| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

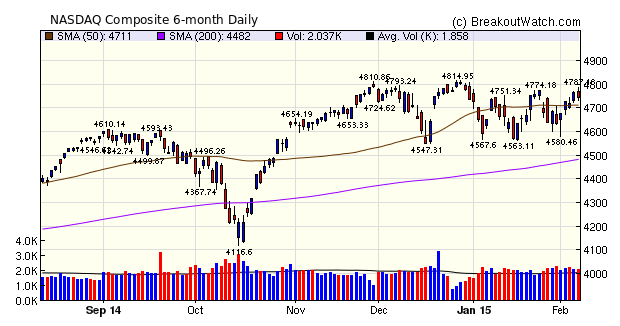

The NASDAQ Composite set higher highs each day this week on above average volume. The strong jobs report on Friday allowed the index to test resistance at 4774 but waned in the afternoon to close for a loss as enthusiasm was tempered by the prospect that a stronger economy could bring on a rise in Fed rates sooner than previously expected, and a downgrade of Greece's debt by S&P to B-.

Despite the stronger showing, our trend indicator for each of the major indexes remains negative.

The number of breakouts slipped back to 22 this week from 30 last week, while the average gain rose from 1.63% to 2.2%.

| Breakouts for Week Beginning 02/02/15 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 02/02/15 | FTR | CwH | N | 6.91 | 7.15 | 7.93 | 14.76 | 17.22 |

| 02/03/15 | AEIS | CwH | N | 25.07 | 25.42 | 27.23 | 8.62 | 12.41 |

| 02/05/15 | BLL | DB | N | 67.41 | 72.03 | 70.61 | 4.75 | 9.03 |

| 02/05/15 | ATW | HSB | N | 30.07 | 30.89 | 32.18 | 7.02 | 8.75 |

| 02/03/15 | CEVA | CwH | Y | 18.73 | 19.59 | 19.23 | 2.67 | 8.57 |

| 02/05/15 | KIRK | CwH | Y | 24.73 | 25.71 | 25.66 | 3.76 | 8.33 |

| 02/06/15 | AIRM | HSB | N | 44.86 | 47.69 | 47.69 | 6.31 | 7.4 |

| 02/03/15 | DSPG | CwH | N | 11.02 | 11.20 | 11.31 | 2.63 | 5.81 |

| 02/04/15 | SIMO | CwH | N | 28.57 | 28.75 | 29.59 | 3.57 | 5.01 |

| 02/02/15 | AMZN | DB | N | 360.84 | 364.47 | 374.28 | 3.72 | 4.98 |

| 02/03/15 | IMOS | CwH | Y | 24.18 | 24.98 | 24.12 | -0.25 | 4.63 |

| 02/03/15 | HTLF | CwH | N | 28.84 | 28.90 | 29.53 | 2.39 | 3.43 |

| 02/03/15 | SHPG | CwH | N | 222.17 | 227.41 | 223.68 | 0.68 | 2.99 |

| 02/05/15 | MRTX | CwH | N | 22.65 | 22.96 | 22.65 | 0.00 | 2.65 |

| 02/05/15 | DRNA | HTF | N | 21.71 | 21.97 | 21.31 | -1.84 | 2.49 |

| 02/06/15 | MS | DB | N | 35.53 | 35.79 | 35.79 | 0.73 | 2.2 |

| 02/03/15 | CUB | DB | N | 52.99 | 53.34 | 53.32 | 0.62 | 2.13 |

| 02/03/15 | MDU | HSB | N | 22.91 | 23.37 | 21.94 | -4.23 | 2.01 |

| 02/04/15 | SPIL | CwH | N | 8.82 | 8.92 | 8.63 | -2.15 | 1.59 |

| 02/02/15 | SCIF | CwH | N | 48.84 | 49.51 | 46.7 | -4.38 | 1.37 |

| 02/03/15 | COP | HSB | N | 67.72 | 67.74 | 67.49 | -0.34 | 0.97 |

| 02/03/15 | ABT | DB | N | 45.79 | 45.83 | 45.5 | -0.63 | 0.92 |

| Weekly Average (22 breakouts) | 2.2 | 5.22 | ||||||

No new features this week.

