| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

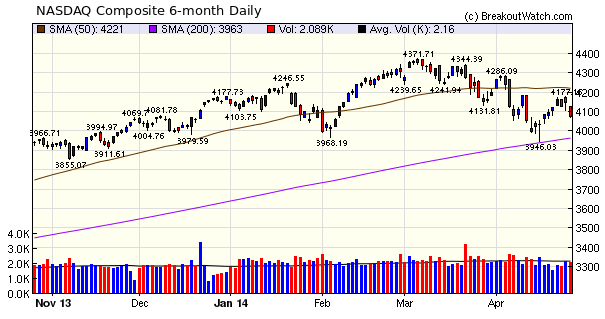

Although the NASDAQ continued to rally through Thursday, Friday's collapse left our market signal for the NASDAQ Composite pointing down, while the DJI and S&P 500 have reversed and are showing an upward trend developing. Only the S&P 500 showed a positive gain for the week, however. The positive trend for large cap stocks must be viewed with some skepticism considering the Ukrainian situation. With new sanctions to be imposed on Russia on Monday, the possibility of a renewed global recession is looking plausible, so caution is still advised.

The rally in the NASDAQ which started the week produced a larger number of breakouts this week. Three stocks produced intraday gains of over 10% with only 4 out of 15 breakouts closing down.

| Breakouts for Week Beginning 04/21/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | Breakout Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intranet High |

|---|---|---|---|---|---|---|---|---|

| 04/23/14 | DEN | CwH | N | 9.00 | 9.67 | 9.5 | 5.56 | 19.78 |

| 04/21/14 | SYRG | CwH | N | 11.06 | 11.25 | 12.2 | 10.31 | 13.83 |

| 04/23/14 | PAM | CwH | N | 6.65 | 7.08 | 7.07 | 6.32 | 10.23 |

| 04/22/14 | VTNR | HTF | N | 7.73 | 7.75 | 8.14 | 5.30 | 7.37 |

| 04/23/14 | PEBO | SQZ | Y | 25.84 | 25.94 | 26.29 | 1.74 | 5.88 |

| 04/22/14 | PEBO | SQZ | Y | 25.84 | 25.94 | 26.29 | 1.74 | 5.88 |

| 04/24/14 | GPI | HSB | N | 67.81 | 69.39 | 68.94 | 1.67 | 5.71 |

| 04/21/14 | AZN | DB | N | 65.69 | 69.10 | 68.66 | 4.52 | 5.19 |

| 04/23/14 | TNP | CwH | Y | 7.95 | 8.35 | 7.18 | -9.69 | 5.03 |

| 04/21/14 | Z | CwH | Y | 100.24 | 103.00 | 92.77 | -7.45 | 4.59 |

| 04/24/14 | MNK | SQZ | Y | 66.33 | 67.61 | 66.99 | 1.00 | 3.74 |

| 04/24/14 | LCUT | SQZ | Y | 18.78 | 19.09 | 19.3 | 2.77 | 3.3 |

| 04/21/14 | HNRG | SQZ | Y | 9.03 | 9.04 | 9.1 | 0.78 | 2.88 |

| 04/22/14 | HMHC | HTF | Y | 20.57 | 20.63 | 20.45 | -0.58 | 1.33 |

| 04/24/14 | LAZ | CwH | Y | 49.00 | 49.01 | 47.37 | -3.33 | 0.02 |

| Weekly Average (15 breakouts) | 1.38 | 6.32 | ||||||

No new features this week.

Recommended Reading for New Subscribers

New subscribers may not have found our newsletter archive (navigate to Monitor > Newsletters) which contains a huge number of tips for subscribers that I have developed over the thirteen years we have been operating.

There's a lot to read, so this week, I'm suggesting just a few of the newsletter "Top Tips" that you may find useful.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16361.5 | -1.3% | -1.3% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4075.56 | -2.42% | -2.42% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1863.4 | 0.81% | 0.81% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | AEE | Ameren Corporation | 0 |

| Top Technical | AEE | Ameren Corporation | 0 |

| Top Fundamental | SAM | Boston Beer Company, Inc. (The) | 0 |

| Top Tech. & Fund. | SAM | Boston Beer Company, Inc. (The) | 0 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | LAZ | Lazard Ltd. | 39 |

| Top Technical | LAZ | Lazard Ltd. | 39 |

| Top Fundamental | LAZ | Lazard Ltd. | 39 |

| Top Tech. & Fund. | LAZ | Lazard Ltd. | 39 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.