Breakoutwatch Weekly Summary 02/04/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks build on their year-to-date rally

Most of the major indexes extended their winning streaks into February, helped by some upside surprises in economic data and fourth-quarter earnings reports, as well as what some saw as encouraging signals from the Federal Reserve. The S&P 500 Index reached an intraday high of 4,195 on Thursday, its best level since late August. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33926 |

| Wk. Gain | 0.05 % |

| Yr. Gain | 2.43 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4136.48 |

| Wk. Gain | 2.15 % |

| Yr. Gain | 8.03 % |

| Trend | Up |

|

|

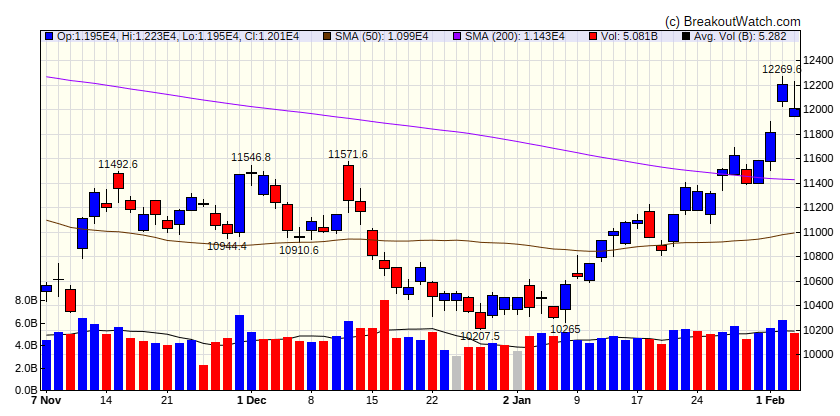

| NASDAQ Comp. | |

|---|---|

| Last Close | 12007 |

| Wk. Gain | 4.3 % |

| Yr. Gain | 15.8 % |

| Trend | Up |

|

|

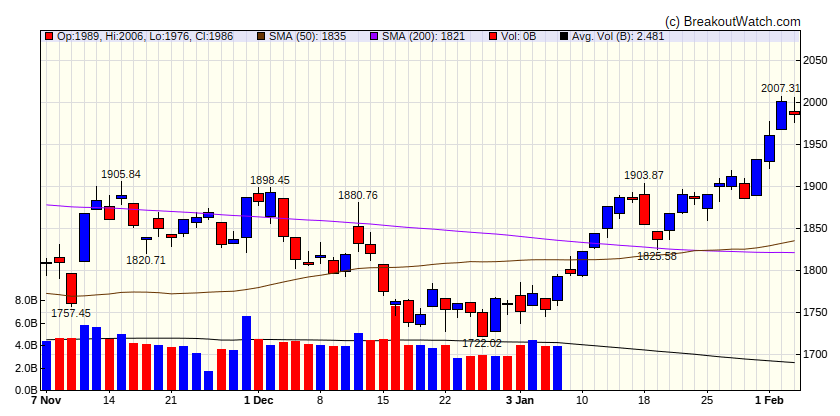

| Russell 2000 | |

|---|---|

| Last Close | 1985.53 |

| Wk. Gain | 4.33 % |

| Yr. Gain | 12.19 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 3.41 | 18.59 | Up |

| Consumer Staples | 1.24 | -0.58 | Up |

| Energy | -4.69 | -0.28 | Down |

| Finance | 2.21 | 8.97 | Up |

| Health Care | 0.31 | -0.79 | Down |

| Industrials | 3.02 | 7.35 | Up |

| Technology | 5.14 | 15.66 | Up |

| Materials | 1.46 | 8.97 | Up |

| REIT | 2.59 | 11.47 | Up |

| Telecom | 5.65 | 22.12 | Up |

| Utilities | -0.59 | -3.85 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | STM | STMicroelectronics N.V. | Semiconductors | 88.1 % | 3.3 % |

| SQZ | TGLS | Tecnoglass Inc. | Building Materials | 86.7 % | 2.7 % |

| CWH | SAIA | Saia, Inc. | Trucking | 81.2 % | 3 % |

| SQZ | ULH | Universal Logistics Holdings, Inc. | Trucking | 78.9 % | 4.1 % |

| CWH | IGT | International Game Techno | Gambling | 78.6 % | 1.1 % |

| SQZ | EXP | Eagle Materials Inc | Building Materials | 78 % | 1.7 % |

| CWH | CMI | Cummins Inc. | Specialty Industrial Machinery | 77.9 % | 0.6 % |

| CWH | XPRO | Expro Group Holdings N.V. | Oil & Gas Equipment & Services | 77.9 % | 1.7 % |

| SQZ | CCRN | Cross Country Healthcare, Inc. | Medical Care Facilities | 77.5 % | 3.5 % |

