Breakoutwatch Weekly Summary 05/01/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

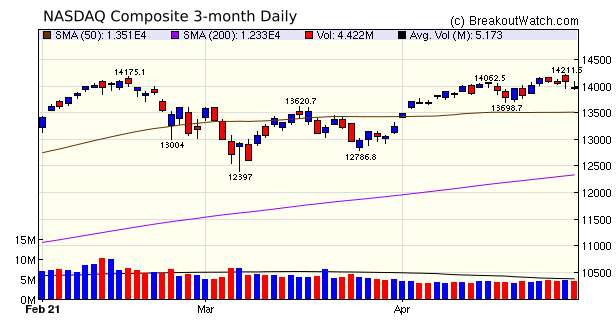

| This week, 37 Breakouts Gained over

5% Despite Market Consolidation The major indexes all consolidated this week as market participants fretted over the "peak growth" narrative, which contends that Q1 saw a year-on-year growth rate that can't be sustained as the year progresses, and consequently, the recent upward trend can't be sustained, despite the mostly excellent recent earnings reports, massive projected fiscal stimulus, and a promise of continued low interest rates from the Fed. The NASDAQ set another new high on Thursday and then retreated on Friday to finish the week with a loss of 0.4%.  The consolidation, particularly in

the DJI and S&P 500, allowed volatility to fall leaving many

stocks in a Volatility Squeeze (SQZ). As a consequence, we saw a

very large number of stocks breakout from that pattern, with

many making large percentage gains. Because of the high number

of SQZ breakouts (296), I have chosen to limit the number of

breakouts in the table below to only those gaining at least 5%.

|

Avid Technology

(AVID) is showing a handle setup with 4 days of profit

taking after setting a pivot on April 14 since followed by 8

days of accumulation on the right side of the handle. Notably

volume increased over the last 2 days to 50 day average levels.

Should AVId continue to move higher, there is an opportuity of

at least a 10% gain before meeting resitance at the left cup

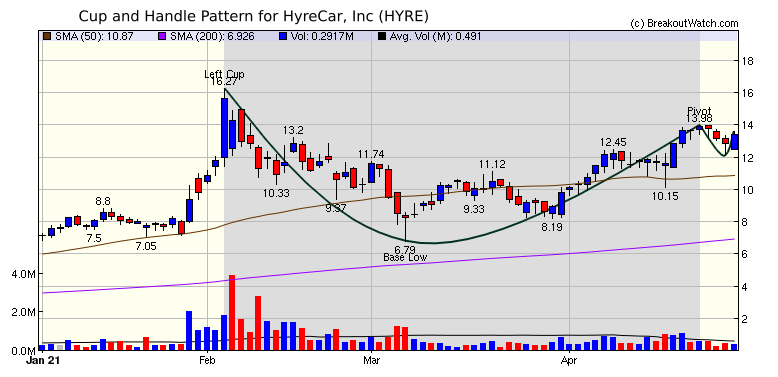

level. Honorable mention: HyreCar

(HYRE)

HyreCar, Inc. were a chart of the

week selection 2 weeks ago and went on to make a 9% gain after

breakout. It is now back on the Cup and Handle list and

Friday's volume indicates that buyers are back after profit

taking on the last breakout, HYRE also has a very high

relative Strength rank of 98.

Both AVID and HYRE are on our

list of stocks likely to breakout at the next session.

|

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 13 | 0.2 |

| SQZ | 296 | 0.57 |

| HTF | 2 | 2.89 |

| HSB | 0 | |

| DB | 14 | -0.23 |

| Because of the large number of SQZ breakouts, this list has been trimmed to include only those breakouts exceeding a 5% gain at Friday's Close | |||||||||

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-04-26 | EDRY | SQZ | y | 10.32 | 10.35 | 94 | 12.85 | 24.52% | 24.52% |