Our Modified Version of CAN SLIM® will Lead you to more Profitable Breakouts with Less Risk

A trial subscriber who is a CAN SLIM devotee sought my help this week in understanding how the site could help him find CAN SLIM® style stocks. After I walked him through what we have to offer, he felt that the site offered him all the information he would need to apply the system successfully.

While we do aim to fill a void left by Investors Business Daily by anticipating breakouts rather than reporting on them after the fact, there are several areas in which our experience after 12 years of operating this site and analyzing what works and what doesn't, leads us to recommend some modifications to the CAN SLIM® methodology.

1. Only two of the CAN SLIM®

recommendations for minimum levels for the growth in earnings,

sales, institutional ownership, return on investment, and so on

(see our CE

Scoring for a complete list of these metrics and minimum

criteria) have a measurable effect on performance after

breakout. These are:

- the last two quarters' earnings must be positive and

- earnings growth rates must have increased in each of the last four quarters. (see here).

2. Minimum volume on breakout

should be at least 225% of average daily volume NOT at least

150%. While stocks with lesser volumes can do well, the chance

of getting a strong gain after breakout, at least 25% gain above

breakout price, is considerably improved at breakout day volumes

of 225% ADV or more. (see here).

3. Lower priced stocks give better returns than higher priced ones. By using the CAN SLIM® recommendation of a $12 minimum we found you were losing 60% of your potential gains compared to the minimum price of $6 we require for inclusion on our watchlists.

4. Relative Strength Rank of at least 80 is too low. We found a RS Rank of at least 92 was necessary to give average returns after breakout of at least 25%. (see here).

5. Industry Rank has no correlation with subsequent performance after breakout and can be safely ignored when selecting a breakout stock for purchase. High performing breakouts can come from any industry.

6. While stocks that ranked higher in their industry are more likely to breakout, their rank within industry was not correlated with a better performance after breakout.

3. Lower priced stocks give better returns than higher priced ones. By using the CAN SLIM® recommendation of a $12 minimum we found you were losing 60% of your potential gains compared to the minimum price of $6 we require for inclusion on our watchlists.

4. Relative Strength Rank of at least 80 is too low. We found a RS Rank of at least 92 was necessary to give average returns after breakout of at least 25%. (see here).

5. Industry Rank has no correlation with subsequent performance after breakout and can be safely ignored when selecting a breakout stock for purchase. High performing breakouts can come from any industry.

6. While stocks that ranked higher in their industry are more likely to breakout, their rank within industry was not correlated with a better performance after breakout.

Summary

The criteria ideal for a strong breakout are:

- Minimum RS Rank of 92

- Breakout day volume of 225% of Average Daily Volume (ADV)

- ADV must be at least 100,000

- Last two quarters earnings must be positive

- Last four quarters must have shown accelerating earnings

- set a stop loss at 6% of the breakout price

- move the stop up after the stock has gained at least 5%

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17824.3 | 3.84% | 0.01% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4744.4 | 2.36% | 0.18% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2055.47 | 3.03% | -0.17% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GFIG | GFI Group Inc. | 100 |

| Top Technical | GFIG | GFI Group Inc. | 100 |

| Top Fundamental | CBPO | China Biologic Products, Inc. | 36 |

| Top Tech. & Fund. | CBPO | China Biologic Products, Inc. | 36 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SPIL | Siliconware Precision Industries Company, Ltd. | 81 |

| Top Technical | SIMO | Silicon Motion Technology Corporation | 46 |

| Top Fundamental | IMOS | ChipMOS TECHNOLOGIES (Bermuda) LTD. | 41 |

| Top Tech. & Fund. | KIRK | Kirkland's, Inc. | 44 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.