| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

Fears that a strengthening economy would reignite inflationary pressures were calmed this week by Fed. Chairman Bernanke's testimony before Congress which emphasized that although inflation risks remain, inflation should moderate this year and the economy should gain momentum as the impact of the housing recession recedes. This cheered investors and a two day rally ensued, although a lack of strong volume implied that not everyone bought into the theory that stocks were undervalued. This caution was reinforced on Friday when housing starts figures showed a decline of over 14% in January and the markets spent most of the session in the red. The DJI and NASDAQ Composite closed the week 1.48% higher and the S&P 500 lagged only slightly with a 1.22% gain.

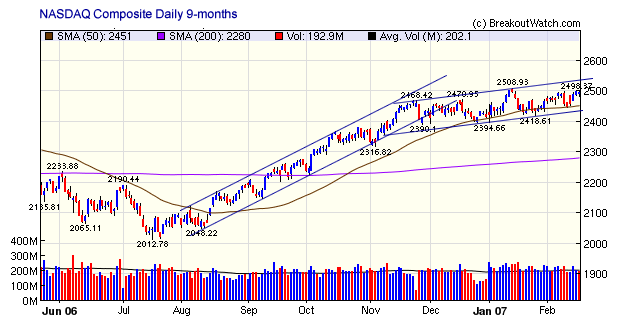

The DJI set new highs on four successive days this week, three of which were accumulation days. The S&P 500 is at a 6-year high while the NASDAQ is just 1% below the 6 year high set on January 16 this year. These valuations seem extraordinarily high, given the uncertainties in the economy, the length of the bull market and the business cycle, but we are not seeing signs of 'irrational exuberance'. Instead the markets are moving steadily higher, with a good deal of caution moderating strong upside moves. Until there are clear signs that the market's mood has changed, which will be guaged by our market signals, there is no reason to believe that the current gradual move higher cannot be sustained. This point is illustrated by the following chart of the NASDAQ Composite which shows a moderated growth channel after the rapid gains from August to November. If the NASDAQ can overcome mild resistance at 2498, then a new 6-year high becomes a possibility.

We counted 28 confirmed breakouts this week for an average gain by week's end of 3.32%. Those gaining double digits or more over their breakout price were VSNT (18.74%), FALC (13.52%) and RICK (10%). Since the start of the year, our TradeWatch Buy at Open portfolio has comfortably outpaced the major indexes with a return of 8.84%. See our Top Tip this week for advice on how to pick the winners in this difficult market. Our best performer has been Reserach Frontiers Inc. (REFR) which hit an intraday high over 93% above its breakout price since it broke out on January 30. REFR was also TradeWatch Buy at Open selection.

| Get a 14 day Trial of our premium 'Platinum'

service and TradeWatch for just $9.95 and if you subsequently subscribe

to any subscription level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

There were no new features added this week.

Picking Winning Stocks in the Current Market

2007 has been kind to us so far. Our TradeWatch selections have done very well year to date with gains that have far outperformed the major indexes. For example, here are the returns in each TradeWatch category.

| TradeWatch List | Avg Gain Positions Closed |

Avg. Gain Positions open |

Combined Annualized Return |

|---|---|---|---|

| Buy at Open | 6.12% | 8.87% | 248.7% |

| Buy on Breakout | 0% | 4.22% | 154% |

| Swing Trade | 2.33% | N/A | 116% |

| Day Trade | 0.83% | N/A | 208% |

Our TradeWatch Buy at Open portfolio, using the parameters recommended in our Newsletter of 12/09/2006 has returned 8.84%.

However, you don't need to be a TradeWatch subscriber to achieve exceptional returns.

Our Expected Gain metric is available to subscribers at all levels. Buying breakouts with an expected gain of 75% or more on breakout would have provided 13 selections since the start of the year. These substantially beat the performance of the average breakout by providing an 80% better return to the intraday high after breakout. To the close on breakout day, they made an average gain from BoP of 3.18% and average gains of 22.3% to their maximum intraday level since breakout . Our backtest tool on the CwHwatch list illustrates this performance using a filter on expected gain of 75%.

The list of stocks meeting the 75% Expected Gain filter (which includes REFR) can also be obtained from the backtest tool:

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

PivotPoint Advisors, LLC takes a technical approach to investment planning and management. A breakoutwatch.com subscriber since May, 2004, they use breakouts, market signals, and now TradeWatch to enhance returns for their clients. Learn more at http://pivotpointadvisors.net or contact John Norquay at 608-826-0840 or by email at john.norquay@pivotpointadvisors.net.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

| Get a 14 day Trial of

our premium 'Platinum' service and TradeWatch for just $9.95 and

if you subsequently subscribe to any subscription

level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12767.6 | 1.48% | 2.44% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2496.31 | 1.48% | 3.35% | enter | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1455.54 | 1.22% | 2.63% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 29 | 22.69 | 4.74% | 3.12% |

| Last Week | 36 | 23.08 | 5.25% | 2.38% |

| 13 Weeks | 354 | 25 | 10.28% |

4.8% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

FINANCIAL SERVICES

|

Closed-End Fund - Equity

|

4

|

COMPUTER SOFTWARE & SERVICES

|

Business Software & Services

|

3

|

COMPUTER SOFTWARE & SERVICES

|

Application Software

|

2

|

LEISURE

|

Restaurants

|

2

|

MANUFACTURING

|

Farm & Construction Machinery

|

2

|

BANKING

|

Money Center Banks

|

1

|

BANKING

|

Regional - Pacific Banks

|

1

|

CHEMICALS

|

Specialty Chemicals

|

1

|

COMPUTER SOFTWARE & SERVICES

|

Information Technology

|

1

|

CONSUMER NON-DURABLES

|

Paper & Paper Products

|

1

|

DIVERSIFIED SERVICES

|

Business Services

|

1

|

DRUGS

|

Biotechnology

|

1

|

ELECTRONICS

|

Semiconductor Equipment & Materials

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Debt

|

1

|

FOOD & BEVERAGE

|

Food - Major Diversified

|

1

|

FOOD & BEVERAGE

|

Meat Products

|

1

|

HEALTH SERVICES

|

Medical Appliances & Equipment

|

1

|

LEISURE

|

Lodging

|

1

|

MANUFACTURING

|

Diversified Machinery

|

1

|

MANUFACTURING

|

Metal Fabrication

|

1

|

METALS & MINING

|

Gold

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | HL | Hecla Mining Co | 88 |

| Top Technical | AVTR | Avatar Holdings Inc | 14 |

| Top Fundamental | KSS | Kohl's Corp | 18 |

| Top Tech. & Fund. | SWHC | Smith & Wesson Hldg Corp | 67 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | EGO | El Dorado Gold Corp | 104 |

| Top Technical | NUAN | Nuance Communications Inc | 51 |

| Top Fundamental | BITS | Bitstream Inc | 73 |

| Top Tech. & Fund. | BITS | Bitstream Inc | 73 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2007 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.