Breakoutwatch Weekly Summary 06/26/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

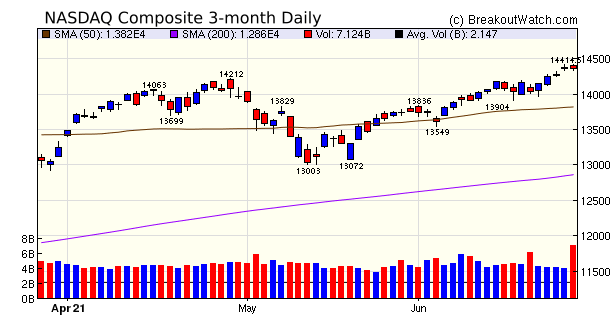

| Breakouts Surge as NASDAQ and

S&P 500 make New Highs The NASDAQ presented what is now a familiar pattern: Buy the Dip but sell when there is a new high. The NASDAQ set a new high on Thursday and early trading on Friday based on overnight orders attempted to go high er but failed and the index sank for the rest of the day as traders took profits leaving the index slightly down on the day on massive volume. Nevertheless, the index gained 2.4% for the week but lagged the S&P 500 which gained 2.7%. This indicates that the broader market is beating the tech stock focus, and has done since the start of the year.  I am departing on Monday to resume

my normal summer vacation trip to cycling the French Alps and

this year including Tuscany. Consequently, newsletter production

will cease until I return. The site, of course, will continue to

be maintained each day and support question answered.

I wish a healthy, prosperous

and safe summer to all.

|

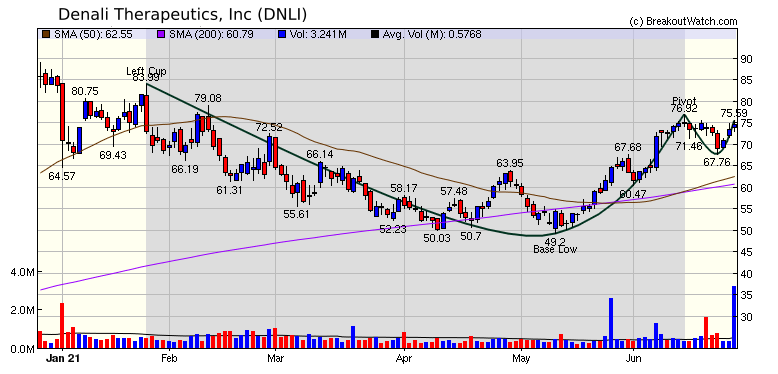

The list of cup and

handle stocks that could breakout at the next session is long

and is included below. Many of them are showing constructive

handle behavior, and I recommend you access the website so you

can see the chart patterns of each of them. I've chosen to

highlight DenaliTherapeutics, Inc because of their constructive

handle, heavy volume on Friday and 12% upside before meeting

resistance at the left cup. |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 36 | 2.67 |

| SQZ | 63 | 3.15 |

| HTF | 4 | 10.44 |

| HSB | 0 | |

| DB | 5 | 4.19 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-06-21 | LPI | HTF | n | 68.31 | 75.06 | 98 | 87.23 | 27.7% | 34.34% |

