Breakoutwatch Weekly Summary 04/11/20

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

| Trend is Still Down Despite Record

Week for Markets The NASDAQ gained 11% this week in what Marketwatch called the best week for stocks in 45 years. Nevertheless our trend model still considers that the overall market direction is negative. Although that results from a purely technical analysis, many market observers who compare this rally to previous meltdowns of this scale, believe the March low will be retested in the coming weeks (example). Has the reality of the hit to the economy of 16 million unemployed (and climbing) yet been priced into the market? We could learn more next week as the Q1 earnings season begins and companies report forward guidance.  |

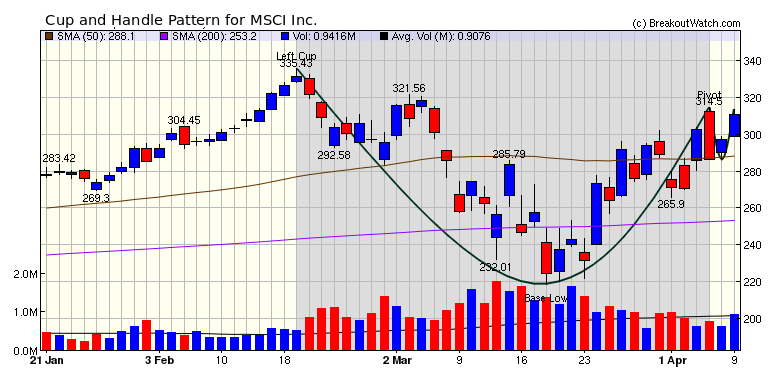

This week I've

chosen a cup and handle pattern stock to watch on Monday: MSCI

inc. MSCI Inc., together with its subsidiaries, provides

investment decision support tools for the clients to manage

their investment processes worldwide. Thursday's volume was

above the 50 day average and above that of the day before. The

stock is above both it's 50 and 200 day moving average. A

breakout could test resistance at 322. |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 1 | 1.02 |

| SQZ | 3 | 4.77 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-04-09 | CYRX | SQZ | y | 17.00 | 18.27 | 90 | 18.27 | 7.47% | 11.29% |

| 2020-04-07 | HTLD | SQZ | y | 18.99 | 19.24 | 81 | 20.26 | 6.69% | 7.27% |

| 2020-04-07 | CY | CWH | n | 23.58 | 23.81 | 93 | 23.82 | 1.02% | 1.06% |

| 2020-04-07 | CHT | SQZ | y | 35.85 | 35.99 | 88 | 35.9 | 0.14% | 0.75% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| CTSO | 7.73 | 1,229,976 | Cytosorbents Corporation - Common Stock | Medical Devices | 96 | 6.59 |

| VSTO | 9.71 | 1,307,824 | Vista Outdoor Inc. Common Stock | Leisure | 94 | 8.95 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 23719.4 |

12.67% | -16.89% | Down |

| NASDAQ | 8153.58 |

10.59% | -9.13% | Down |

| S&P 500 | 2789.82 |

12.1% | -13.65% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite -11.41 |

NASDAQ Composite 2.55 |

NASDAQ Composite -9.13 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Shell Companies |

REIT - Industrial |

| Uranium 50 |

Gold 95 |

Grocery Stores 203 |

Grocery Stores 185 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 04/11/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.