| 2021-04-26 | CROX | SQZ | y | 84.16 | 84.84 | 93 | 100.12 | 18.96% | 22.21% |

| 2021-04-27 | CROX | SQZ | y | 84.85 | 97.82 | 92 | 100.12 | 18% | 21.21% |

| 2021-04-27 | OSTK | SQZ | y | 69.53 | 70.56 | 93 | 81.5 | 17.22% | 27.14% |

| 2021-04-28 | CNTY | SQZ | y | 11.23 | 12.81 | 95 | 13.15 | 17.1% | 20.84% |

| 2021-04-26 | EVLO | SQZ | y | 11.55 | 12.24 | 90 | 13.15 | 13.85% | 14.03% |

| 2021-04-26 | IMO | SQZ | y | 25.51 | 25.54 | 82 | 28.95 | 13.48% | 13.96% |

| 2021-04-26 | WLL | SQZ | y | 35.49 | 35.93 | 99 | 40.07 | 12.91% | 15.89% |

| 2021-04-26 | UAN | HTF | n | 49.90 | 52.7 | 99 | 56.01 | 12.24% | 26.22% |

| 2021-04-28 | IMO | SQZ | y | 25.89 | 27.01 | 83 | 28.95 | 11.82% | 12.28% |

| 2021-04-26 | IRIX | SQZ | y | 7.72 | 9.2 | 97 | 8.6 | 11.4% | 25.84% |

| 2021-04-27 | LDL | SQZ | y | 33.16 | 34.1 | 91 | 36.85 | 11.13% | 13.9% |

| 2021-04-26 | DFS | SQZ | y | 102.85 | 106.19 | 87 | 114 | 10.84% | 11.62% |

| 2021-04-28 | NOG | SQZ | y | 13.07 | 14.21 | 99 | 14.48 | 10.79% | 15.99% |

| 2021-04-26 | ALPN | SQZ | y | 12.08 | 12.56 | 85 | 13.27 | 9.85% | 10.6% |

| 2021-04-27 | GLP | SQZ | y | 22.22 | 22.76 | 86 | 24.13 | 8.6% | 10.17% |

| 2021-04-28 | LDL | SQZ | y | 34.11 | 36.02 | 91 | 36.85 | 8.03% | 10.73% |

| 2021-04-29 | RLGY | DB | n | 16.05 | 16.83 | 86 | 17.28 | 7.66% | 11.65% |

| 2021-04-28 | HT | SQZ | y | 10.74 | 11.02 | 89 | 11.56 | 7.64% | 10.24% |

| 2021-04-26 | LAZY | CWH | n | 23.00 | 23.51 | 98 | 24.75 | 7.61% | 11.91% |

| 2021-04-27 | EVLO | SQZ | y | 12.25 | 12.42 | 90 | 13.15 | 7.35% | 7.51% |

| 2021-04-27 | AGS | SQZ | y | 8.35 | 8.63 | 93 | 8.95 | 7.19% | 8.98% |

| 2021-04-29 | IMO | SQZ | y | 27.02 | 27.64 | 85 | 28.95 | 7.14% | 7.59% |

| 2021-04-26 | EVH | SQZ | y | 20.34 | 21.19 | 88 | 21.66 | 6.49% | 8.95% |

| 2021-04-26 | PGNY | CWH | n | 53.47 | 55.9 | 85 | 56.91 | 6.43% | 11.39% |

| 2021-04-26 | DBD | SQZ | y | 14.15 | 14.2 | 92 | 15.01 | 6.08% | 10.53% |

| 2021-04-27 | THC | SQZ | y | 55.89 | 56.46 | 89 | 59.26 | 6.03% | 9.57% |

| 2021-04-28 | GLP | SQZ | y | 22.77 | 23.73 | 86 | 24.13 | 5.97% | 7.51% |

| 2021-04-28 | PBFX | SQZ | y | 14.57 | 14.65 | 83 | 15.4 | 5.7% | 7.69% |

| 2021-04-27 | XEC | SQZ | y | 62.69 | 63.63 | 92 | 66.2 | 5.6% | 10.34% |

| 2021-04-26 | PRTY | SQZ | y | 6.63 | 6.65 | 99 | 7 | 5.58% | 10.41% |

| 2021-04-28 | DVN | SQZ | y | 22.15 | 24.03 | 90 | 23.38 | 5.55% | 12.19% |

| 2021-04-27 | FANG | SQZ | y | 77.47 | 79.32 | 90 | 81.73 | 5.5% | 13.07% |

| 2021-04-26 | GTLS | SQZ | y | 152.80 | 155.2 | 94 | 160.63 | 5.12% | 9.55% |

| 2021-04-26 | VRTS | CWH | n | 260.20 | 261.68 | 89 | 273.46 | 5.1% | 6.82% |

| 2021-04-29 | PBFX | SQZ | y | 14.66 | 15.23 | 82 | 15.4 | 5.05% | 7.03% |

| 2021-04-28 | APA | SQZ | y | 19.04 | 20.49 | 81 | 20 | 5.04% | 11.61% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| CDNA | CareDx, Inc. | Diagnostics & Research | 89 | 79.07 | 81.86 | 96.59 |