| 2021-06-21 | ROKU | SQZ | y | 368.44 | 382.73 | 91 | 430.94 | 16.96% | 17.24% |

| 2021-06-22 | RMCF | CWH | n | 6.90 | 7.03 | 84 | 7.84 | 13.62% | 14.2% |

| 2021-06-23 | SUNW | SQZ | y | 9.76 | 10.42 | 99 | 10.96 | 12.3% | 17.32% |

| 2021-06-22 | UUU | CWH | n | 8.00 | 8.86 | 99 | 8.94 | 11.75% | 18.62% |

| 2021-06-23 | OPRX | DB | y | 56.96 | 57.43 | 95 | 63.33 | 11.18% | 12.18% |

| 2021-06-24 | OPRX | SQZ | y | 57.44 | 61.41 | 96 | 63.33 | 10.25% | 11.24% |

| 2021-06-22 | UPWK | CWH | n | 51.45 | 54.41 | 95 | 55.98 | 8.8% | 14.56% |

| 2021-06-23 | NNDM | SQZ | y | 8.08 | 8.65 | 96 | 8.77 | 8.54% | 12.31% |

| 2021-06-21 | ANGO | CWH | n | 25.75 | 25.85 | 94 | 27.9 | 8.35% | 9.9% |

| 2021-06-22 | TSLA | SQZ | y | 620.84 | 623.71 | 84 | 671.87 | 8.22% | 12.37% |

| 2021-06-22 | LSCC | SQZ | y | 51.76 | 52.22 | 83 | 55.87 | 7.94% | 9.01% |

| 2021-06-21 | NTRA | CWH | n | 107.06 | 109.3 | 82 | 115.15 | 7.56% | 14.23% |

| 2021-06-23 | GVA | SQZ | y | 39.51 | 39.79 | 89 | 42.45 | 7.44% | 12.15% |

| 2021-06-22 | SSTK | CWH | n | 95.83 | 97.97 | 88 | 102.84 | 7.32% | 7.76% |

| 2021-06-23 | URBN | SQZ | y | 38.45 | 40.04 | 85 | 41.2 | 7.15% | 9.49% |

| 2021-06-23 | OXY | CWH | n | 30.72 | 30.96 | 89 | 32.91 | 7.13% | 7.45% |

| 2021-06-23 | VCEL | CWH | n | 62.97 | 64.79 | 96 | 67.4 | 7.04% | 9.46% |

| 2021-06-25 | CHS | HTF | n | 6.48 | 6.93 | 98 | 6.93 | 6.94% | 12.5% |

| 2021-06-24 | KLIC | CWH | n | 57.48 | 59.14 | 91 | 61.45 | 6.91% | 8.54% |

| 2021-06-23 | RILY | SQZ | y | 71.32 | 71.65 | 95 | 76.21 | 6.86% | 7.08% |

| 2021-06-21 | AHC | HTF | n | 7.17 | 7.57 | 99 | 7.66 | 6.83% | 7.25% |

| 2021-06-22 | LB | DB | n | 67.70 | 69.09 | 95 | 72.27 | 6.75% | 8.2% |

| 2021-06-21 | AXGN | SQZ | y | 20.83 | 21.54 | 81 | 22.08 | 6% | 9.55% |

| 2021-06-22 | BCYC | SQZ | y | 29.31 | 29.69 | 80 | 31.04 | 5.9% | 8.27% |

| 2021-06-23 | MYGN | CWH | y | 30.85 | 31.57 | 90 | 32.61 | 5.71% | 6.09% |

| 2021-06-21 | BLBD | SQZ | y | 26.11 | 26.57 | 86 | 27.54 | 5.48% | 7.7% |

| 2021-06-24 | LSCC | SQZ | y | 53.03 | 55.43 | 84 | 55.87 | 5.36% | 6.4% |

| 2021-06-21 | LIVN | SQZ | y | 82.26 | 84.07 | 81 | 86.59 | 5.26% | 6.21% |

| 2021-06-22 | VCTR | SQZ | y | 30.80 | 31.42 | 84 | 32.39 | 5.16% | 6.33% |

| 2021-06-25 | VNDA | CWH | n | 19.76 | 20.78 | 84 | 20.78 | 5.16% | 6.33% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| DMTK | DermTech, Inc. | Diagnostics & Research | 95 | 45.99 | 47.40 | 97.03 |

| NTLA | Intellia Therapeutics, Inc. | Biotechnology | 96 | 88.83 | 89.71 | 99.02 |

| DNLI | Denali Therapeutics Inc. | Biotechnology | 89 | 74.68 | 76.92 | 97.09 |

| LPG | Dorian LPG Ltd. | Oil & Gas Midstream | 82 | 15.08 | 15.26 | 98.82 |

| EPR | EPR Properties | REIT - Retail | 83 | 53.81 | 54.38 | 98.95 |

| CASA | Casa Systems, Inc. | Communication Equipment | 88 | 9.41 | 9.75 | 96.51 |

| PBI | Pitney Bowes Inc. | Business Equipment & Supplies | 91 | 9 | 9.35 | 96.26 |

