Breakoutwatch Weekly Summary 05/21/22

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| Breakout Opportunities Persist

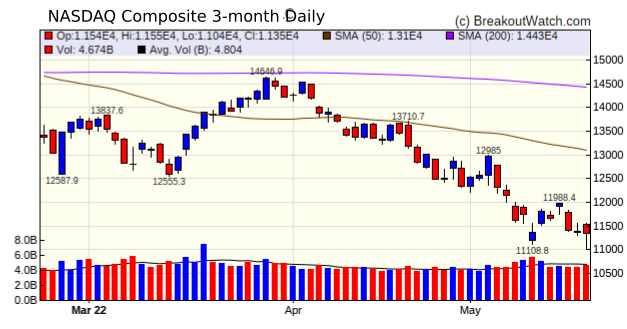

Despite Rally not confirmed by Follow Through Day We counted 61 breakouts this week, with 7 gaining at least 5%. The Volatility Squeeze pattern continued to deliver the best performers although one cup and handle breakout, AZPN, delivered a 14% gain. I considered that last Friday was technically the first day of a possible rally and that we should wait for a follow through day in the next 4 - 7 days. provided the day one close was not undercut. Tuesday, day 3, looked promising with a strong move higher, but day one's close was undercut on Wednesday. Investors were shaken by disappointing results from Target, among others, as profits were undermined by higher supply and labor costs. Fears of a looming recession were also heightened by a warning from Fed Chairman Powell, that interest rates would continue to rise until inflation came down.  |

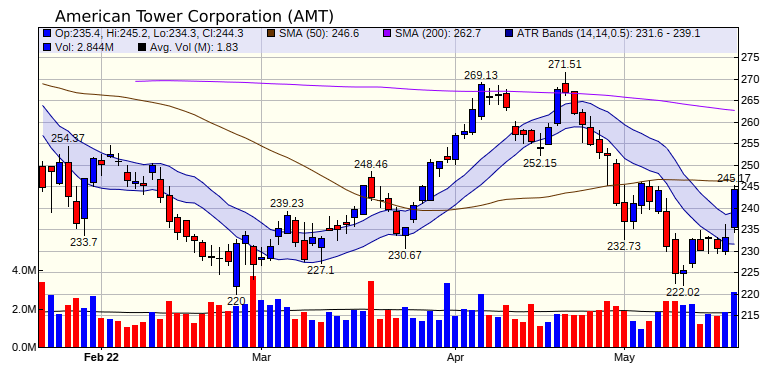

| American Tower

Corporation (AMT) American Tower Corporation, one of the largest global REITs, is a leading independent owner, operator and developer of multi-tenant communications real estate with a portfolio of approximately 219,000 communications sites. It is a personal holding of mine. AMT broke out of its Average Trading Range (ATR) on Friday after announcing a 2.1% dividend increase payable July 8 to shareholders of record on June 17.  |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 5 | 3.09 |

| SQZ | 56 | 1.25 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2022-05-17 | PBT | SQZ | y | 13.53 | 13.98 | 98 | 16.4 | 21.21% | 21.95% |

| 2022-05-19 | PBT | SQZ | y | 13.89 | 14 | 98 | 16.4 | 18.07% | 18.79% |

| 2022-05-20 | PBT | SQZ | y | 14.01 | 16.4 | 98 | 16.4 | 17.06% | 17.77% |

| 2022-05-17 | AZPN | CWH | n | 170.16 | 184 | 94 | 194.01 | 14.02% | 14.51% |

| 2022-05-17 | CRT | SQZ | y | 16.66 | 16.79 | 94 | 18.31 | 9.9% | 12.85% |

| 2022-05-18 | CRT | SQZ | y | 16.80 | 17.1 | 94 | 18.31 | 8.99% | 11.9% |

| 2022-05-19 | JKS | SQZ | y | 53.86 | 56.45 | 93 | 57.16 | 6.13% | 7.33% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| XENT | Intersect ENT, Inc. | Medical Devices | 93 | 28.24 | 28.25 | 99.96 |

| IIN | IntriCon Corporation | Medical Instruments & Supplies | 96 | 24.23 | 24.31 | 99.67 |

| PLAN | Anaplan, Inc. | Software - Infrastructure | 96 | 65.01 | 65.86 | 98.71 |

| PHI | PLDT Inc. | Telecom Services | 95 | 38.53 | 39.00 | 98.79 |

| LHCG | LHC Group | Medical Care Facilities | 92 | 166.34 | 169.84 | 97.94 |

| *These stocks were selected using our CWH price breakout model. This model selects stocks likely to close above the breakout price at the next session. When backtested over the three years beginning January 2019 until October 28, 2021, 80% of the stocks selected closed above their breakout price. This does not mean that on any day, 80% of the stocks selected will breakout, but it is the expectation over an extended period of time. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| BLU | 9.09 | 1,094,402 | BELLUS Health Inc. | Biotechnology | 98 | 8.25 |

| TUFN | 13.00 | 1,197,701 | Tufin Software Technologi | Software - Infrastructure | 96 | 12.55 |

| ARCO | 8.11 | 1,433,320 | Arcos Dorados Holdings Inc. | Restaurants | 95 | 7.55 |

| DNOW | 12.55 | 1,163,132 | NOW Inc. | Oil & Gas Equipment & Services | 93 | 10.38 |

| MERC | 17.17 | 504,825 | Mercer International Inc. | Paper & Paper Products | 93 | 14.24 |

| ICPT | 20.00 | 1,499,292 | Intercept Pharmaceuticals - Inc. | Biotechnology | 92 | 17.46 |

| RFP | 15.23 | 948,186 | Resolute Forest Products Inc. | Paper & Paper Products | 92 | 13.19 |

| KT | 15.30 | 1,365,601 | KT Corporation | Telecom Services | 88 | 14.07 |

| OEC | 19.00 | 756,043 | Orion Engineered Carbons S.A | Specialty Chemicals | 87 | 18.33 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 31261.9 |

-2.9% | -13.97% | Down |

| NASDAQ | 11354.6 |

-3.82% | -27.42% | Down |

| S&P 500 | 3901.36 |

-3.05% | -18.14% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

Dow Jones -8.27 |

Dow Jones -12.19 |

Dow Jones -13.97 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Thermal Coal |

Thermal Coal |

REIT - Residential |

Uranium |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 05/21/2022 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.