low, despite profit taking before Friday's close. There is a possibility that Monday's low will in future be seen as the market bottom, following the passage of the $2trillion rescue package, combined with the support announced by the Fed (new credit facilities,purchase of investment-grade corporate bonds, municipal debt, and U.S.-listed exchange ETFs for investment grade corporate bonds). The chart below shows that following the low set on Monday. March 23, the index closed higher that day and continued to move higher until Thursday which was day 4 of the (possible) recovery. Under the O'Neil method for recognizing a market bottom, we look for a 'follow-through day' on the 4th through 7th day of the low. The requirement is that a follow through day must meet the condition of closing higher, on higher volume , than the day before. We can see that day 4 did not meet the condition, and neither did day 5.  For an alternative approach, we can

look at our Trend Reversal Signals for the NASDAQ Comp.The blue

areas indicate when the trend was up, and we see that the trend

has not yet reversed.

|

No chart of the week. |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 1 | 0.84 |

| SQZ | 1 | -1.14 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-03-27 | TBIO | CWH | n | 10.72 | 10.81 | 91 | 10.81 | 0.84% | 8.68% |

| 2020-03-25 | HMI | SQZ | y | 14.01 | 14.56 | 96 | 13.85 | -1.14% | 6.07% |

| *RS Rank on day before breakout. | |||||||||

| date | symbol | list | support | close | gain % |

|---|---|---|---|---|---|

| 03/26/2020 | GFI | HST | 5.97 | 5.64 | 5.53 % |

| 03/26/2020 | GFI | SS | 6.11 | 5.64 | 7.69 % |

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| No stocks met our suggested screening factors for

our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 21636.8 |

12.84% | -24.18% | Down |

| NASDAQ | 7502.38 |

9.05% | -16.39% | Down |

| S&P 500 | 2541.47 |

10.26% | -21.34% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite -16.7 |

NASDAQ Composite -5.51 |

NASDAQ Composite -16.39 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Shell Companies |

Utilities - Renewable |

| Gold 40 |

Grocery Stores 117 |

Grocery Stores 197 |

Grocery Stores 184 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 03/28/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.