Breakoutwatch Weekly Summary 09/25/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

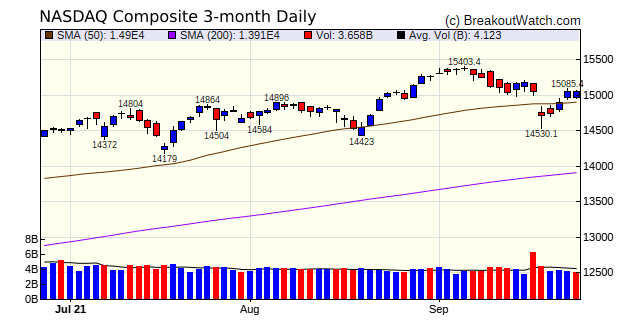

| NASDAQ Shrugs Off China Contagion

Fears and Investors Buy the Dip The week started with fears that a possible default by Chinese property developer Evergrande would destabilize world markets adding to worries that a correction is near as debt ceiling and infrastructure talks appear close to failing. This led to a sharp drop in the markets on Monday, taking the NASDAQ to below the 50 day average. The threat to world markets was soon seen as exaggerated and investors saw another opportunity to buy the dip. The NASDAQ is now just 3% below its September 7 high. However, failure to raise the debt ceiling and the defeat of the Biden agenda by factions in his own party would certainly threaten the continued economic recovery as many of the programs that have supported the economy over the last 18 months have been, or soon will be, withdrawn.  The problems with the site over the

last month are now mostly resolved and I can return to its

continued enhancement. Please tell me if any functions are not

working as expected.

|

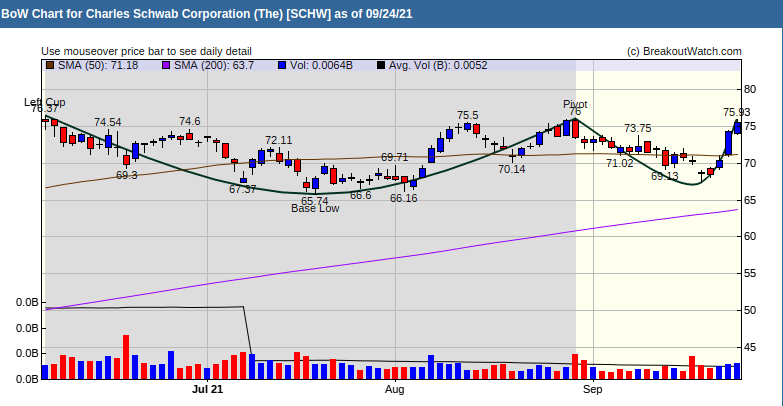

| The financial

sector gained 2.2% this week after the Fed's statement on

Wednesday said that "our interest rate and balance sheet tools

is providing powerful support of the economy and will continue

to do so". This chart shows that Charles Schwab reacted positively to statement and could be poised to breakout on Monday.  |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 9 | 2.19 |

| SQZ | 42 | 1.89 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-09-21 | CALX | SQZ | y | 47.41 | 47.6 | 92 | 52 | 9.68% | 13.56% |

| 2021-09-23 | AER | SQZ | y | 55.03 | 58.29 | 86 | 58.44 | 6.2% | 8.03% |

| 2021-09-23 | EQBK | SQZ | y | 31.92 | 33.6 | 89 | 33.67 | 5.48% | 6.7% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| SCHW | Charles Schwab Corporation (The) | Capital Markets | 88 | 75.59 | 76.00 | 99.46 |

| SSBI | Summit State Bank | Banks - Regional | 84 | 17.48 | 17.50 | 99.89 |

| USIO | Usio, Inc. | Software - Infrastructure | 96 | 6.28 | 6.67 | 94.15 |

| TSQ | Townsquare Media, Inc. | Advertising Agencies | 94 | 13.09 | 13.64 | 95.97 |

| *These stocks were selected using our price breakout model. This model correctly selected CWH stocks that met or exceeded their breakout price with 80% probability over Jan. 2019 to Nov. 2020. This does not imply that on any one day, 80% or any of the stocks selected will meet or exceed their breakout price. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| No stocks met our suggested screening factors for

our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 34798 |

0.62% | 13.7% | Up |

| NASDAQ | 15047.7 |

0.02% | 16.76% | Up |

| S&P 500 | 4455.48 |

0.51% | 18.62% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 4.79 |

NASDAQ Composite 14.53 |

S&P 500 18.62 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Uranium |

Thermal Coal |

Uranium |

Shell Companies |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 09/25/2021 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.