Breakoutwatch Weekly Summary 01/28/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

Stocks rise on “soft landing” hopes

Stocks resumed their winning streak, as investors appeared to welcome some hopeful signals that the economy might skirt a recession in 2023. Consumer discretionary stocks were especially strong, thanks partly to a big jump in Tesla shares over the week following a favorable outlook from CEO Elon Musk. The typically defensive consumer staples, health care, and utilities segments lagged. Relatedly, value stocks underperformed growth shares. [more...]

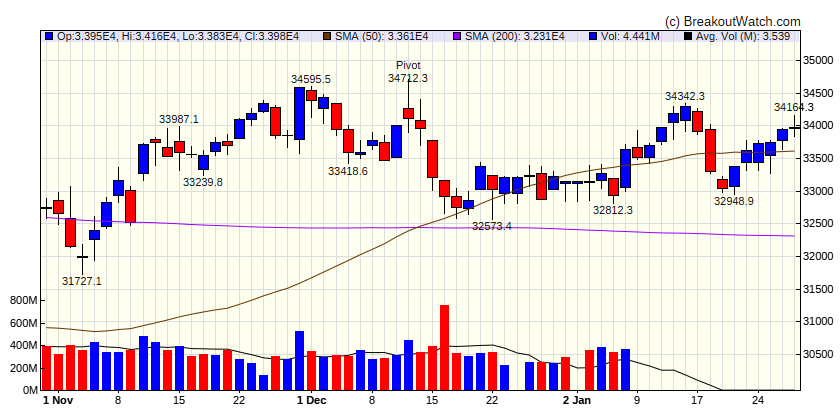

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33978.1 |

| Wk. Gain | 1.61 % |

| Yr. Gain | 2.59 % |

| Trend | Up |

|

|

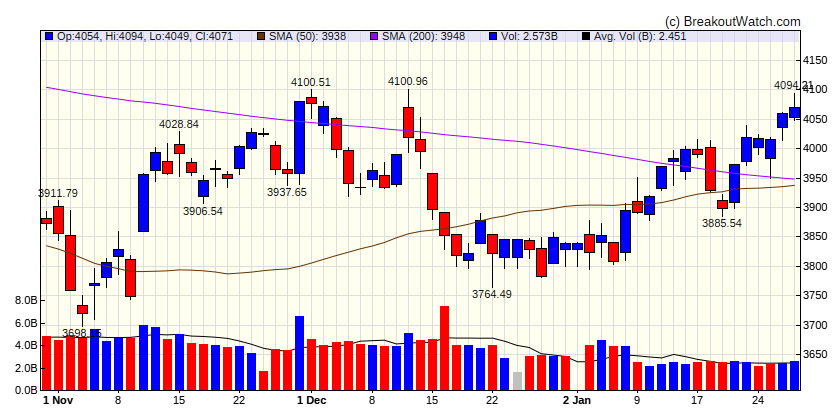

| S&P 500 | |

|---|---|

| Last Close | 4070.56 |

| Wk. Gain | 2.32 % |

| Yr. Gain | 6.31 % |

| Trend | Up |

|

|

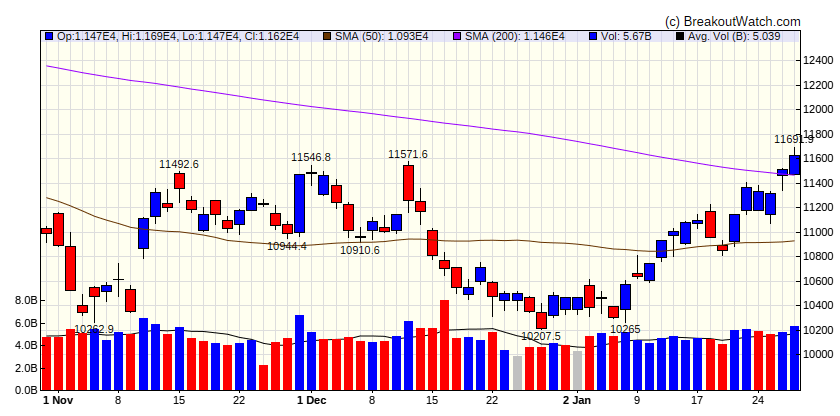

| NASDAQ Comp. | |

|---|---|

| Last Close | 11621.7 |

| Wk. Gain | 4.03 % |

| Yr. Gain | 12.09 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1911.46 |

| Wk. Gain | 2.27 % |

| Yr. Gain | 8.01 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 5.91 | 15.69 | Up |

| Telecom | 3.81 | 16.66 | Up |

| Technology | 3.71 | 11.31 | Up |

| REIT | 3.01 | 9.53 | Up |

| Finance | 2.66 | 7.16 | Up |

| Industrials | 2.15 | 4.86 | Up |

| Materials | 1.21 | 8.11 | Up |

| Energy | 0.38 | 5.52 | Up |

| Consumer Staples | 0.37 | -1.63 | Down |

| Utilities | -0.05 | -2.87 | Down |

| Health Care | -0.63 | -0.95 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | TGLS | Tecnoglass Inc. | Building Materials | 86.8 % | 1.4 % |

| CWH | CRH | CRH PLC American Deposita | Building Materials | 82 % | 1.8 % |

| SQZ | WSC | WillScot Mobile Mini Holdings Corp. | Rental & Leasing Services | 81.7 % | 4 % |

| SQZ | PFHD | Professional Holding Corp. | Banks - Regional | 80.7 % | 2.1 % |

| CWH | ALTG | Alta Equipment Group Inc. | Rental & Leasing Services | 80.6 % | 0.8 % |

