| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

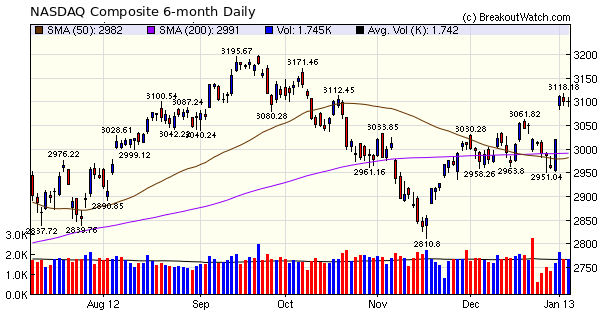

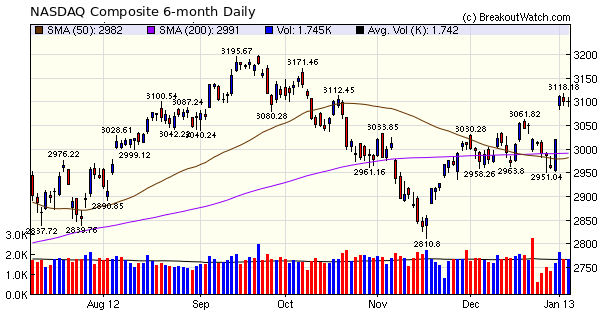

We wish

all our readers a prosperous New Year

With the fiscal cliff disaster

postponed for two months, the markets rallied

strongly. The NASDAQ Composite delivered a 5.6% gain

from Monday's low to Wednesday's high with the S&P

500 and DJI close behind . The NASDAQ also delivered

the highest overall gain (4.8%) of the major indexes

for the week. As a result, all our trend indicators

are pointing upwards. The NASDAQ did pull back

slightly on profit taking, while the S&P and DJI

kept their rally going until Friday's close. However,

the markets are likely to continue to be skittish as

debt ceiling negotiations will soon be back in the

headlines and will prove even more fought than we have

just seen. Wednesday's high for teh NASDAQ is now a

resistance level that we may not see overcome for some

time. The first test for the markets comes on Tuesday

as earnings season kicks off with Alcoa being the

first to report.

The move up on Monday and Wednesday produced a record number of breakouts with a total of 73 for the week. A full report of all breakouts is available to subscribers on our Recent Breakouts page.

The move up on Monday and Wednesday produced a record number of breakouts with a total of 73 for the week. A full report of all breakouts is available to subscribers on our Recent Breakouts page.

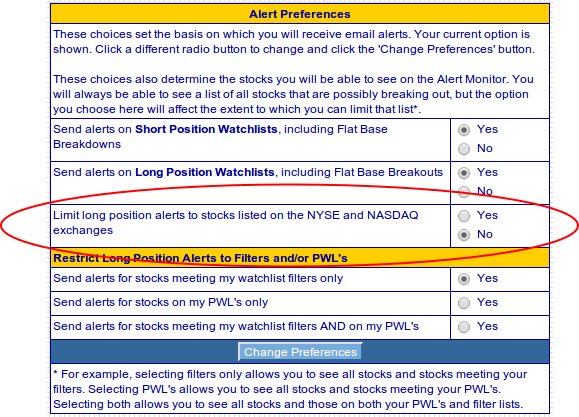

New AmEx Exchange Alert Restriction

We had a request to allow the exclusion of stocks listed on the AmEx exchange from the daily alerts. As there are now many minor exchanges, we chose to implement a filter that allowed the restriction of alerts to only stocks listed on the NYSE and NASDAQ exchanges. This setting is available on the Alert Preferences page accessed from the 'Take Action - Alerts!' main menu.

The default setting is that there is no limitation. You do not need to take any action unless you wish to impose this restriction. Note that the restriction only applies to long position alerts.

No tip this week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 13435.2 | 3.84% | 2.53% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3101.66 | 4.77% | 2.72% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1466.47 | 4.57% | 2.82% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is

derived from our proprietary market model. The

market model is described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 73 | 17.92 | 4.25% | 3.7% |

| Last Week | 5 | 13.92 | 3.55% | 3.5% |

| 13 Weeks | 308 | 19.54 | 6.79% |

4.22% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | TUES | Tuesday Morning Corporation | 103 |

| Top Technical | TUES | Tuesday Morning Corporation | 103 |

| Top Fundamental | TYL | Tyler Technologies, Inc. | 29 |

| Top Tech. & Fund. | TYL | Tyler Technologies, Inc. | 29 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GGAL | Grupo Financiero Galicia S.A. (ADR) | 86 |

| Top Technical | DYN | Dynegy Inc. | 55 |

| Top Fundamental | CYT | Cytec Industries Inc | 33 |

| Top Tech. & Fund. | WAL | Western Alliance Bancorporation | 68 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and

the slogan "tomorrow's breakouts today" are service marks

of NBIcharts LLC. All other marks are the property of

their respective owners, and are used for descriptive

purposes only.

BreakoutWatch is not affiliated with Investor's Business

Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.