Breakoutwatch Weekly Summary 03/26/22

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| Trend Indicators Turn Positive; 68

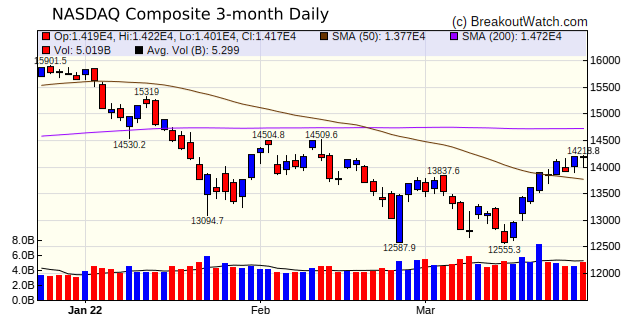

breakouts with 6 > 5% Gain Our trend indicators turned positive for the 3 major indexes on Tuesday, March 22. For the week the NASDAQ gained 2%. The S&P 500 was close behind with a 1.8% gain while the DJI added just 0.3%. Also on Tuesday, the NASDAQ closed above its 200 day average for the first time since January 18. However, the NASDAQ's gains for the week were moderated on Friday when Citigroup forecast that the Fed will raise rates by 50 bps at the next four policy meetings, which would add 2% to interest rates over the next four months.  |

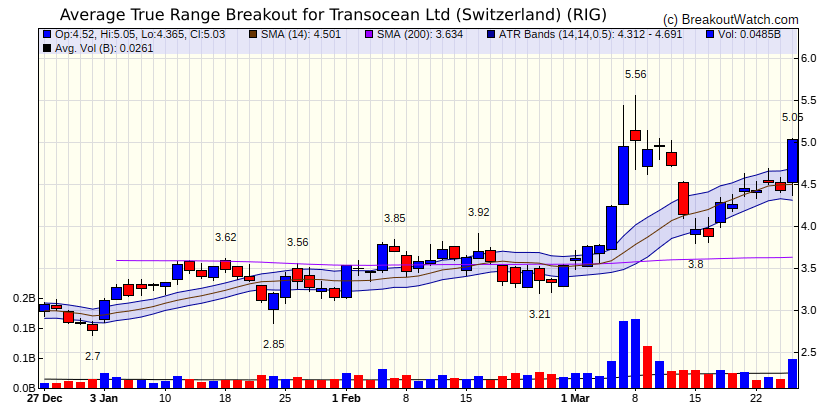

| Transocean Ltd

(RIG) Energy stocks are on the move upwards as the sanctions imposed on Russia disrupt oil markets. Transocean broke out above its average true range on Friday on 2 times average volume. Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts its mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. As of February 14, 2022, the company had partial ownership interests in and operated a fleet of 37 mobile offshore drilling units, including 27 ultra-deep water and 10 harsh environment floaters. It serves integrated energy companies, government-owned or government-controlled oil companies, and other independent energy companies. The company was founded in 1926 and is based in Steinhausen, Switzerland.  |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 21 | 2.66 |

| SQZ | 46 | 1.5 |

| HTF | 1 | 1.29 |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2022-03-23 | CRK | CWH | n | 10.52 | 11.2 | 95 | 12.82 | 21.86% | 23.57% |

| 2022-03-22 | CRS | SQZ | y | 39.50 | 41.12 | 89 | 42.58 | 7.8% | 7.8% |

| 2022-03-21 | BDL | SQZ | y | 32.01 | 33.6 | 85 | 34.2 | 6.84% | 10.28% |

| 2022-03-22 | PNBK | SQZ | y | 16.34 | 16.5 | 96 | 17.35 | 6.18% | 10.16% |

| 2022-03-21 | AFG | CWH | n | 142.10 | 142.72 | 88 | 149.39 | 5.13% | 5.14% |

| 2022-03-21 | STNG | CWH | n | 19.64 | 19.88 | 92 | 20.64 | 5.09% | 5.8% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| IEA | Infrastructure and Energy Alternatives, Inc. | Engineering & Construction | 93 | 14.03 | 14.45 | 97.09 |

| FCCO | First Community Corporation | Banks - Regional | 81 | 21.485 | 21.99 | 97.7 |

| CVBF | CVB Financial Corporation | Banks - Regional | 86 | 23.98 | 24.37 | 98.4 |

| CTR | ClearBridge MLP and Midstream Total Return Fund In | Asset Management | 93 | 28.97 | 29.04 | 99.76 |

| NXGN | NextGen Healthcare, Inc. | Health Information Services | 90 | 20.11 | 20.81 | 96.64 |

| TBBK | The Bancorp, Inc. | Banks - Regional | 93 | 30.07 | 30.56 | 98.4 |

| CCMP | CMC Materials, Inc. | Semiconductor Equipment & Materials | 89 | 188.02 | 189.18 | 99.39 |

| REX | REX American Resources Co | Oil & Gas Refining & Marketing | 87 | 103.51 | 105.85 | 97.79 |

| *These stocks were selected using our CWH price breakout model. This model selects stocks likely to close above the breakout price at the next session. When backtested over the three years beginning January 2019 until October 28, 2021, 80% of the stocks selected closed above their breakout price. This does not mean that on any day, 80% of the stocks selected will breakout, but it is the expectation over an extended period of time. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| DNOW | 11.50 | 1,277,081 | NOW Inc. | Oil & Gas Equipment & Services | 93 | 11.16 |

| IEA | 14.45 | 774,610 | Infrastructure and Energy Alternatives - Inc. | Engineering & Construction | 93 | 14.03 |

| OII | 18.20 | 1,304,684 | Oceaneering International - Inc. | Oil & Gas Equipment & Services | 93 | 16.22 |

| SILV | 10.13 | 1,279,184 | SilverCrest Metals Inc. | Other Industrial Metals & Mining | 90 | 9.49 |

| RFP | 15.10 | 1,112,565 | Resolute Forest Products Inc. | Paper & Paper Products | 88 | 13.91 |

| BHR | 6.50 | 702,041 | Braemar Hotels & Resorts Inc. | REIT - Hotel & Motel | 86 | 6.02 |

| FPI | 14.15 | 705,811 | Farmland Partners Inc. | REIT - Specialty | 85 | 13.40 |

| PSO | 11.07 | 1,130,674 | Pearson - Plc | Publishing | 85 | 10.53 |

| BW | 9.08 | 854,031 | Babcock & Wilcox Enterprises - Inc. | Specialty Industrial Machinery | 83 | 8.45 |

| AG | 14.49 | 9,624,151 | First Majestic Silver Cor | Silver | 81 | 13.87 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 34861.2 |

0.31% | -4.06% | Up |

| NASDAQ | 14169.3 |

1.98% | -9.43% | Up |

| S&P 500 | 4543.06 |

1.79% | -4.68% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

Dow Jones -5.18 |

S&P 500 1.97 |

Dow Jones -4.06 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Healthcare Plans |

Oil & Gas Drilling |

Thermal Coal |

Home Improvement Retail |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 03/26/2022 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.