| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

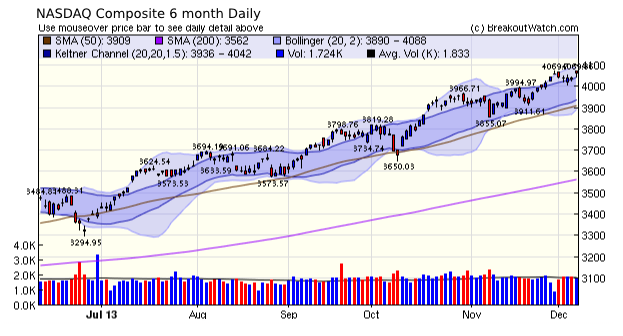

The NASDAQ Composite was the only major index to gain ground this week and it closed above the psychologically resistant level of 4,000. There have been concerns that markets are overvalued but Friday's employment numbers pleased the markets and all three major indexes closed higher. This came as a bit of a surprise to me as I expected the indexes to fall as improving employment means the Fed is closer to ending QE. Perhaps the markets are endorsing Barry Ritholz' argument that we are not in a bubble:

"There are many “reasonable future

outcomes” that would justify current prices. It would only take

a small marginal improvement in the economy, or a small uptick

in hiring, or heaven help us, even a modest increase in wages --

to increase revenues and drive profits significantly higher.

What is currently a somewhat overvalued U.S. market could easily

become a fairly valued or even cheap market if the economy were

to accelerate modestly."

"Squeeze" Added to real Time Alerts.

If a stock on which we issue an alert is in a squeeze, then this will now be shown on each real time alert. You can set your watchlist filters to receive alerts only stocks in a squeeze on each watchlist. For more information on how to do this see New Features in our November 9 newsletter . Also, see below as we have changed the definition of a squeeze for cup-with-handle patterns.

Change to Squeeze Definition for CwH Patterns

I have continued my research on how a squeeze may help us identify breakout stocks. After using several statistical techniques to look for the most significant factor in determining if a CwH stock will close above its breakout price on the day of an alert going back to January1,2008 (to include the crash), I found the most significant factor was a combination of squeeze, positive momentum and positive momentum slope. Accordingly, for CwH stocks I've set the squeeze flag to be 'y' if the squeeze is present and both momentum and momentum slope is positive.

Over that time frame, there would have been 2348 alerts with a squeeze present on the day before the alert and with positive momentum and slope. Of those, 1577, or 67%, closed above their breakout price.

Note that I am not saying that these will reach the volume levels necessary for a "confirmed" breakout, but it does represent an opportunity to make a short term profit. This may be of particular interest to options traders.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16020.2 | -0.41% | 22.25% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4062.52 | 0.06% | 34.54% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1805.09 | -0.04% | 26.57% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 7 | 10.92 | 13.25% | 9.61% |

| Last Week | 4 | 11.31 | 5.16% | -6.25% |

| 13 Weeks | 143 | 11.62 | 20.29% |

8.68% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PAM | Pampa Energia S.A. (ADR) | 113 |

| Top Technical | PAM | Pampa Energia S.A. (ADR) | 113 |

| Top Fundamental | NGVC | Natural Grocers by Vitamin Cottage Inc | 48 |

| Top Tech. & Fund. | NGVC | Natural Grocers by Vitamin Cottage Inc | 48 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | NSTG | NanoString Technologies Inc | 89 |

| Top Technical | ICGE | ICG Group Inc. | 51 |

| Top Fundamental | HLF | Herbalife Ltd. | 44 |

| Top Tech. & Fund. | HLF | Herbalife Ltd. | 44 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.