| CWH | IOSP | Innospec Inc. | Specialty Chemicals | 77.2 % | 2.2 % |

| SQZ | FHI | Federated Hermes, Inc. | Asset Management | 77.2 % | 0.8 % |

| CWH | HGV | Hilton Grand Vacations Inc. | Resorts & Casinos | 76.9 % | 4.2 % |

| CWH | MPWR | Monolithic Power Systems, Inc. | Semiconductors | 76.7 % | 4.6 % |

| CWH | ALSN | Allison Transmission Holdings, Inc. | Auto Parts | 75.9 % | 2.2 % |

| CWH | RNGR | Ranger Energy Services, Inc. | Oil & Gas Equipment & Services | 75.9 % | 1.1 % |

| SQZ | EZPW | EZCORP, Inc. | Credit Services | 75.9 % | 3.3 % |

| SQZ | VGR | Vector Group Ltd. | Tobacco | 75.9 % | 0.9 % |

| CWH | OWL | Blue Owl Capital Inc. | Asset Management | 75.7 % | 1.7 % |

| SQZ | ADI | Analog Devices, Inc. | Semiconductors | 75.6 % | 4.3 % |

| CWH | AMOT | Allied Motion Technologies, Inc. | Electronic Components | 75.4 % | 2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | VMI | Valmont Industries, Inc. | Conglomerates | 78.2 % | -2.1 % |

| SS | FCNCA | First Citizens BancShares, Inc. | Banks - Regional | 76.3 % | -0 % |

| SS | CVX | Chevron Corporation | Oil & Gas Integrated | 73.3 % | -4.5 % |

| SS | HHS | Harte-Hanks, Inc. | Advertising Agencies | 70 % | -1.8 % |

| SS | CVE | Cenovus Energy Inc | Oil & Gas Integrated | 68.5 % | -2.2 % |

| SS | DVN | Devon Energy Corporation | Oil & Gas E&P | 67.6 % | -4.5 % |

| SS | NTIC | Northern Technologies International Corporation | Specialty Chemicals | 66.9 % | -1.5 % |

| SS | DCPH | Deciphera Pharmaceuticals, Inc. | Drug Manufacturers - Specialty & Generic | 66.6 % | -1 % |

| SS | FMC | FMC Corporation | Agricultural Inputs | 66.4 % | -0.1 % |

| SS | WES | Western Midstream Partners, LP | Oil & Gas Midstream | 66.2 % | -0.6 % |

| SS | SRPT | Sarepta Therapeutics, Inc. | Biotechnology | 65.3 % | -3.4 % |

| SS | MCK | McKesson Corporation | Medical Distribution | 64.4 % | -4.1 % |

| SS | KHC | The Kraft Heinz Company | Packaged Foods | 62.5 % | -2.2 % |

| SS | ALHC | Alignment Healthcare, Inc. | Healthcare Plans | 56.6 % | -2 % |

| SS | CPNG | Coupang, Inc. | Internet Retail | 55.7 % | -4.5 % |

| SS | RVLP | RVL Pharmaceuticals plc | Biotechnology | 47.2 % | -1.6 % |

| SS | EMBC | Embecta Corp. | Drug Manufacturers - Specialty & Generic | 42.1 % | -0.3 % |

| SS | SST | System1, Inc. | Specialty Business Services | 35.7 % | -2.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout at Next Session

| Symbol | BoP | Company | Industry | Within x% of BoP | C Score* |

|---|---|---|---|---|---|

| BSMX | System1, Inc. | Banks - Regional | 97.68 | 38.7 | |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

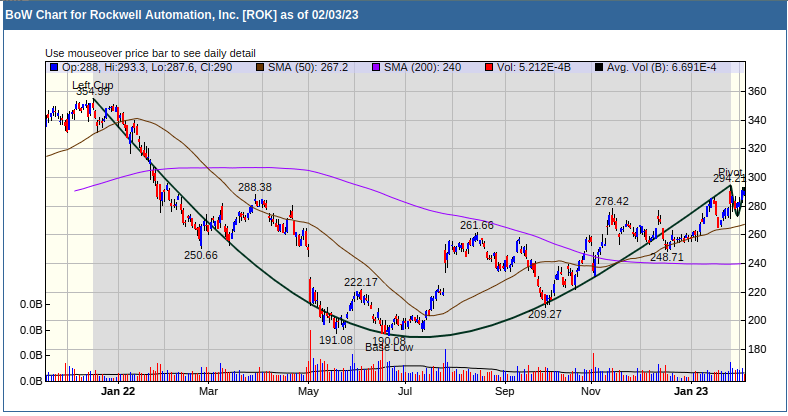

Cup and Handle Chart of the Week