| MCS | Marcus Corporation (The) | Entertainment | 90 | 22.3 | 22.87 | 97.51 |

| FRBA | First Bank | Banks - Regional | 87 | 14.09 | 14.33 | 98.33 |

| ARWR | Arrowhead Pharmaceuticals, Inc. | Biotechnology | 86 | 90.32 | 93.66 | 96.43 |

| BSIG | BrightSphere Investment Group Inc. | Asset Management | 86 | 23.93 | 24.25 | 98.68 |

| RHP | Ryman Hospitality Properties, Inc. | REIT - Hotel & Motel | 87 | 83.77 | 84.58 | 99.04 |

| GTYH | GTY Technology Holdings, Inc. | Software - Application | 88 | 7.14 | 7.74 | 92.25 |

| SBNY | Signature Bank | Banks - Regional | 93 | 256.44 | 264.00 | 97.14 |

| FET | Forum Energy Technologies, Inc. | Oil & Gas Equipment & Services | 91 | 24.99 | 25.36 | 98.54 |

| LYV | Live Nation Entertainment, Inc. | Entertainment | 80 | 92.6 | 94.00 | 98.51 |

| M | Macy's Inc | Department Stores | 94 | 19.62 | 20.38 | 96.27 |

| CVEO | Civeo Corporation (Canada) | Specialty Business Services | 87 | 18.06 | 18.48 | 97.73 |

| GWB | Great Western Bancorp, Inc. | Banks - Regional | 92 | 34.71 | 35.18 | 98.66 |

| MEDP | Medpace Holdings, Inc. | Diagnostics & Research | 80 | 180.26 | 183.72 | 98.12 |

| ONTO | Onto Innovation Inc. | Semiconductor Equipment & Materials | 89 | 72.12 | 75.61 | 95.38 |

| IMAX | Imax Corporation | Entertainment | 83 | 22.77 | 23.54 | 96.73 |

| PCB | PCB Bancorp | Banks - Regional | 80 | 15.96 | 16.83 | 94.83 |

| EGBN | Eagle Bancorp, Inc. | Banks - Regional | 84 | 57.13 | 58.80 | 97.16 |

| RDI | Reading International Inc | Entertainment | 82 | 6.87 | 6.95 | 98.85 |

| RH | RH | Specialty Retail | 90 | 690.72 | 719.77 | 95.96 |

| COHR | Coherent, Inc. | Scientific & Technical Instruments | 88 | 263.89 | 269.98 | 97.74 |

| USCR | U S Concrete, Inc. | Building Materials | 94 | 73.7 | 75.47 | 97.65 |

| SWTX | SpringWorks Therapeutics, Inc. | Biotechnology | 81 | 84.89 | 86.56 | 98.07 |

| VNOM | Viper Energy Partners LP | Oil & Gas Midstream | 89 | 19.31 | 20.09 | 96.12 |

| FFBC | First Financial Bancorp. | Banks - Regional | 84 | 24.9 | 26.22 | 94.97 |

| ERII | Energy Recovery, Inc. | Pollution & Treatment Controls | 91 | 21.22 | 21.86 | 97.07 |

| CPLG | CorePoint Lodging Inc. | REIT - Hotel & Motel | 88 | 10.21 | 10.70 | 95.42 |

| SITC | SITE Centers Corp. | REIT - Retail | 86 | 15.02 | 15.91 | 94.41 |

| HTH | Hilltop Holdings Inc. | Banks - Regional | 82 | 37.31 | 39.14 | 95.32 |

| ZLAB | Zai Lab Limited | Biotechnology | 88 | 173.71 | 181.92 | 95.49 |

| *These stocks were selected using our price breakout model. This model correctly selected CWH stocks that met or exceeded their breakout price with 80% probability over Jan. 2019 to Nov. 2020. This does not imply that on any one day, 80% or any of the stocks selected will meet or exceed their breakout price. | ||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 34433.8 |

3.44% | 12.5% | Down |

| NASDAQ | 14360.4 |

2.35% | 11.42% | Up |

| S&P 500 | 4280.7 |

2.74% | 13.97% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 7.7 |

S&P 500 14.6 |

S&P 500 13.97 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Uranium |

Industrial Distribution |

Uranium |

Shell Companies |

| Consumer Electronics 66 |

Building Materials 80 |

REIT - Specialty 113 |

Oil & Gas Drilling 127 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 06/26/2021 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.