| CWH | ASAI | Sendas Distribuidora S A | Grocery Stores | 79.7 % | 1.4 % |

| CWH | MCHP | Microchip Technology Inco | Semiconductors | 79.7 % | 2.1 % |

| SQZ | VMI | Valmont Industries, Inc. | Conglomerates | 79.5 % | 0 % |

| CWH | AGM | Federal Agricultural Mortgage Corporation | Credit Services | 79.2 % | 4.5 % |

| CWH | ODFL | Old Dominion Freight Line, Inc. | Trucking | 78.8 % | 1.2 % |

| CWH | HAYN | Haynes International, Inc. | Metal Fabrication | 78.2 % | 0.7 % |

| SQZ | NX | Quanex Building Products Corporation | Building Products & Equipment | 78.1 % | 1.3 % |

| SQZ | FHN | First Horizon Corporation | Banks - Regional | 77.7 % | 0.2 % |

| SQZ | ULH | Universal Logistics Holdings, Inc. | Trucking | 77.7 % | 0.3 % |

| SQZ | COP | ConocoPhillips | Oil & Gas E&P | 77.6 % | 2.7 % |

| CWH | CRUS | Cirrus Logic, Inc. | Semiconductors | 76.8 % | 2.2 % |

| CWH | TEX | Terex Corporation | Farm & Heavy Construction Machinery | 76.8 % | 3.7 % |

| SQZ | MRO | Marathon Oil Corporation | Oil & Gas E&P | 76.6 % | 1.5 % |

| SQZ | UNVR | Univar Solutions Inc. | Chemicals | 76.4 % | 4.9 % |

| SQZ | EME | EMCOR Group, Inc. | Engineering & Construction | 75.8 % | 0.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | FCNCA | First Citizens BancShares, Inc. | Banks - Regional | 80.2 % | -1.7 % |

| SS | PLPC | Preformed Line Products Company | Electrical Equipment & Parts | 73.2 % | -1.5 % |

| SS | CRAI | CRA International,Inc. | Consulting Services | 71.5 % | -3 % |

| SS | CPHC | Canterbury Park Holding Corporation | Gambling | 67.8 % | -2.4 % |

| SS | VRAY | ViewRay, Inc. | Medical Devices | 64.5 % | -1.3 % |

| SS | KHC | The Kraft Heinz Company | Packaged Foods | 64.3 % | -0.9 % |

| SS | CTRA | Coterra Energy Inc. | Oil & Gas E&P | 64.1 % | -1.2 % |

| SS | TPG | TPG Inc. | Asset Management | 63 % | -0.2 % |

| SS | ALHC | Alignment Healthcare, Inc. | Healthcare Plans | 60.4 % | -1 % |

| SS | STRO | Sutro Biopharma, Inc. | Biotechnology | 59.1 % | -0.1 % |

| SS | IMRA | IMARA Inc. | Biotechnology | 58.3 % | -3.8 % |

| SS | UTL | UNITIL Corporation | Utilities - Diversified | 57.9 % | -1.8 % |

| SS | LMAT | LeMaitre Vascular, Inc. | Medical Instruments & Supplies | 57.6 % | -0.1 % |

| SS | RNER | Mount Rainier Acquisition Corp. | Shell Companies | 35.5 % | -4.1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout at Next Session

| Symbol | BoP | Company | Industry | Within x% of BoP | C Score* | Chart Link |

|---|---|---|---|---|---|---|

| There were no CWH stocks meeting our breakout model criteria | ||||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

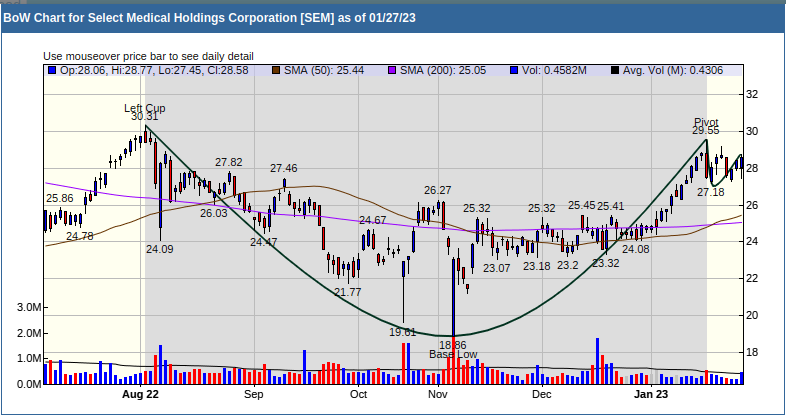

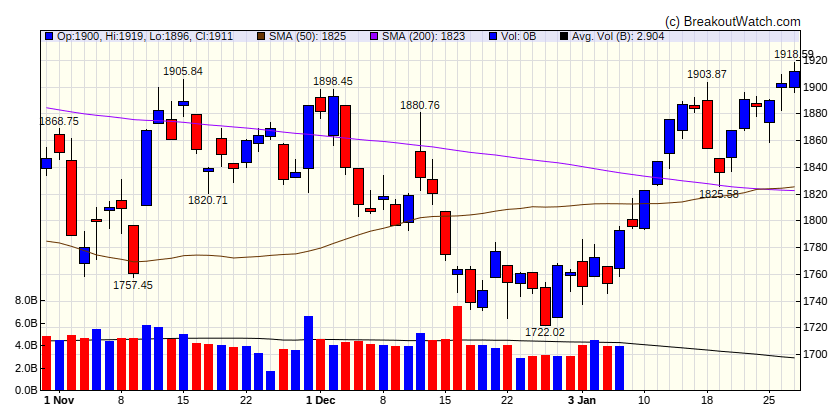

Cup and Handle Chart of the Week