| ALB | Albemarle Corporation | Specialty Chemicals | 86 | 168.17 | 171.96 | 97.8 |

| AVID | Avid Technology, Inc. | Electronic Gaming & Multimedia | 94 | 22.74 | 23.54 | 96.6 |

| LBAI | Lakeland Bancorp, Inc. | Banks - Regional | 81 | 18.13 | 18.32 | 98.96 |

| HYRE | HyreCar Inc. | Rental & Leasing Services | 98 | 13.4 | 13.98 | 95.85 |

| CLNY | Colony Capital, Inc. | REIT - Diversified | 95 | 7 | 7.22 | 96.95 |

| ALTM | Altus Midstream Company | Oil & Gas Midstream | 98 | 60 | 61.84 | 97.02 |

| CDMO | Avid Bioservices, Inc. | Biotechnology | 96 | 21.405 | 22.14 | 96.68 |

| RL | Ralph Lauren Corporation | Apparel Manufacturing | 84 | 133.29 | 135.25 | 98.55 |

| NUAN | Nuance Communications, Inc. | Software - Application | 86 | 53.17 | 53.93 | 98.59 |

| SIM | Grupo Simec, S.A.B. de C. | Steel | 85 | 14.5 | 14.73 | 98.44 |

| LDL | Lydall, Inc. | Auto Parts | 91 | 36.85 | 37.77 | 97.56 |

| CMD | Cantel Medical Corp. | Medical Instruments & Supplies | 83 | 87.91 | 89.76 | 97.94 |

| HBI | Hanesbrands Inc. | Apparel Manufacturing | 80 | 21.06 | 21.49 | 98 |

| STXB | Spirit of Texas Bancshares, Inc. | Banks - Regional | 85 | 23.17 | 24.27 | 95.47 |

| REZI | Resideo Technologies, Inc. | Security & Protection Services | 97 | 30.01 | 31.22 | 96.12 |

| NTRA | Natera, Inc. | Diagnostics & Research | 88 | 110.02 | 117.54 | 93.6 |

| NET | Cloudflare, Inc. | Software - Infrastructure | 90 | 84.74 | 88.04 | 96.25 |

| NVAX | Novavax, Inc. | Biotechnology | 98 | 236.93 | 263.67 | 89.86 |

| *These stcocks were selected using our price breakout model. This model correctly selected CWH stocks that met or exceeded their breakout price with 80% probability over Jan. 2019 to Nov. 2020. This does not imply that on any one day, 80% or any of the stocks selected will meet or exceed their breakout price. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| HYRE | 13.98 | 736,461 | HyreCar Inc. | Rental & Leasing Services | 98 | 13.40 |

| CLNY | 7.22 | 5,251,682 | Colony Capital - Inc. | REIT - Diversified | 95 | 7.00 |

| VLRS | 16.94 | 222,820,496 | Controladora Vuela Compan | Airlines | 94 | 16.27 |

| UMC | 11.25 | 294,692,070 | United Microelectronics Corporation (NEW) | Semiconductors | 93 | 9.92 |

| SKT | 18.82 | 291,562,317 | Tanger Factory Outlet Centers - Inc. | REIT - Retail | 92 | 17.45 |

| HBM | 8.54 | 2,208,210 | Hudbay Minerals Inc. | Copper | 91 | 7.47 |

| GT | 18.66 | 7,321,438 | The Goodyear Tire & Rubber Company | Auto Parts | 90 | 17.21 |

| DVAX | 11.84 | 4,790,488 | Dynavax Technologies Corporation | Biotechnology | 89 | 9.98 |

| AGRO | 9.64 | 824,412 | Adecoagro S.A. | Farm Products | 87 | 9.31 |

| SIM | 14.73 | 223,504,947 | Grupo Simec - S.A.B. de C. | Steel | 85 | 14.50 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 33874.9 |

-0.5% | 10.68% | Up |

| NASDAQ | 13962.7 |

-0.39% | 8.34% | Up |

| S&P 500 | 4181.17 |

0.02% | 11.32% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| S&P 500 |

Dow Jones 6.82 |

NASDAQ Composite 27.96 |

S&P 500 11.32 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Aluminum |

Luxury Goods |

Home Improvement Retail |

| Beverages - Non-Alcoholic 32 |

Beverages - Brewers 59 |

REIT - Residential 97 |

Airports & Air Services 117 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 05/01/2021 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.