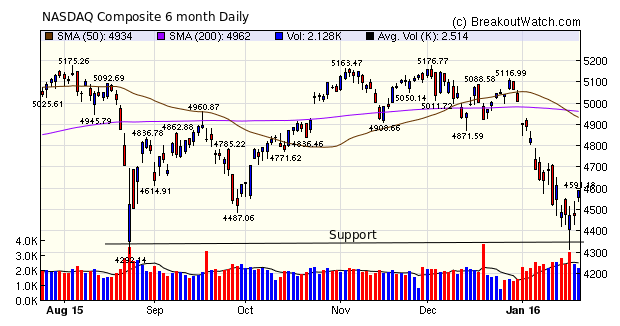

On Wednesday, the NASDAQ Composite found support at Last August's low and closed higher than the day's low, signifying a rally attempt had begun. Thursday's close was higher and Friday's gap up at the open was encouraging and the index closed 2.3% higher for the week, outperforming the two other major indexes.

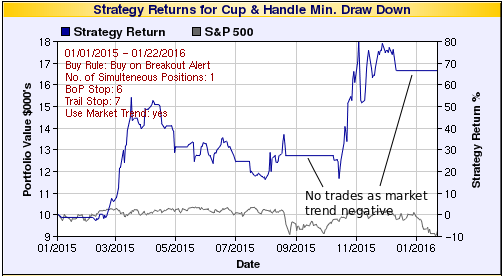

So is the correction, which reached almost 17% for the NASDAQ, over? Investors Business Daily advises to wait for a "follow through day" (FTD) which could occur as early as Monday, although my analysis of the success of FTD's (see Are Follow Through Days a Reliable Indicator of Downward Trend Reversal?) concluded they were not reliable, confirming only two out of six actual rallys studied. Following that study, I developed my own trend reversal signal, which continues to indicate a downward trend.

As for the longer term outlook, Nouriel Roubini, who was one of the few economists to warn of the 2008 crash, is moderately upbeat about the prospects for the global economy this year.